According to Bloomberg, one of the most well-known processing processors in the world, BitPay Inc. announced a change in the structure of payments using digital assets over the last year.

BTC usage in companies using a payment system processor last year dropped to about 65% of transactions, from 92% in 2020, according to Bitpay. ETH accounts for 15% of all transactions, other currencies such as Litecoin (LTC) and Dash (DASH) have increased their share.

Since November last year, people have started to use stablecoin more often for cross-border payments, because their value is constant and minimizes the risks of volatility in the cryptocurrency market.

The growing popularity of stablecoins has partially encouraged the use of alternative coins for payment. For example, last year Dogecoin (DOGE) came to prominence thanks to its supporters, including Tesla CEO Elon Musk, who announced that the coin would be accepted for the purchase of Tesla-related products.

At the moment, all indications are that people are saving BTC, not spending it. According to Bitpay, most of the BTC transactions last year involved luxury items such as jewelry, watches and cars.

According to Bitpay CEO Stephen Pear, the volume of transactions for the purchase of luxury items in 2021 increased by 31% from 9% in 2020. In 2021, the volume of payments increased by 57% in all directions.

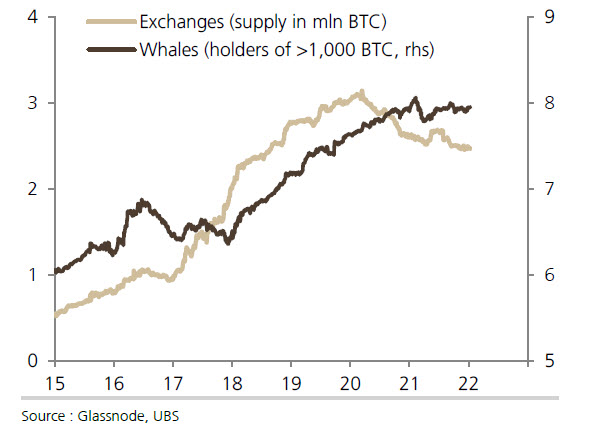

Whales have also never held more coins than they do now.

How to buy, sell and create NFT on OpenSea

- Dogecoin Price Analysis – January 14, 2025 - January 14, 2025

- Bitcoin (BTC) Price Analysis – January 13, 2025 - January 13, 2025

- Baby Doge Coin (BABYDOGE) Price Analysis – January 13, 2025 - January 13, 2025