China has always been an important market for BTC and other cryptocurrencies, but that has now changed – what is the current situation?

BTC and Co. have been an integral part of China for a long time. The Chinese crypto community has long been one of the most active in the world. Despite the increasingly restrictive measures taken by the Chinese government (CPC), China has the second largest market for cryptocurrencies after the US.

Data from the crypto analytics company Chainalysis show that between January and July 2021 alone, cryptocurrencies worth over 150 billion US dollars flowed into China.

In addition, China has also dominated the BTC mining industry in particular in the past. At times, the Middle Kingdom was estimated to be responsible for around 65 percent of the global BTC hash rate.

However, China is increasingly losing its status as a crypto superpower. And that’s because the Chinese government is cracking down on cryptocurrency trading and the mining industry.

In May 2021, government officials announced their intention to crack down on mining and trading in cryptocurrencies. Shortly thereafter, the global hash rate fell as many Chinese miners had to cease operations. Poolin, AntPool, F2Pool, BTC.top and ViaBTC are all mining pools that were mainly based in China and caused a sharp drop in the BTC hash rate as a result of the BTC mining ban in May 2021.

The graphic of Chainalysis Illustrates how the hash rate of all Chinese mining pools decreased after the mining ban. At the same time, it can be seen that the Czech mining pool SlushPool did not experience a drop in hash rate over the same period.

Why Chinese Companies Still Dominate Mining

After the ban, many Chinese miners moved to other countries. The USA, South America, Iran and Kazakhstan were particularly popular among miners. As a result, a massive redistribution of the hash rate took place on a global level and one can assume that sooner or later the last BTC miner will also leave China.

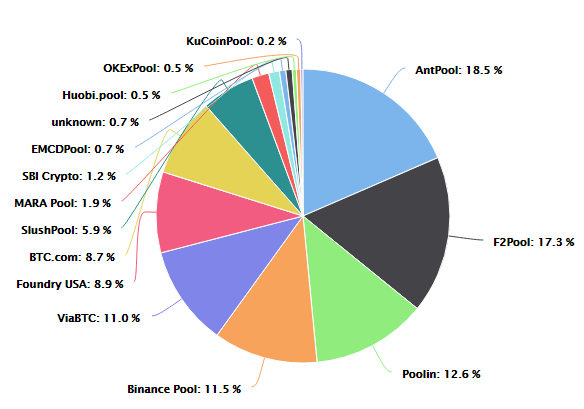

But if you look at the current hash rate distribution one recognizes that Chinese mining pools are now back at the top.

So it seems that a vast majority of Chinese miners have managed to transfer their mining equipment to other countries. The three largest BTC miners are again Chinese companies that have set up their farms in other countries.

In addition, China continues to dominate the mining equipment market. Much of the mining hardware is manufactured by the Chinese company Bitmain. Bitmain is also the owner of AntPool, currently the second largest mining pool in the world. In addition, an analysis by Chainalysis shows how important Bitmain still is to the mining industry.

The graph shows Bitmain’s on-chain transactions with some of the largest mining pools. Green arrows stand for newly mined BTC that are being used by mining pools. Red lines represent mining pools that send BTC directly to Bitmain to buy mining hardware. In addition to Bitmain, you can also see a wallet for a company called MatrixPort. According to Chainalysis, MatrixPort is a cryptocurrency payment service provider that has been processing payments flowing to Bitmain since 2019. These cash flows are shown in the graphic with orange lines. They show that the same mining pools are still buying the bulk of their mining equipment from Bitmain – a sign that Chinese companies are still dominating the mining sector.

summary

The Chinese government has expelled almost all miners from China and massively restricted the trade in cryptocurrencies. Meanwhile, the Chinese government is also cracking down on crypto trading. Nevertheless, Chinese mining pools dominate by far the largest part of the BTC hash rate and at the same time most miners are still dependent on Chinese mining hardware.

How could things go on in China?

The development dynamics in China seem puzzling at first glance. On the one hand, the Middle Kingdom promotes blockchain innovation in its own country. On the other hand, the Chinese government is cracking down on the crypto space with bans and trading restrictions.

Many indications suggest that the CPC have recognized the power of cryptocurrencies and blockchain technology. The CPC might now want to ensure that they control the use of this power as much as possible and therefore continue to restrict the crypto market. Bobby Lee, a crypto veteran, said in a July interview Bloomberg that he could even imagine that sooner or later China will completely ban trading in cryptocurrencies. This prediction has now been confirmed by the latest news from the Middle Kingdom. A few hours ago we reported that the Chinese central bank had declared all crypto transactions to be illegal.

That, in turn, could be because the Chinese government wants to push its own digital currency. Why the Chinese government has gone to their mining companies, but not directly, could be loud Chainalysis because China wants to continue to undermine the US sanctions regime. This fact could also explain why so many mining companies have partnerships with Iranian companies received says Chainalysis.

Top alternative exchanges for Binance without KYC verification

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024