The big price rally on the crypto market could actually have started already. At least if most analysts are to be believed. Some predicted, especially in March, when one high after another was reached, that the BTC price could already be at 100,000 USD. But things turned out quite differently. The all-time high of just under 74,000 USD could no longer be reached. Experts nevertheless expect that the big crypto rally has only been postponed and not canceled. Some data suggests this. This includes the falling Bitcoin supply on crypto exchanges.

As little Bitcoin as in 2021 on the stock exchanges

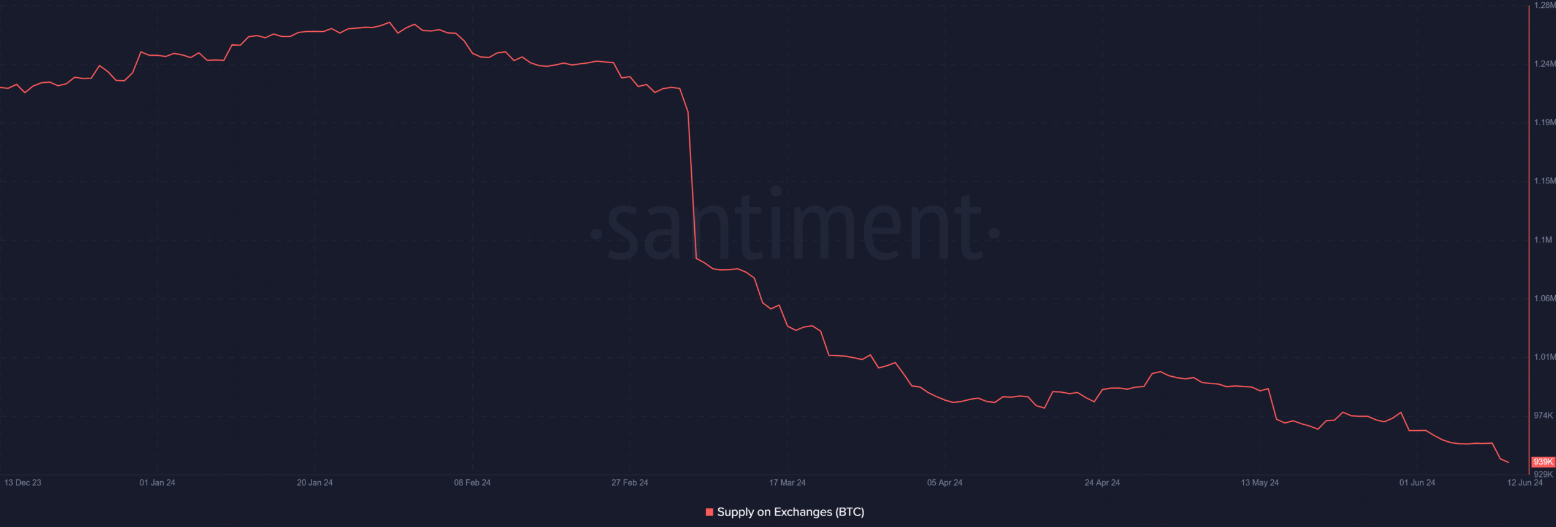

A key factor that makes BTC so attractive to investors is the fact that the total supply is limited. In the end, there will only be 21 million BTC. However, due to the halving, which takes place every four years and halves the rate at which new Bitcoins are issued, it will take over 100 years until all 21 million Bitcoins have been mined. This scarcity is now also evident on the crypto exchanges. The last time there was as little BTC on the exchanges as there is today was in 2021.

The supply on the exchanges is falling rapidly. While there were still over 1.2 million Bitcoin on the exchanges at the beginning of March, there are now only 939,000 BTC. The trend is continuing to fall. It is undisputed that the falling supply will sooner or later lead to rising prices.

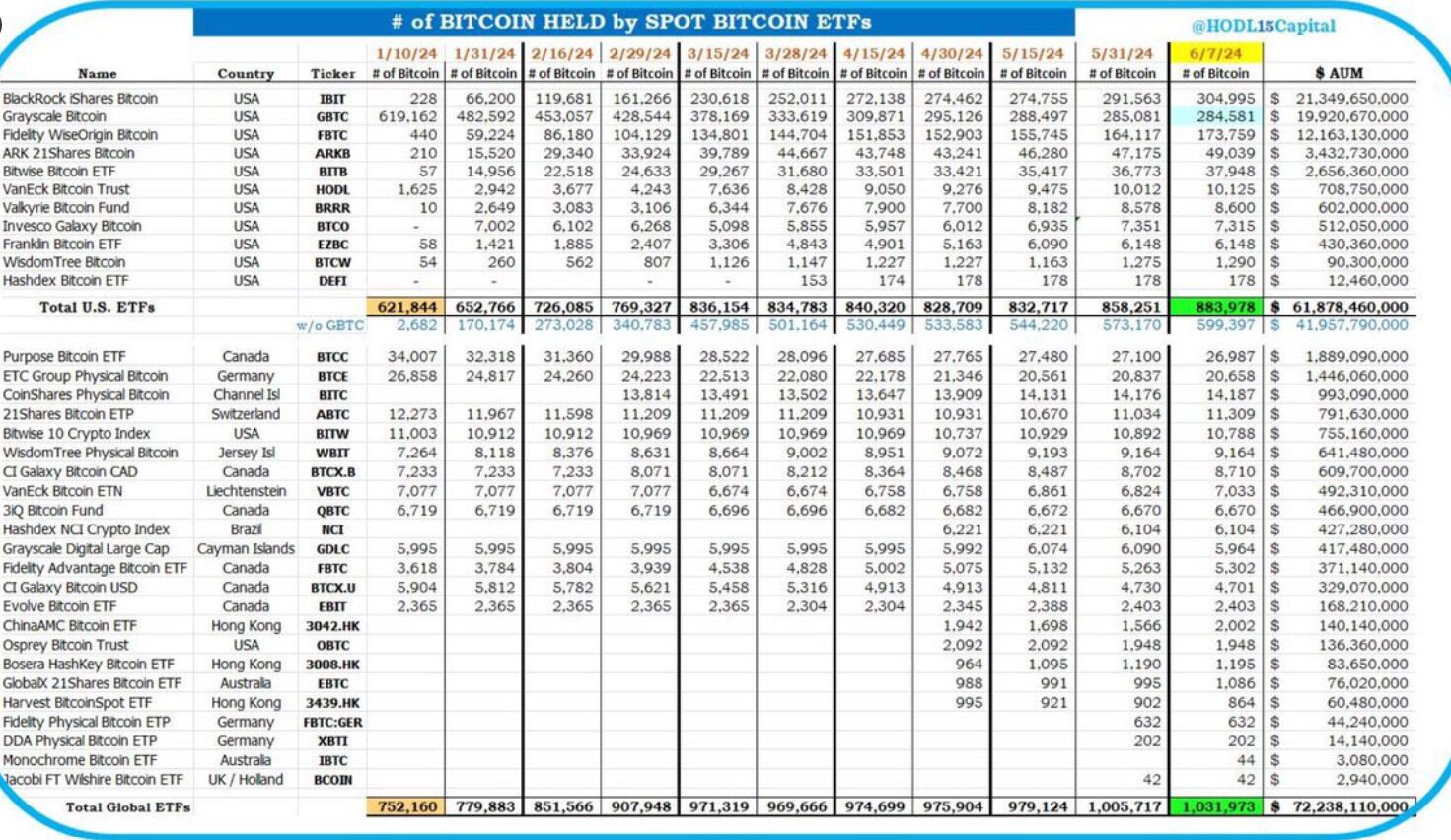

ETF issuers are buying up the market

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024