BTC has had a surprisingly strong week. The market continues to show strong supply dynamics, while on-chain activity remains well below bull market highs.

LTH’s on-chain activity is well below the bull market highs

Long-term holders have allocated a very small part of their assets, as has been the case in all previous cycles. However, despite fluctuations slightly below record highs, on-chain activity remains only slightly above bear market levels. In addition, exchnage balances continue to decline and the hashrate with miners’ incomes is approaching new highs.

This combination of strong supply dynamics, renewal of the mining network and relatively low network activity indicates a relatively good future for BTC in the coming weeks.

Assessment of supply side dynamics

On-chain analysis gives us an idea of the movement of coins between the wallets of investors, exchanges and other players in the network. Generally speaking, we use a combination of coin life (time since their last move) and heuristics to distinguish between seasoned smart money and new, inexperienced investors.

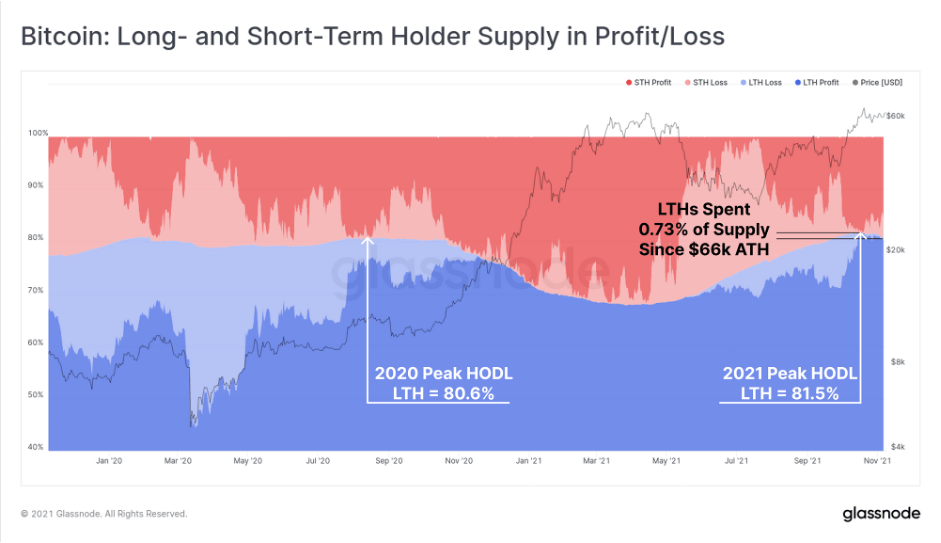

Typical behavior when BTC prices approach record highs is for long-term holders (savvy investors) to start distributing coins. When BTC reached the level of $ 66,000, the offer held by LTH also peaked. At the time when they jointly owned the local maximum of the entire coin supply, the share was 81.5%.

Since then, LTH has returned 0.73% of the coin supply to circulation, providing an upper estimate of the segment’s selling pressure.

Demand dynamics

The dynamics of demand in the bull market usually takes place in two phases:

- Accumulation of smart money (to ATH) when activity in the chain is low, supply dynamics remain constructive and most spending looks like strategic profit generation.

- Hype and euphoria (after ATH), as media coverage of the asset increases, retailers’ interest increases and chain activity begins to gain momentum.

Both the supply dynamics described above on the LTH sales side and the subsequent demand dynamics strongly suggest that the current market characteristics are still in the first phase: accumulation of smart money , although they are closer to the end of this phase.

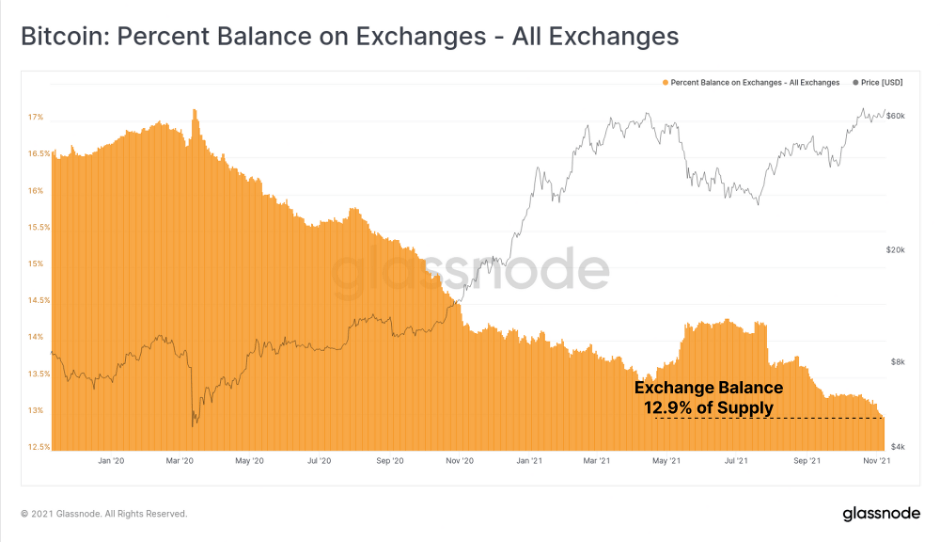

This is evidenced by the indicator of net flows on exchanges, which continues to show a significant predominance of outflows. The outflow accelerated this week to more than 5,000 BTC per day. As a result of the continuing outflow, the aggregate balance of BTC on exchanges fell to multi-annual lows of 12.9% of the total supply.

source: Glassnode

Taproot: Big BTC update is imminent