Table of Contents

Bitcoin is becoming increasingly popular. Recently, even a US state bought Bitcoin ETFs – this could have a signaling effect.

• Wisconsin is the first US state to invest in Bitcoin ETFs

• 164 million US dollars invested in two different BTC ETFs

• Crypto fans react enthusiastically – and hope for a signal effect

At least since the introduction of Bitcoin spot ETFs in the USA , which was approved by the US Securities and Exchange Commission (SEC) in January, even the most determined crypto opponents cannot deny that cryptocurrencies – especially BTC – have gone from being a small niche product for risk-taking speculation to a standard asset class suitable for the masses. Further proof of this was recently provided: for the first time, a US state invested in a BTC ETF.

Wisconsin invests hundreds of millions in Bitcoin ETFs

According to a recent filing with the U.S. Securities and Exchange Commission (SEC), the State of Wisconsin Investment Board (SWIB) made investments in the newly approved Bitcoin spot ETFs in the first quarter. Specifically, at the end of the first quarter – on March 31, 2024 – the company owned approximately ten million shares of the Grayscale Bitcoin Trust (GBTC) and 2.4 million shares of BlackRock ‘s iShares BTC Trust (IBIT) . The total value of these shares was around 164 million US dollars. The investment company SWIB is behind, among other things, the state pension fund (WRS) and Wisconsin’s state investment fund (SIF). SWIB did not respond to a Reuters request for further information.

A first in US economic history

This is a first in US economic history: For the first time, a US state has invested in BTC using the spot ETFs approved in January. This is significant because it is the first time that part of the state pension system’s funds have been invested in cryptocurrencies. However, the invested sum of 164 million US dollars must be put into perspective: According to Reuters, SWIB’s assets under management total 156 billion USD. The share of Bitcoin spot ETFs in the total portfolio therefore only accounts for a good 0.1 percent, which is negligible. Nevertheless, Wisconsin’s Bitcoin investment attracted attention not only in crypto circles, as a new trend could be emerging here.

Expert sees Wisconsin’s Bitcoin investment as a “big deal”

David Krause, professor emeritus of finance at Marquette University in Wisconsin, sees some advantages to investing in BTC ETFs. “Like any good portfolio manager, you want to diversify,” Krause explains in an interview with Wisconsin Public Radio. “And now that BTC has been around for over a decade, we know that it not only offers pretty high returns – sometimes even phenomenal returns over longer periods of time – but also offers diversification opportunities. It doesn’t move directly in lockstep with stocks and bonds.”

Krause goes on to say that it is a “big deal” for SWIB to get involved in the BTC funds. Wisconsin’s pension fund is considered one of the most respected in the country. Krause is certain that Wisconsin’s Bitcoin ETF purchase will make waves in investment circles. “I can assure you that most institutional money managers have taken note of this,” stresses Krause. “The pension magazine (“Pensions & Investments”, editor’s note) pointed out just a few days ago that Wisconsin has done this. So I’m pretty sure that pretty much everyone who manages large pension funds or institutional funds knows that SWIB has taken this step.” The result is likely to be increased interest in Bitcoin ETFs from institutional investors such as other US state pension funds.

Crypto scene celebrates Wisconsin’s Bitcoin commitment

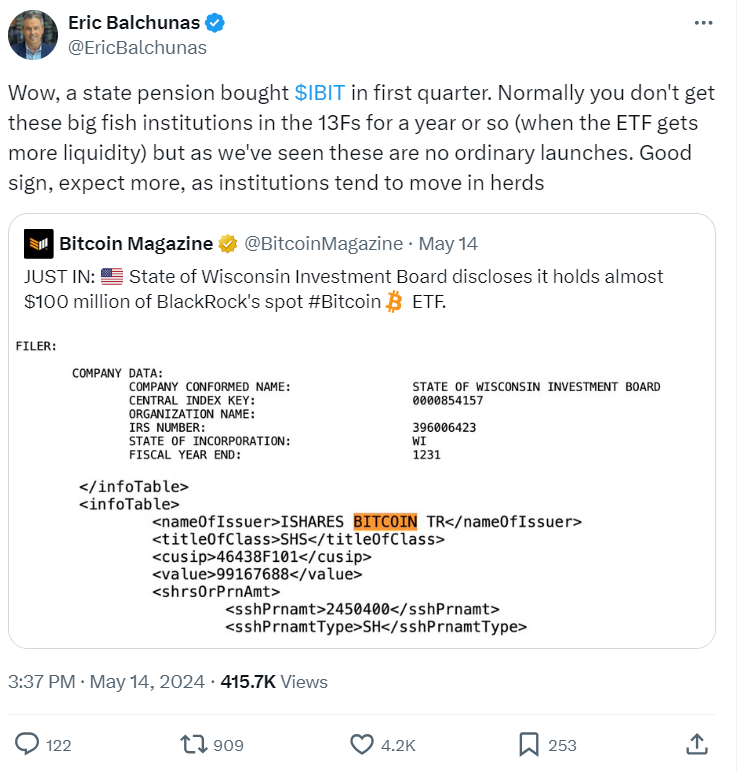

Many influential crypto enthusiasts also reacted promptly to what they considered to be a positive announcement from the SEC. Many crypto magazines such as the “Crypto Valley Journal” or For example, Eric Balchunas writes on X (formerly Twitter): “Wow, a government pension fund bought IBIT in the first quarter.” He sees this as a positive surprise: “Usually these big fish don’t show up in the 13Fs for a year or so (when the ETF gets more liquidity), but as we’ve seen, these aren’t ordinary new launches. A good sign, because institutions tend to move in herds.”

Consequently, Balchunas expects that other institutional investors – such as other US states – will jump on the bandwagon. BTC investors should be pleased about this, as the increasing demand for Bitcoin ETFs would fuel the price of the world’s largest cryptocurrency, as “DER AKTIONÄR” points out. In fact, Bitcoin, which has already risen 60.17 percent since the beginning of the year at a current price of 67,306 USD, is currently creeping ever closer to its record high.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024