Table of Contents

What would have to happen for the BTC price to break the $1 million mark? There is no question that some capital would have to flow into the market. But not nearly as much as one or the other might think at first.

The market cap thing

The calculation seems simple at first. With a BTC price of $1 million and a circulation volume of just under 19 million BTC, we would arrive at a market capitalization of $19 trillion. With the current market capitalization of almost 760 billion US dollars, we are still missing 18.2 trillion US dollars. Where are they supposed to come from?

The answer is: we don’t need that much. After all, the market capitalization says little about how much money is actually in BTC. It just multiplies the current BTC price by the number of coins in circulation. And the current course only shows at what price people are currently buy BTC And sell.

In addition: An estimated 4 million BTC have disappeared in the land of lost keys and will probably never be traded again. BTC is therefore a very scarce commodity that will become increasingly scarce as demand increases. So much for the basics.

BTC price of $ 1 million: That’s what we’re missing

Like financial youtuber Andrei Jikh in a recent video explained there are various catalysts that, in combination, could lead us to our goal.

Jikh lists the international remittance market as the first catalyst. In principle, this is the number 1 use case for cryptocurrency: sending money. This system is currently characterized by long waiting times, limited business hours on weekends and high fees. BTC is a lot more efficient there. According to Jikh’s analysis, if the cryptocurrency claimed about 50 percent of the international remittance market, it would inject $300 billion into the ecosystem. The BTC price would thus be increased by 14,000 US dollars.

Catalyst 2 are the emerging market currencies, i.e. money and money equivalents of emerging countries. These include the Chinese renminbi, the Russian ruble, the Brazilian real and the Indian rupee. This is where BTC can act as a store of value. Only left in February Goldman Sachs state that they think it is likely that BTC will play an increasingly important role as a reserve currency in the future. If BTC manages to claim 10 percent of the market here, it would inject $2.8 trillion into the market. For the BTC course, that would mean a plus of 133,000 US dollars per coin. Jikh describes this as a conservative estimate: The top 4 emerging market currencies would be excluded from this calculation.

Catalyst 3 for the BTC price of $1 million is the Economic Settlement Network, the international payments network. The background: When banks send money, they usually have a currency in which they “meet”, for example the US dollar. If the cryptocurrency manages to claim 25 percent of this market for itself, another 3.8 trillion US dollars would come into the digital pot of gold. According to Jikh’s calculations, that would be an additional $181,000 per BTC.

Treasuries, high net worth individuals and institutional investors

Catalyst 4 are the state coffers. If BTC managed to grab 1 percent of the reserves here, we could add another $3.8 trillion to our hopium-laced digital treasury. Another 181,000 US dollars would then be added to the BTC course. In any case, the fact that El Salvador will not remain alone with its BTC acceptance for long plays into the hands of this argument.

Catalyst 5 for a BTC price of 1 million US dollars are high net worth individuals, i.e. wealthy people. If these people converted 5 percent of their assets into BTC, we would have another $4 trillion in the pot. For the BTC price, that would be another $190,000.

As a sixth catalyst, Jikh cites institutional investors like Blackrock, whose CEO recently spoke positively about digital currencies. If they held 2.5 percent of their assets in the form of digital gold, that would add another $4.1 trillion to the market cap. Or: An additional $196,000 for the BTC course.

The seventh catalyst for the bullish moon ride are corporate treasury bonds. 5 percent of that wealth would be $4.2 million in additional BTC market cap. Or: A plus of 200,000 US dollars for the BTC course.

The eighth and final catalyst Jikh lists is gold. If BTC secures its place in the sun and takes half the market cap of gold, another $5.5 trillion would be poured into the world’s wallets. That would be another $260,000 for the BTC course. You can read here why this is not so unlikely.

BTC Price at $1 Million: Is It All Reading Coffee Leaves?

If all of these factors come true, BTC would hit $1.36 million. But is that realistic?

BTC would have a market cap of $28.5 trillion. However, that would be just under a third of the global stock market, which currently has an estimated market capitalization of $106 million. This forecast is by no means entirely unfounded.

Buy BTC now?

So should you buy BTC now? It should be clear: the statements made are all within the realm of probability, nobody can claim the magic crystal ball for themselves and can predict the future. All information is in this sense without guarantee. Nevertheless: A growing institutional interest, the growing acceptance of BTC, which is encountering a steadily shrinking supply, can be seen as positive signs.

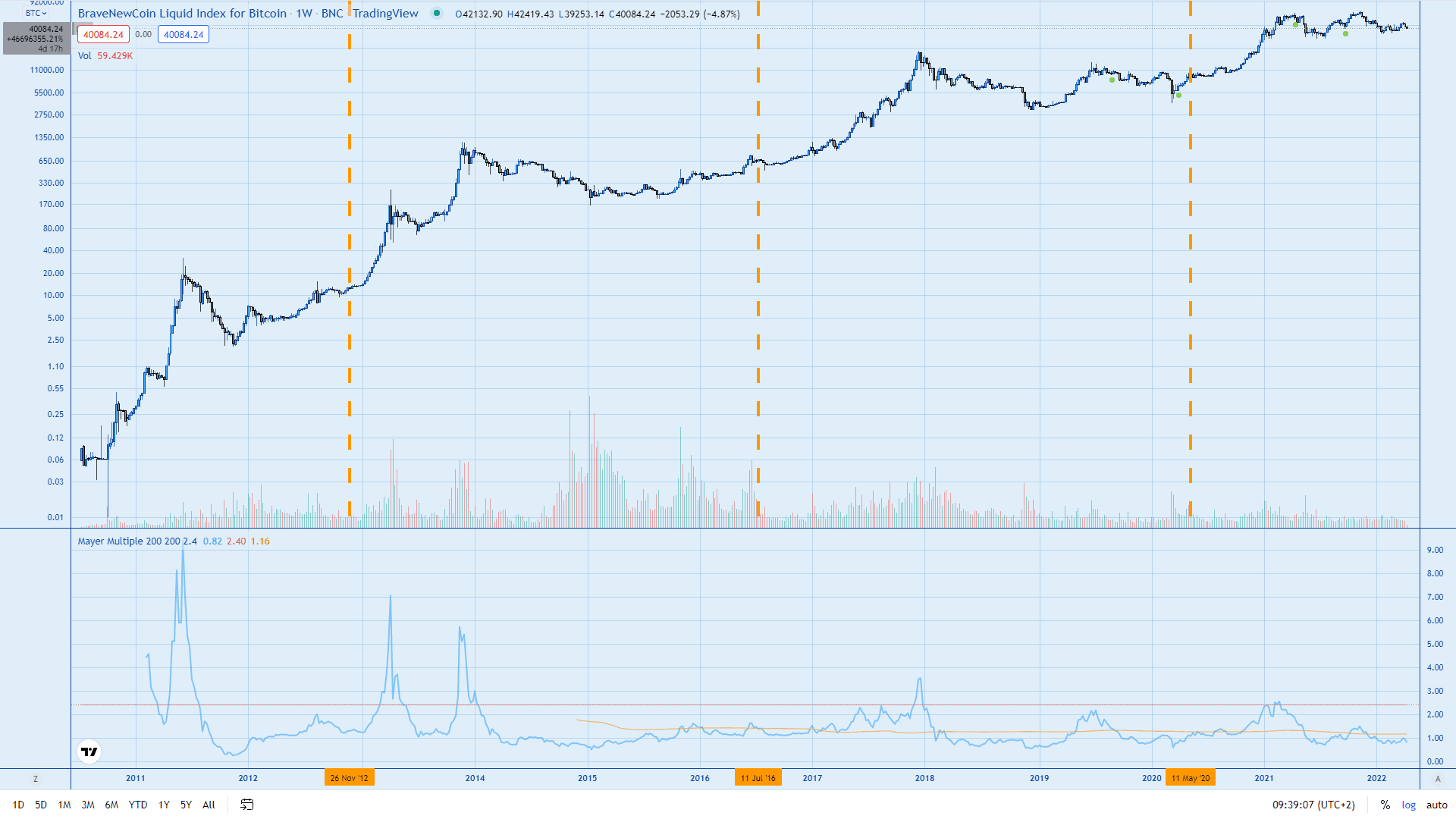

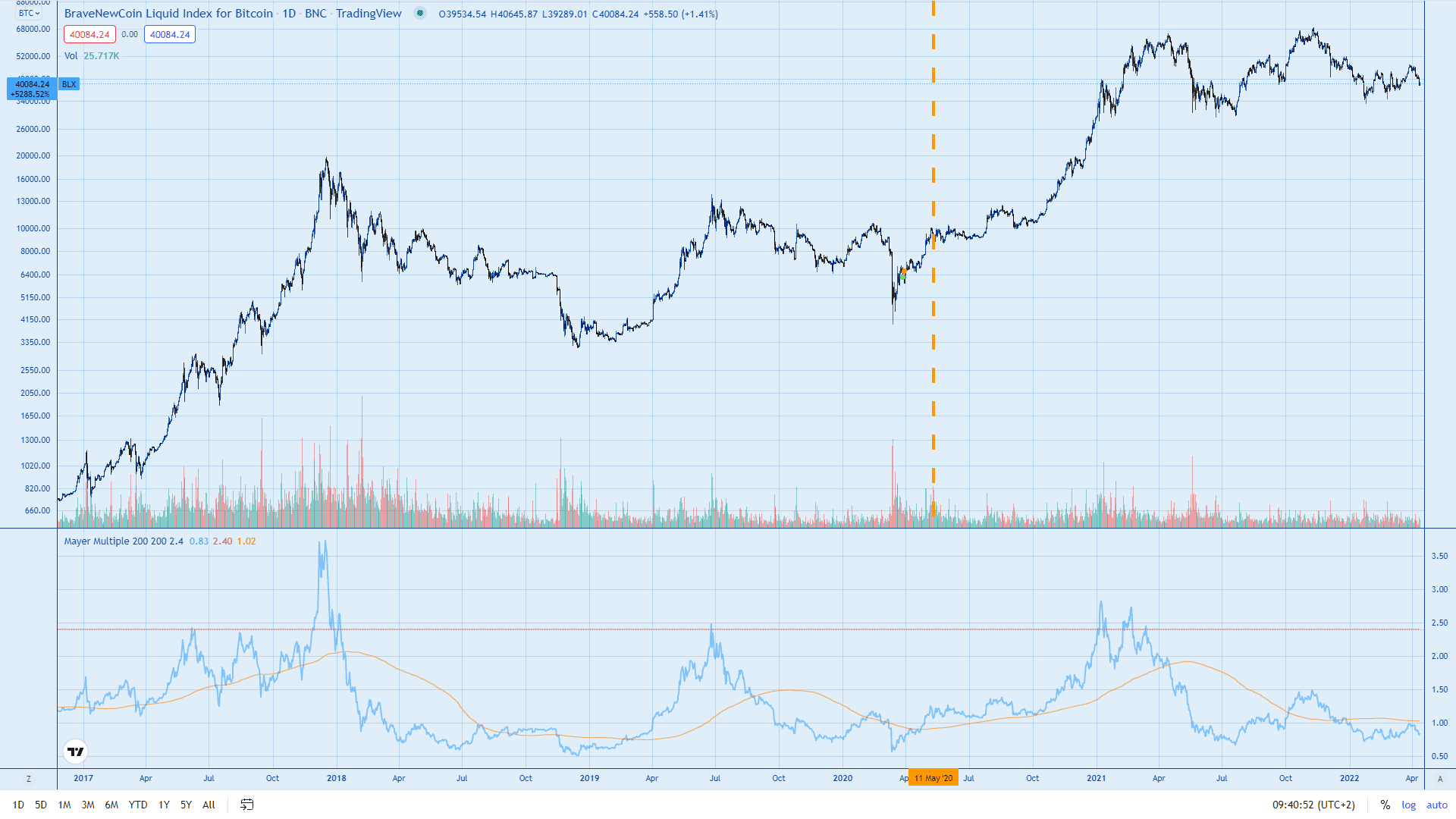

In terms of charts, the BTC course does not look bad either. Jikh suggests the Mayer multiple indicator from technical chart analysis here. This compares the current BTC price to the moving average of the last 200 days (200 SMA). This creates a quotient that, based on historical data, gives an assessment of whether a good entry point could be. In the past, when this was below 2.4, it turned out to be a good entry point in hindsight.

The Mayer multiple indicator is currently at 0.9.

The historical average of the BTC price is 1.4 – so if you take the Mayer multiple as a basis, it is currently an optimal opportunity to buy BTC.

Bored Ape Yacht Club is getting a short film trilogy

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024