The crypto asset market saw a decline over the past weekend, following a week of gains driven by Bitcoin. With the U.S. presidential election set for this Tuesday (05/11), experts are projecting days of high volatility for the sector, as the outcome could have significant implications for cryptocurrencies.

In the current scenario, investor expectations are mixed: a victory for Donald Trump is generally seen as positive for crypto assets. However, a possible win for Kamala Harris could lead to a market pullback due to uncertainties surrounding her economic policy approach.

In addition to the election, other key economic events are on the market’s radar, including a Federal Reserve meeting and the release of relevant economic reports, both of which are expected to add to the uncertainty.

These factors suggest that the crypto asset market may face a busy and highly sensitive week.

Price Index, PMI, and U.S. Labor Market

Last week, the crypto asset market lost some of its gains after the release of the Core PCE Price Index report, which raised doubts about potential rate cuts by the Federal Reserve. The expectation that the Fed might adopt a more cautious stance has pressured the crypto sector.

Investor attention now shifts to new economic data expected in the coming days. This Tuesday, the Institute for Supply Management (ISM) will release the Services PMI, an important metric for assessing business conditions in the U.S. services sector.

In summary, economists and investors are closely watching this indicator for signs of the economy’s direction.

On Thursday (07/11), the focus will be on U.S. labor market data, with employment reports providing an updated view on economic health and labor market conditions in the country.

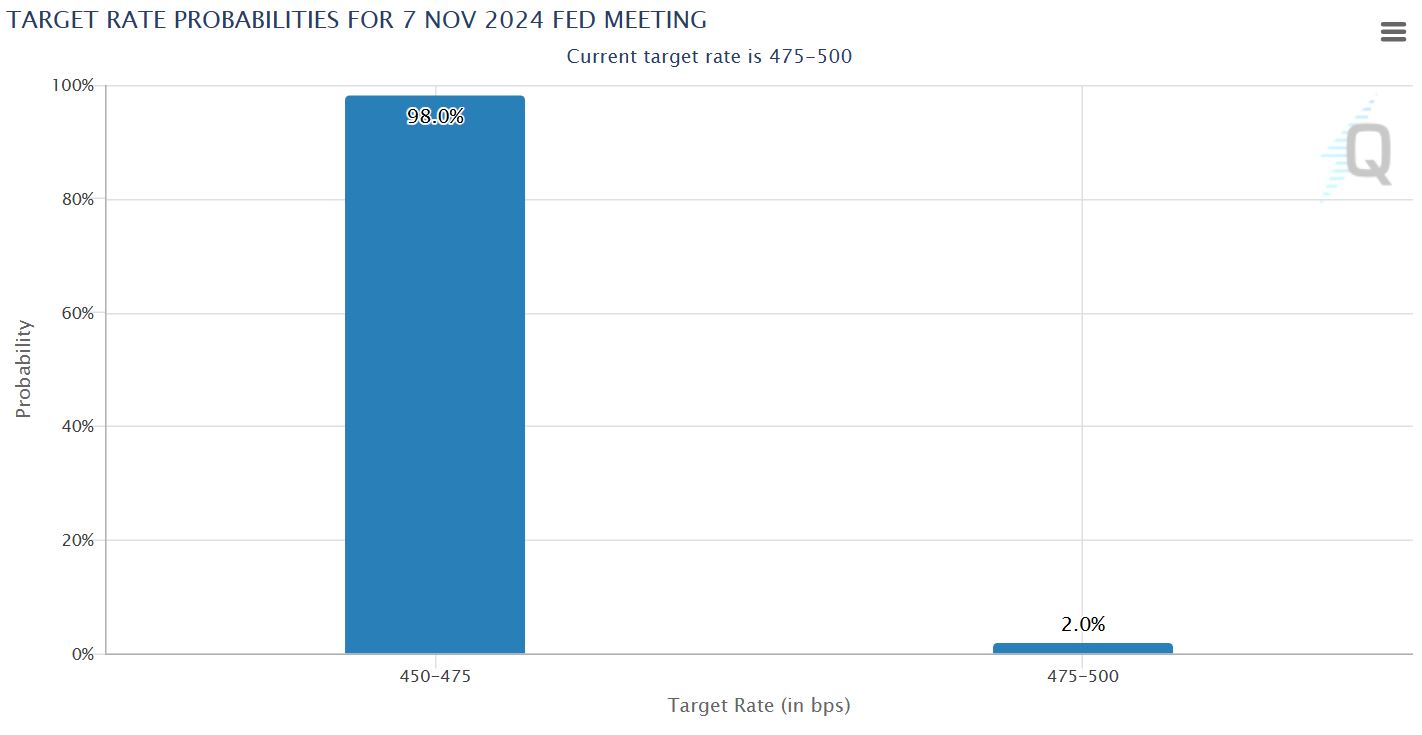

The likelihood of a Fed rate cut is 98%

On November 7, the Federal Reserve is expected to announce its decision on interest rates, with many analysts predicting a 0.25 percentage point cut. According to market tools like the CME Fed Watch, the probability of this reduction is an impressive 98%.

On Friday, the United States will release preliminary indices for Michigan Consumer Sentiment and Consumer Inflation Expectations for November. These data points will provide a clearer picture of consumer expectations regarding confidence and future inflation.

In light of these significant events, many analysts consider this week to be the busiest of the year for the market. With the potential for substantial changes in interest rates and economic expectations, investors are likely to seek ways to mitigate risks as they prepare for the upcoming volatility.

- Dogecoin Price Analysis – January 14, 2025 - January 14, 2025

- Bitcoin (BTC) Price Analysis – January 13, 2025 - January 13, 2025

- Baby Doge Coin (BABYDOGE) Price Analysis – January 13, 2025 - January 13, 2025