Table of Contents

There are currently ups and downs in the prices of cryptocurrencies. In this context, we look at the most important developments in the crypto market after the hype surrounding the Bitcoin Spot ETF and the recently completed Bitcoin Halving died down. Both events have been signposts for market movements in the past and could also herald profound changes now.

Crypto Trends After Bitcoin Halving and ETF Hype: The Next Steps

Because the initial hype surrounding the Bitcoin Spot ETF has died down. Although this BTC event is no longer in the spotlight, analysts increasingly expect spot ETFs to continue injecting liquidity into the market in the coming years. As a result, there will likely be steady demand for Bitcoin. In this context, a correspondingly sustainable basis for market stability that will last for years is obvious.

With the conclusion of Bitcoin’s traditional main event – the BTC Halving, investors’ attention is now slowly starting to turn to altcoins. An example of this is the undisputed number two in the crypto market: Ethereum. The valuation of the ETH coin could recently break through the 0.05 BTC mark. The Ether Coin has therefore reached its highest price value in three weeks when viewed in relation to BTC. This price development is now an increasingly clear sign that interest is shifting towards altcoins.

#Bitcoin halving has passed, what's next for #Altcoins?

The biggest event for Bitcoin has passed. Two events. The Spot ETF and the halving.

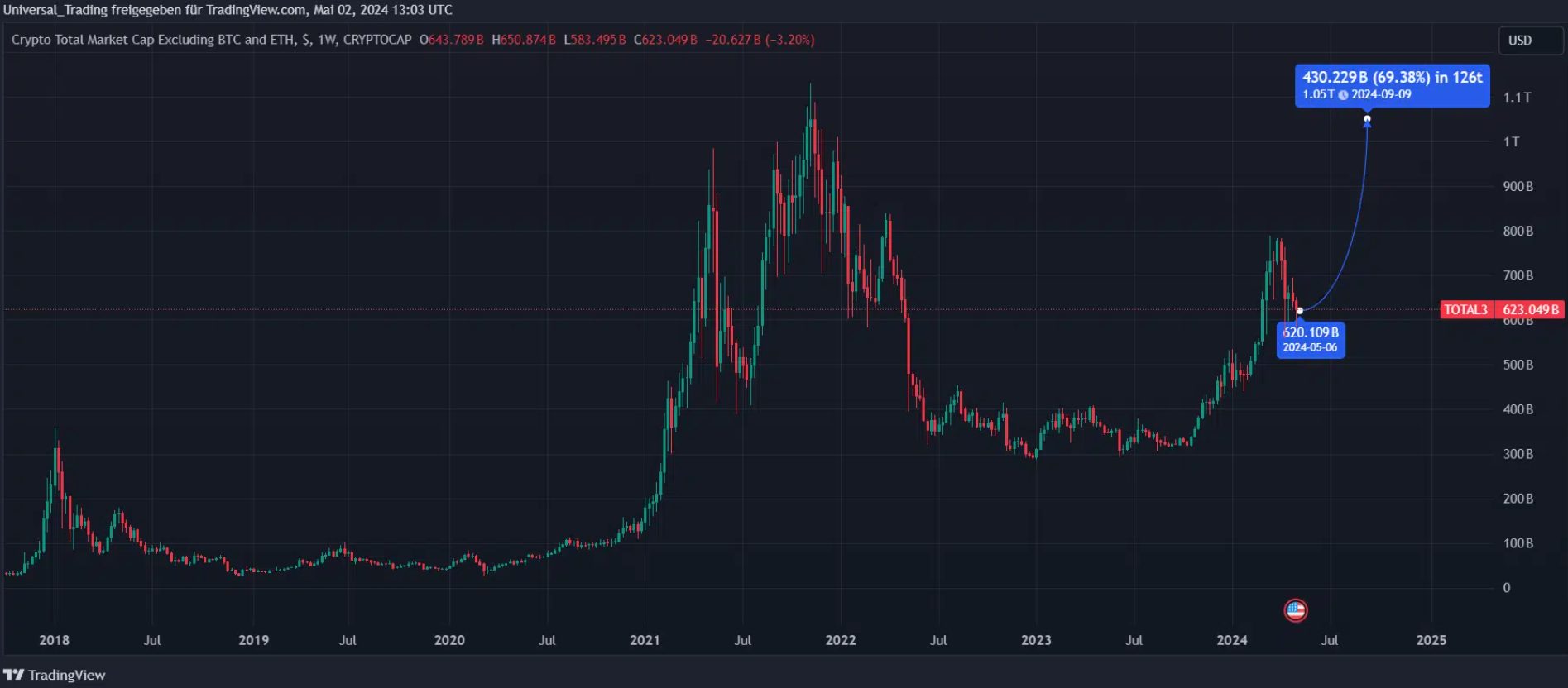

Altcoins have dropped by more than sixty percent in three months time.

What's next?

It's time to discuss some important topics.… pic.twitter.com/6y8nvtlHCo

— Michaël van de Poppe (@CryptoMichNL) April 27, 2024

A Cycle Expands: New Market Mechanisms for Crypto Valuation

There is also a growing belief among many analysts that the current cycle could last longer than previous ones. Several reasons contribute to this hypothesis:

- The market needs more liquidity to initiate movements in the prices of the coins. As market capitalization increases, more liquidity is needed to influence prices. As the cryptocurrencies asset class itself continues to expand, more and more capital is required as new paradigms are reached, which naturally lengthens the cycles accordingly.

- The volatility of the individual cryptocurrencies is slowly reducing. While just a few years ago even the top players saw daily price drops of up to 20-30%, we are currently seeing less and less severe fluctuations. This factor also suggests a lengthening cycle. Furthermore, for Bitcoin, this means that the BTC Coin may currently be entering a phase of slower but more stable growth.

Longer cycles and new opportunities when investing in altcoins

For the further price forecast of the market, let’s look at one final aspect: the duration/time spans of crypto markets and the resulting opportunities for altcoins.

The data and historical patterns suggest that both bear and bull markets for any coin are likely to increase in length.

Looking at past cycles, we see that bear markets tend to get longer. Following the logic of this trend, it is expected that this also applies to bull markets. As a fitting example, Ethereum experienced a nine-month bear market in 2016/2017, followed by a seven-month bull market. This was followed by two years of bear market and two years of bull market.

We are currently in a nearly three-year bear market. Accordingly, one could see a connection that we are now facing an equally long or longer period of a bull market in the near future. The mention of cryptocurrencies in all media and layers of society is increasing. And as a result, a strong impact on the markets could be imminent.

What does this mean for altcoin valuations? How will the courses develop further?

Given BTC valuations, altcoins have fallen by around 70% since January. This shows that general sentiment is at rock bottom. From a historical perspective, such times represent opportunities in which investments in altcoins may be worthwhile.

Especially if Ethereum shows signs of a trend reversal, this could indicate a positive month of May. After the performance of ETH temporarily exceeded the Bitcoin price development, altcoins have often seen strong investment inflows in the past.

The conclusion for investors is clear: It is increasingly likely to be the right moment to invest in altcoins, especially with the ongoing decline in crypto prices. While sentiment is in the basement, a possible trend reversal could soon be initiated.

Crypto exchanges with the lowest fees 2024

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024