While the crypto world awaits the Bitcoin ETF every day, whales are currently betting on a completely different coin! As analysts note, wealthy investors have been buying Ethereum massively in recent weeks. Background: There is increasing evidence that an Ethereum ETF is also coming. Should you buy Ethereum now before the price explodes?

Does Ethereum still have a future?

Crypto whales are causing a stir! As top analyst Ali Martinez reports, these wealthy investors have been investing in Ethereum (ETH) for weeks: a whopping 410,000 ETH changed hands – worth almost a billion dollars! Martinez to his followers:

In the past month, #Ethereum whales bought over 410,000 $ETH, worth nearly $1 billion! pic.twitter.com/1gGguoEypx

— Ali (@ali_charts) January 6, 2024

Is Ethereum (ETH) now catching up – after the smart contract platform has long moved in the shadow of Bitcoin (BTC)? Why are whales investing so heavily in ETH? They clearly expect further upward movements in Ethereum – but why? Could a possible Ethereum ETF be the reason? Top Dutch trader Michael van de Poppe also expects an Ethereum ETF – and correspondingly bullish price action for ETH:

Bitcoin and Ethereum ETFs To Push the Markets Higher: @CryptoMichNL pic.twitter.com/ZfUDTvRcBg

— Adrian Zduńczyk, CMT (@crypto_birb) January 8, 2024

Ethereum ETF: Is there also an ETF for ETH?

The US Securities and Exchange Commission (SEC) has already approved some Ethereum ETFs – but not so-called spot-based funds, which are actually backed by cryptocurrencies and not derivatives. But there are a few factors that suggest that an Ethereum Spot ETF could also be launched alongside the Bitcoin ETF:

- 1. BlackRock, the world’s largest asset management firm, has filed to launch a so-called spot Ethereum ETF. The Ethereum ETF will run under the name “iShares Ethereum Trust”.

- 2. Grayscale and Invesco Galaxy have also submitted an application to open an Ethereum ETF.

Ethereum Forecast: Buy ETH Now?

So should you buy Ethereum (ETH) now before an Ethereum ETF is launched and the price goes through the roof? In the last 24 hours, ETH has already gained almost +4%, moving from $2,223 to as high as $2,296, where the coin is currently trading.

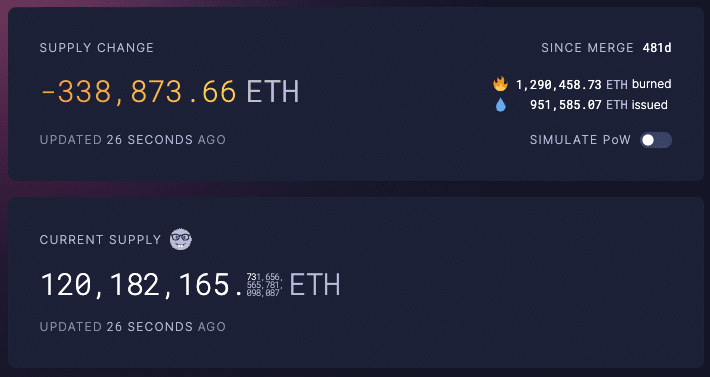

What speaks for Ethereum: The asset is becoming more and more deflationary. Since “The Merge,” nearly 1.3 million ETH has been burned. As a result, the supply is becoming increasingly scarce, making Ethereum more rare. This could also have a positive effect on the price. A current forecast from Gov.capital, for example, sees the Ethereum price at $4,448 by January 2025 and even at $17,336 by 2029.

But there are also opposite forecasts for Ethereum. Walletinvestor.com, for example, considers ETH to be a “bad” investment, warning of a decline to $1,591 in the next 12 months.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024