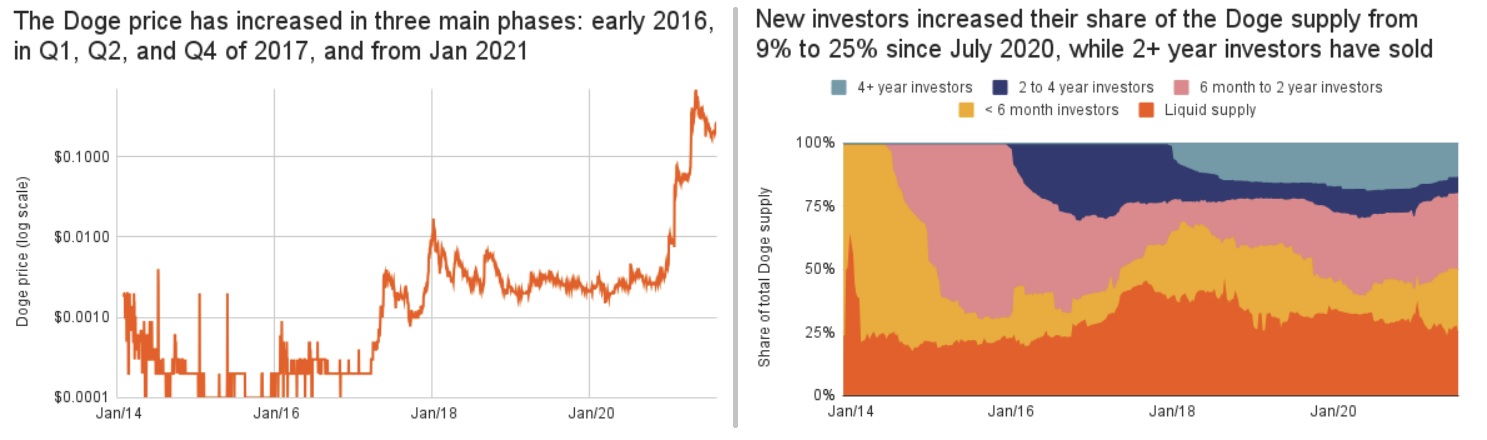

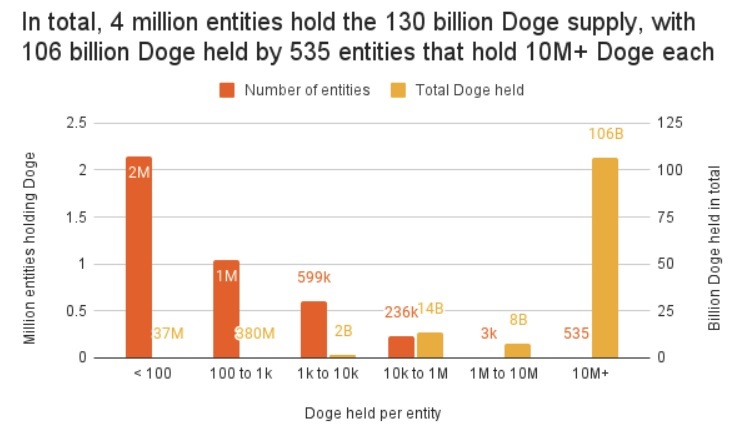

Blockchain’s analyst firm Chainalysis said Dogecoin (DOGE) “is currently being adopted by new investors at levels not seen since the bull market in late 2017.” The company further noted that “most of the supply is held by a small number of wealthy entities.” Specifically, 82% of DOGE’s offer is held by 535 entities that own more than 10 million DOGE.

Dogecoin analysis by Chainalysis platform

The blockchain data platform, Chainalysis, released a Market Intel report on Dogecoin last week. Philip Gradwell, the company’s chief economist, said:

“Dogecoin’s on-chain analysis shows that coins are currently being accepted by new investors at levels we have not seen since the bull market at the end of 2017, with new investors increasing their share of the offer from 9% in July 2020 to 25% in August 2021.”

Chainalysis’s chief economist also pointed out that Dogecoin’s ownership is highly concentrated, stating that “most of the supply is owned by a small number of wealthy entities.”

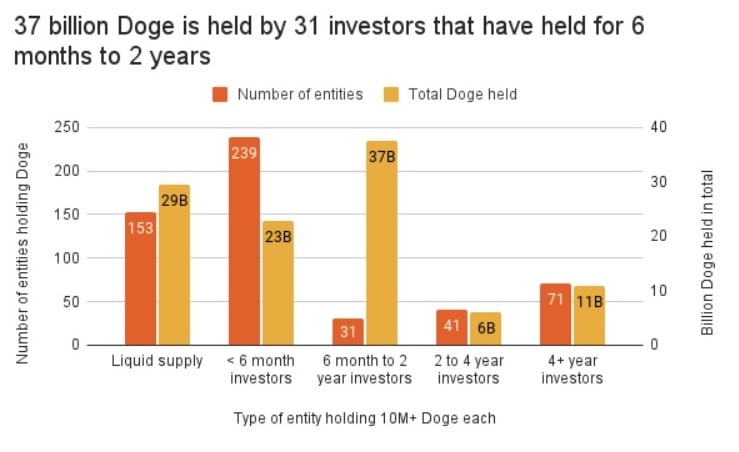

He explained that there are currently 4 million DOGE holders. “Of the 106 billion DOGE, 82% of the offer, however, is held by 535 entities that own more than 10 million DOGE, or 0.01% of the addresses owning most of DOGE,” he said, adding that “it is probably a mixture of companies such as exchanges that hold DOGE on behalf of millions of traders and several, now wealthy, early investors. ”

He further noted that of the 4 million DOGE holders, 2.1 million entities hold less than 100 DOGEs, half of which hold a meme coin for more than two years. The economist explained that “these low-balance entities are not necessarily individuals, but are likely to be scattered wallets belonging to a smaller number of individuals.”

The analysis further reveals: “37 billion out of 106 billion DOGE is held by only 31 investors who have held their DOGE for 6 months to 2 years – an average of more than 1 billion DOGE. Some of them may be businesses, such as exchanges. “

The economist noted that “DOGE is an asset like any other with changes in ownership and liquidity in response to changes in demand and price”:

“The rise in Dogecoin prices proves that cryptocurrencies are experiments with branding for financial assets, created thanks to the hype and creativity of the Internet. While this may seem at odds with traditional financial values, traditional values may not be what consumers want. ”

What do you think about Dogecoin Chainalysis analysis?

Images: Bitcoin.com, Chainalysis

- Bitcoin Drops Below $94,000: Are the Bears Throwing a Blockchain BBQ? 🐻🔥📉 - December 30, 2024

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 23 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)