Last week, the European Central Bank (ECB) cut its key interest rates by 0.25 percent for the first time in five years. This step is quite controversial, so the President herself has now come forward to explain the details of her considerations.

In an article published by the ECB and numerous media outlets, she commented on her considerations. In it, she reviewed the measures taken by the ECB in recent years.

Progress is visible

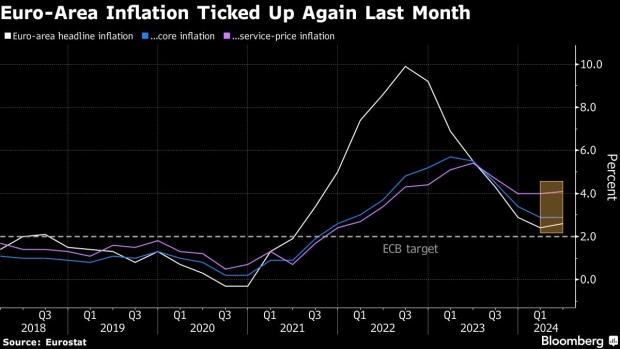

The high inflation was the main reason for the increases, but since inflation is falling overall, the time has now come to reduce the pressure. According to Lagarde, inflation is well on its way to reaching the target of 2 percent next year. The ECB has always understood this to be the target for price stability.

Lagarde emphasized the core objective of the monetary authorities, which makes them the guardians of the euro. Stable prices can be influenced by interest rates and money supply, which is why the ECB uses these instruments.

Russia and supply chain problems are to blame

Lagarde once again points to Russia‘s war against Ukraine as the reason for the sharp rise in inflation. However, she “forgets” to mention that price increases had already risen sharply before the outbreak of war and had exceeded 5 percent. Another reason for the increased prices, according to Lagarde, is the supply chain problems that began during the pandemic.

The people of Europe must not get used to high inflation, she stressed in her article. Therefore, the ECB must do everything to avoid this danger. She is aware of the dangers of a restrictive interest rate policy, but it is the duty of the monetary authorities to ensure stability.

The situation remains uncertain for the time being

Inflation was fought in three phases. First, interest rates were raised quickly. Then the level was kept high, and now the brakes are slowly being released. A rapid reduction in interest rates is still out of the question, as the situation is still too uncertain.

“Interest rates are not necessarily on a linear-declining path, there might be periods when we hold. It is possible ECB will hold rates for longer than a single meeting.”

This will also slow down the markets in Europe. Not only stocks and bonds, but also cryptocurrencies are dependent on interest rate policy. After all, cheap money ensures that investors turn their attention to to riskier assets.

But progress in combating inflation is clearly visible. The ECB’s monetary policy is making an important contribution to this. But it will still take some time before inflation remains at its previous level. Interest rates will therefore remain restrictive until price stability is restored.

- Trillionaire Fund: We expect several countries to adopt Bitcoin - January 2, 2025

- Analyst predicts “Grand Finale” for Altcoins in early 2025 - January 2, 2025

- Dutch crypto analyst: “This is the right time to buy XRP” - January 2, 2025