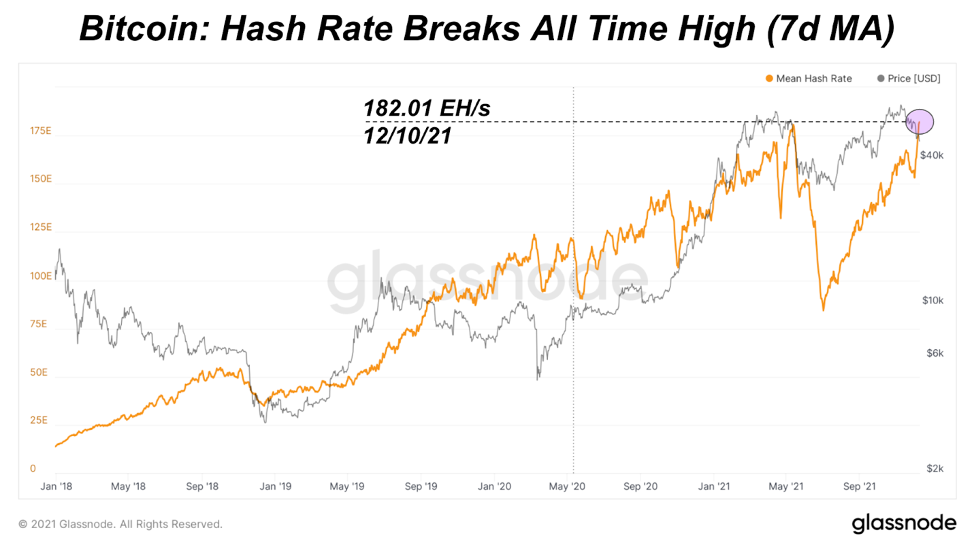

BTC’s average hashrate over the past seven days has restored its previous all-time high to 182.01 Exahash / s.

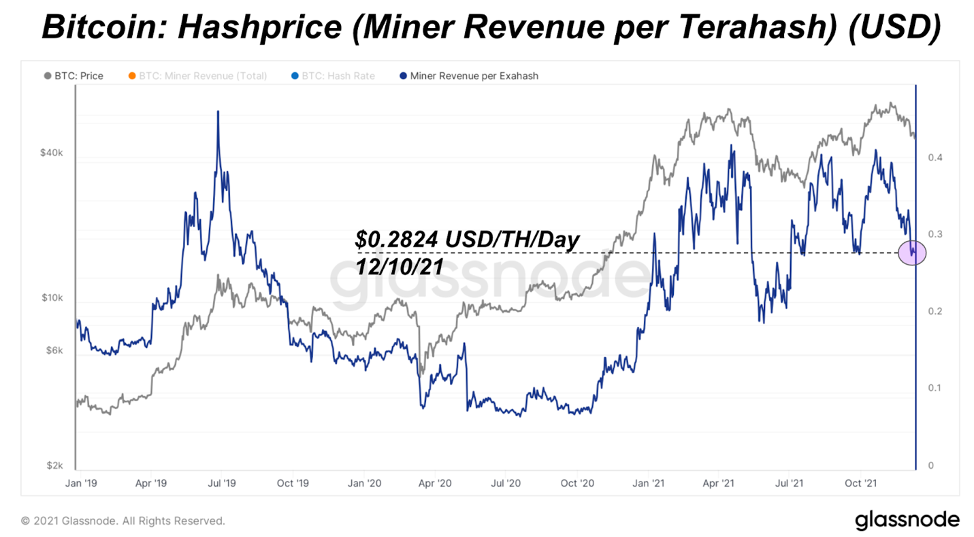

An increase in hashrate means that the competitiveness of mining is growing, and this can be seen in the hashprice. Hashprice is determined by dividing the miners’ daily income by the hashrate and calculates how much income per terahash.

The hashprice is currently about $ 0.28, down from a previously recorded high of $ 0.42 in 2021.

As ASICs become more efficient and there is more hashrate in the network, hashing costs continue to fall. This shows how competitive the mining sector is, as many participants benefit at zero marginal cost (among other things due to sustainable energy resources).

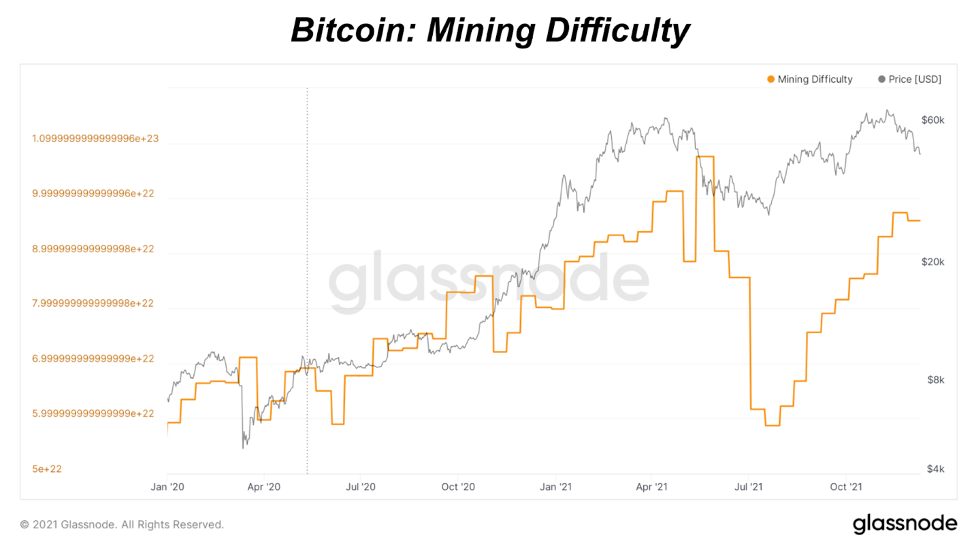

Mining difficulty adjustment is a mechanism that adapts to the growth (or decrease) of the hashrate and ensures the flow of BTC blocks with an average interval of 10 minutes.

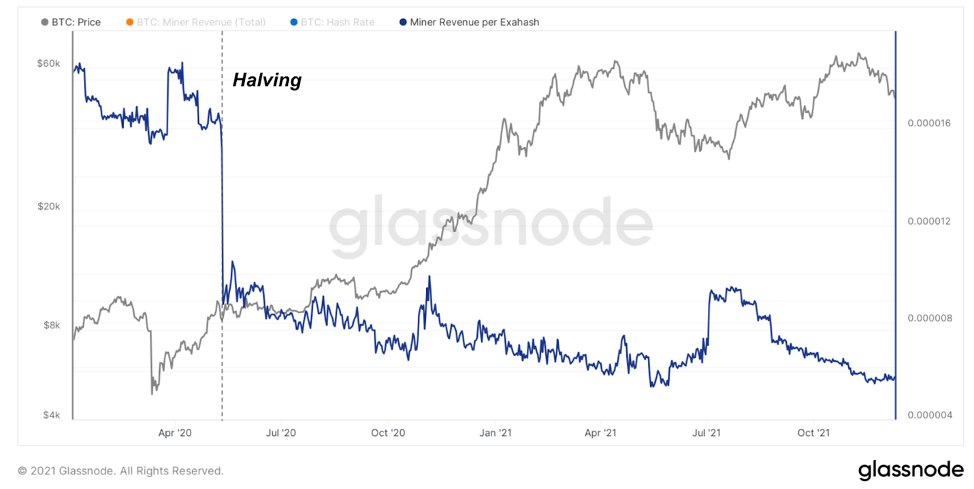

Looking at the hashprice expressed in BTC rather than dollars, revenue does not increase due to rising BTC prices, but only during periods when the hashrate is declining (and subsequently adjusted downwards).

If you look further, the hashprice in BTC is constantly declining with large downward movements during halving (as the block subsidy decreases by 50%).

The logical conclusion is that as long as there is energy that can be mined at low cost, BTC mining will be extremely profitable, so we can expect the hashrate to continue to grow, as the ability to monetize energy is one of the biggest breakthroughs in the digital age.

So with halvings and difficulty adjustments, you can expect BTC to be more difficult to produce (assuming the hash rate increases).

And it will grow forever no .no, at least until 2140.

How ASIC orders from institutional miners affect the price for terahash

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

![Top 10 Cryptocurrency Platforms for Grid Trading in [current_date format=Y] 22 Top 10 Cryptocurrency Platforms for Grid Trading](https://cryptheory.org/wp-content/uploads/2024/12/grid-trading-120x86.jpg)