The cryptocurrency industry has experienced a number of riots in recent months, the resulting effect of which has been reflected in falling prices. BTC has been at the forefront of each of these riots, and China’s latest steps in suppressing all cryptocurrency-related activities have pushed the price of cryptocurrency to a 30-day low of $ 39,787.61.

The number of addresses with at least 0.1 BTC reached a 4-month high

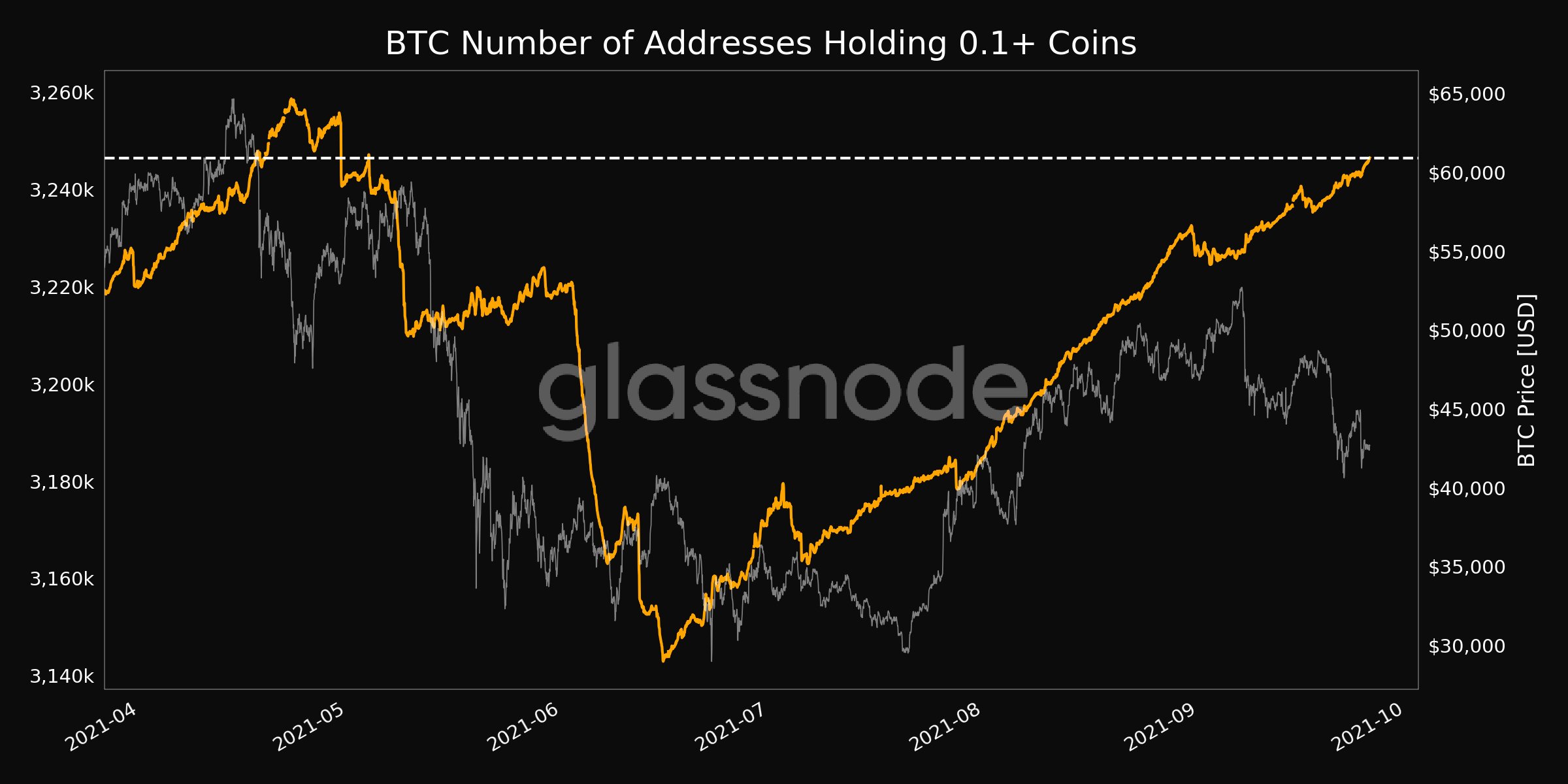

Many small investors used the price drop to “buy a dip”. This is evidenced by data from Glassnode, a platform for cryptote market analysis. According to the shared chart, the number of BTC addresses holding at least 0.1 BTC climbed to a 4-month high of 3,246,533. In other words, the recent decline has led more people to buy, some for the first time and others to expand their portfolios.

Many are waiting for price declines to take new positions in BTC. The period of corrections often serves as an opportunity to buy and make a profit in a short time frame.

Will retail investors cause prices to recover?

The price of BTC began to show a slight recovery. For a stable and sustainable upward trend, BTC will need the aggressive buying momentum that small holders currently support.

However, BTC will have to get above the $ 45,000 resistance level before it can regain its 7-day high of $ 48,328.37. From the small movements observed over the last 48 hours, it can be concluded that the necessary recovery will remain on the shoulders of small investors.

BTC and other cryptocurrencies are known to resist and recover from the impact of all forms of fear, uncertainty and doubt (FUD) that have been spreading through China’s threats over the past decade year after year, quite well. This current FUD will not be an exception in the medium to long term.

Top alternative exchanges for Binance without KYC verification

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024