Table of Contents

The Halving and the Bitcoin ETF. PlanB, probably the best-known BTC analyst in the industry, sees Bitcoin soon at 532,000USD due to the bullish development. BTC to half a million – but the forecast is now also being criticized because not everyone sees BTC exploding like that. Has the crypto guru overstepped the mark this time?

Do crypto ETFs make sense?

He invented the popular “Bitcoin Stock to Flow” price prediction model (S2F) and is considered one of the most popular and well-known on-chain analysts alongside Willy Woo. Now the pseudonymous “PlanB” confirms once again how bullish he is on BTC and the further price development. Because: In his estimation, Bitcoin will explode to 532,000 USD per BTC after the halving! Background to the bullish Bitcoin forecast: There are currently two factors that are potentially driving the markets higher with BTC.

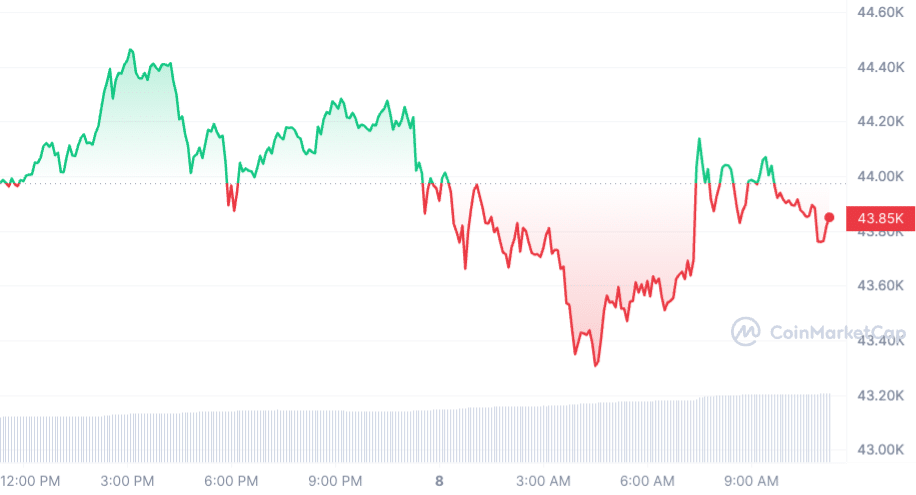

On the daily chart, Bitcoin still appears undecided. Image: Coinmarketcap.com

On the daily chart, Bitcoin still appears undecided. Image: Coinmarketcap.com

Factor 1: Bitcoin ETF

The first factor is the BTC ETFs. Approval is expected to take place this week. Background Bitcoin ETF: A BTC ETF is an investment product through which investors can invest indirectly in BTC. You no longer have to deal with wallets and crypto exchanges, but can easily buy the asset through financial advisors, for example. This ensures increased liquidity because with a BTC ETF, both institutional and private investors could buy BTC without having to deal directly with storing cryptocurrencies. Analysts are convinced: A Bitcoin ETF could increase demand and thus the price of Bitcoin. In addition, a BTC ETF offers the following advantages:

- Regulation and Security: An ETF is subject to strict regulatory standards, which is expected to increase confidence in BTC as an asset class. The result: more investors and potentially rising prices.

- Increased Visibility and Acceptance: A Bitcoin ETF is also expected to increase the visibility of BTC in the traditional financial sector. BTC ETF issuers will promote their BTC ETF – and that, in turn, could lead to more people recognizing BTC as a legitimate asset class. The possible consequence: demand and price increase.

Faktor 2: Bitcoin Halving

Factor 2 is Bitcoin Halving, the so-called halving. The halving will come in April 2024 and will ensure that the amount of newly issued BTC will be reduced by 50% – hence the name. PlanB uses its stock-to-flow model to calculate the BTC price after the halving – and comes up with prices of more than half a million dollars! The Dutchman to his more than 1.9 million followers:

In 2015, when I bought my first btc at $400, people said bitcoin was dead.

In 2019, when btc was $4000, I wrote the S2F article, calling for $55k btc. People said I was crazy.

Today, btc is $40k, and S2F model predicts $532k after 2024 halving. People say it is impossible.

— PlanB (@100trillionUSD) January 7, 2024

Bitcoin (BTC) is currently at 43,818 USD after a decline of -0.32% since yesterday. From here to 532,000 USD – that’s a rally of 1,114%! His trader colleague Michaël van de Poppe (@CryptoMichNL) confirms:

That is not impossible with institutions jumping on the markets.

— Michaël van de Poppe (@CryptoMichNL) January 7, 2024

However, many investors also criticize PlanB for its overly bullish forecast.

Bitcoin forecast from PlanB: Now there is a hail of criticism

For example, a user jokes:

You forgot to mention that your S2F model predicted also 100k for the previous bullrun 😁.

— nicolae 🔺🔶 (@NicolaeGGG) January 7, 2024

And the pseudonymous industry observer “Phoenix ₿” adds:

#BTC $532k seems a bit over top for this cycle. Maybe as target 2030. First we need to skip past $100k and then we maybe see $150k as cycle top.

Supercycle theorists say $250k $BTC top. $532k would double even this super bullish target.

I would be quite happy with that $150k in…

— Phoenix of Crypto (@PhoenixBTC7) January 7, 2024

DuckDive has also had enough of overly optimistic predictions, criticizing:

Didn't you say something like BTC to $100K in Dec 2020 as well?

Everyone expected $100K at some point last cycle. I'm not saying $533K is impossible, but there aren't enough data points to validate the prediction imo.

How about we break previous ath first? Level by level is… pic.twitter.com/okqZBkbauI

— DuckDive (@duckdivegg) January 7, 2024

Crypto exchanges with the lowest fees 2024

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024