Almost every country in the world is going through a long period of high inflation. The only way to maintain the purchasing power of your cash is to invest in riskier assets. But is it viable?

Traditional economists tend to agree on one thing: low inflation is good. It may be controversial, but no matter what you think about it, politicians are targeting an annual inflation rate of around 2%.

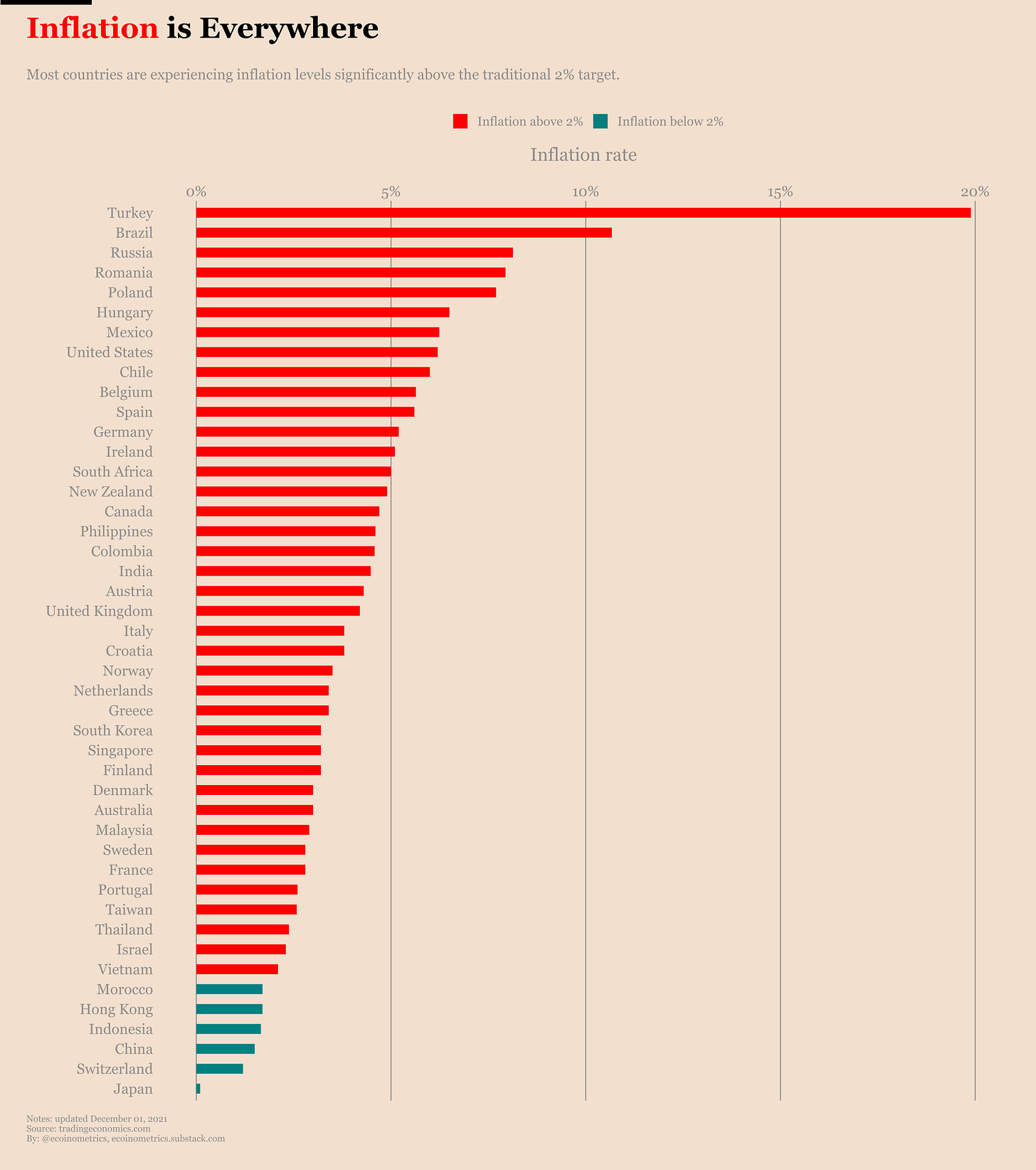

Given this number, how many countries still control their inflation? Probably not that much.

In most large countries, the annual inflation rate exceeds the 2% target. And when I say “exceeds,” I mean “really exceeds.” More than a third of countries have an indicator of 4% and above.

It didn’t start yesterday. These figures are not emissions for one month. This inflation began months after financial markets began to recover from the COVID-19 crash. It was in March 2020 and soon it will be 2022.

Prices are unlikely to fall and it is clear that we potentially need to be prepared to live with high inflation in the years to come.

So how do you maintain the purchasing power of cash when inflation is so high?

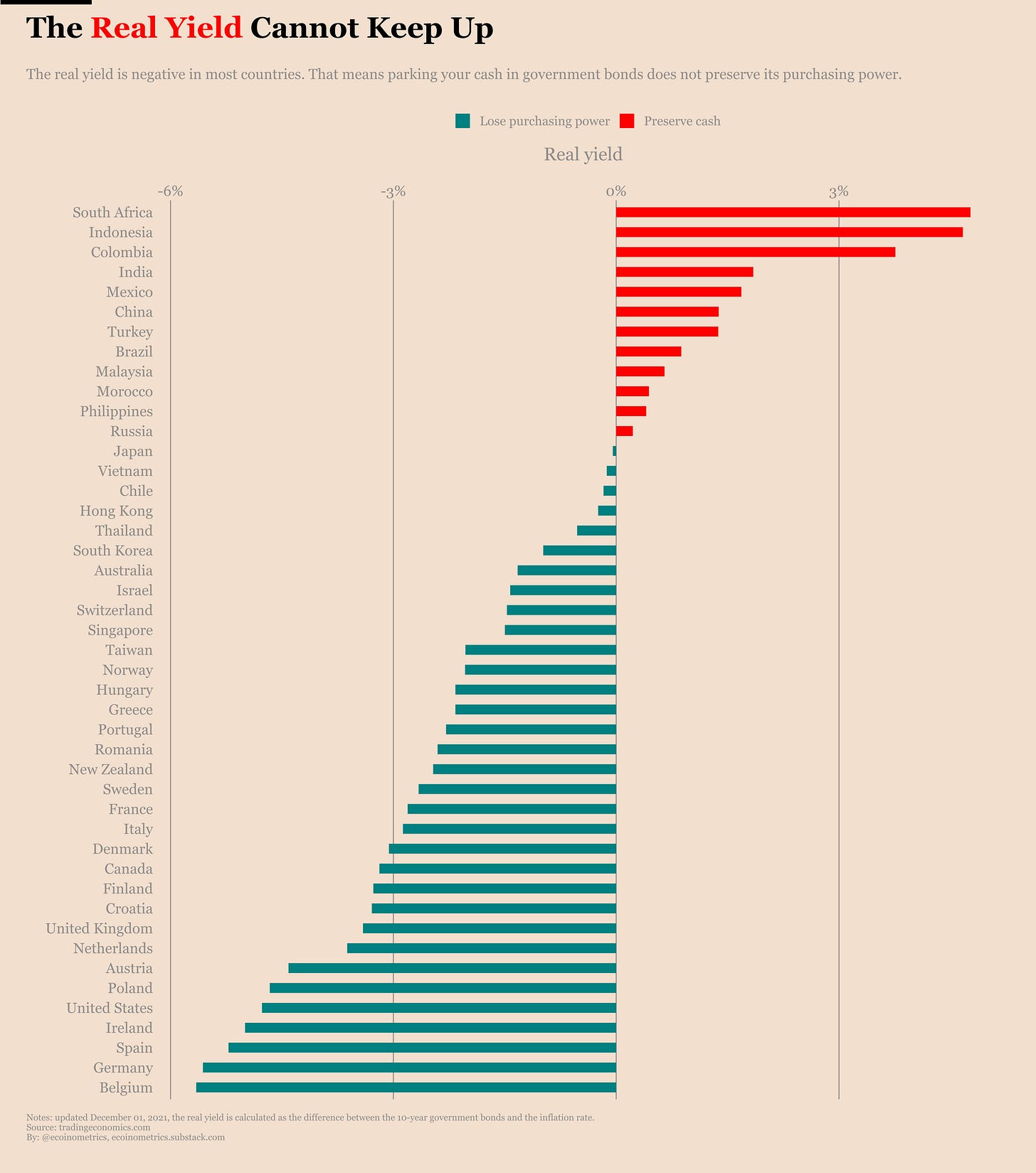

The answer to the ideal situation is simple: be careful, put your money in safe government bonds and wait for them to settle. But how does it work in practice? Judging by real incomes around the world, it doesn’t work at all.

See for yourself.

Countries with the “safest” debt do not offer returns that are attractive enough to offset inflation. And most countries with positive real returns have other kinds of currency problems.

Therefore, you cannot expect to survive the inflationary period without harm if you rely only on the bond market.

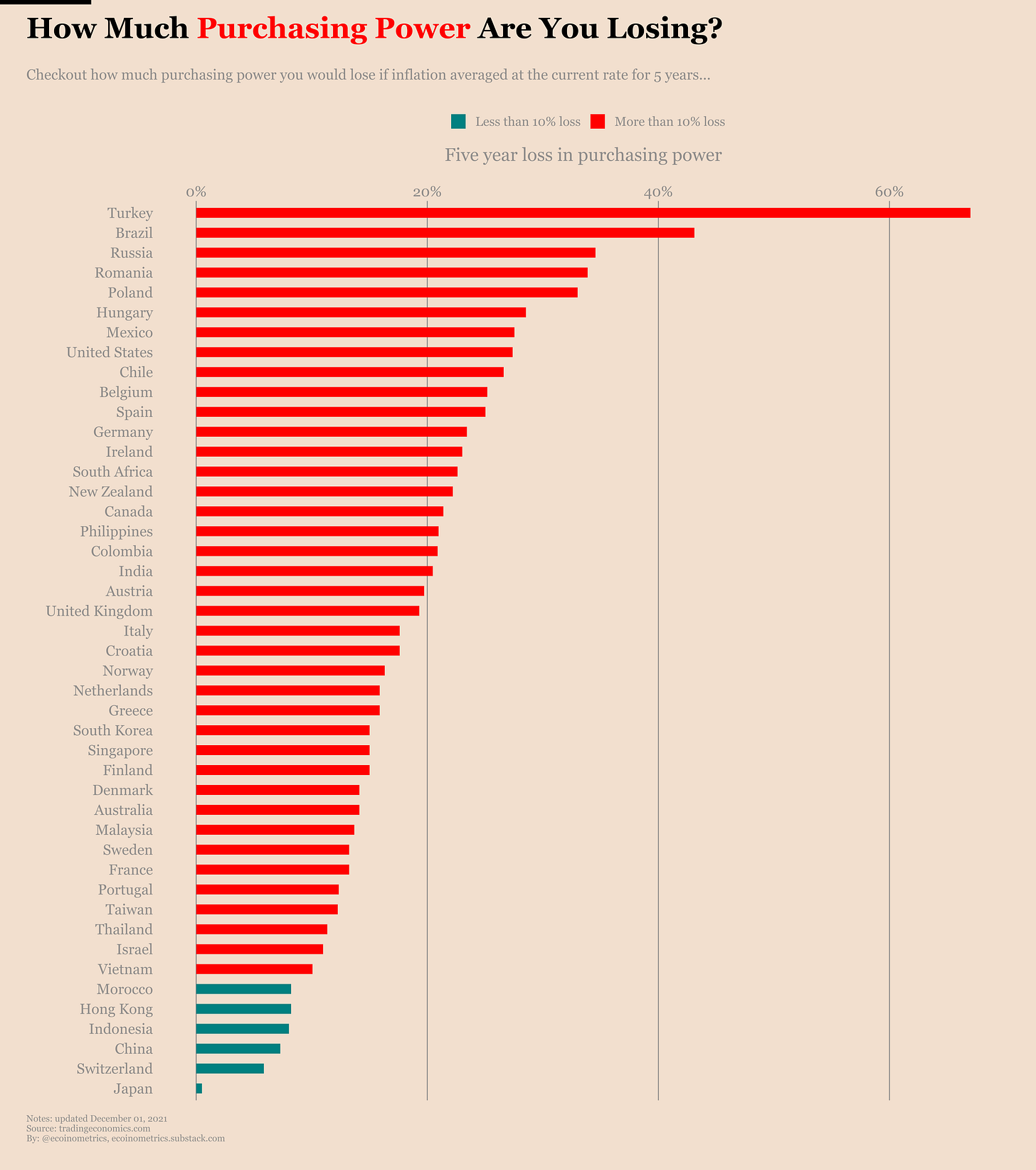

If you think it’s okay to do nothing, think again. In some less crazy scenarios, you can see that the loss of purchasing power can be significant.

If inflation in most countries were on average at the current level for five years, you would lose more than 10% of your purchasing power. In many countries it will be more than 20%.

So the choice is:

- spend your money on government bonds and watch their purchasing power dissipate;

- spend your money on high-yield bonds and risk losing everything due to the weak global economic situation;

- spend your money on stocks that have historically highest valuations in most standard metrics;

- or invest in a new world, BTC and digital assets.

I’m heading here. Many investors (both private and institutional) will think the same and are likely to conclude that the latter has many benefits without being too risky.

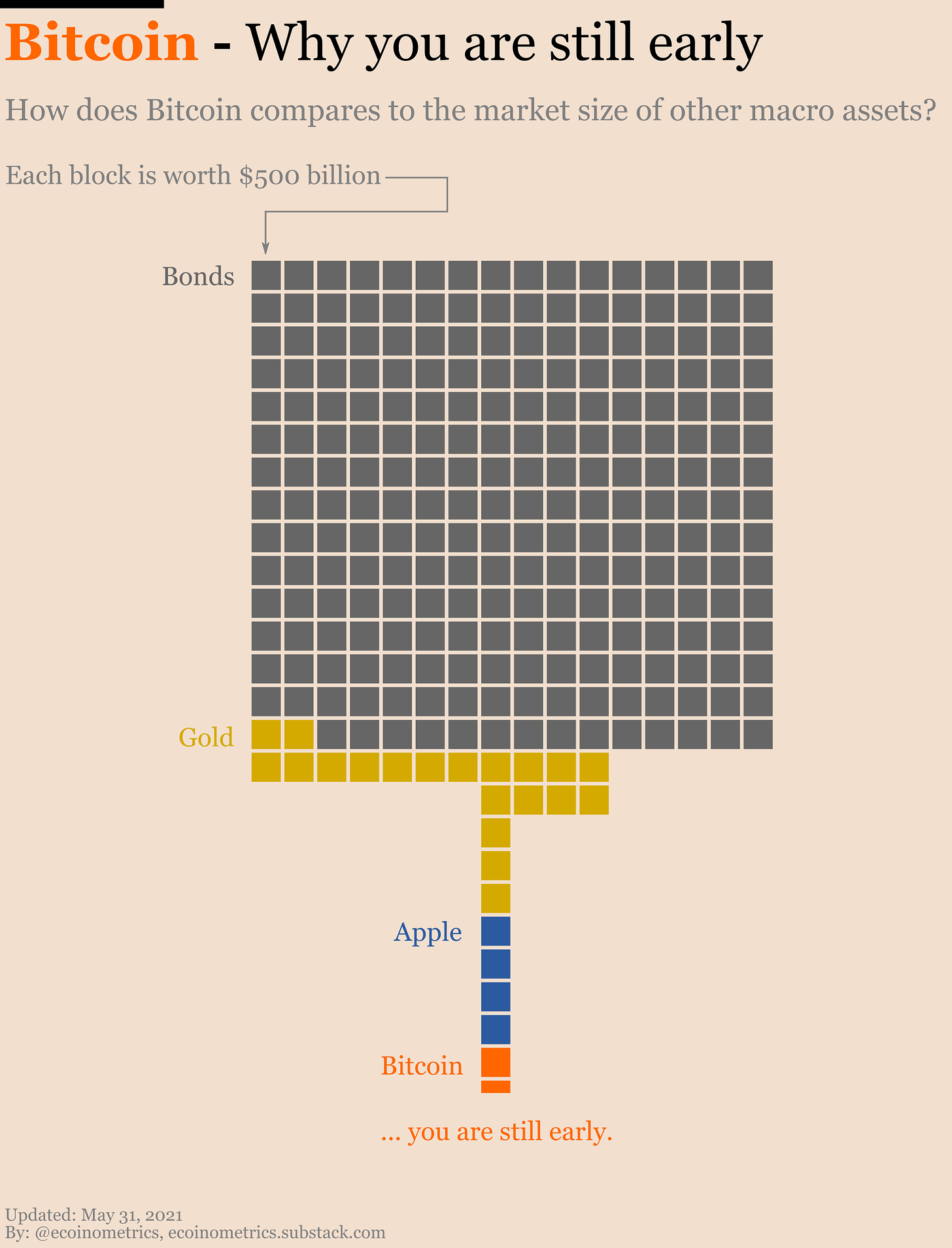

Sometimes people say “The cryptocurrency market is too big right now, it can’t grow fast anymore . “

I don’t know if BTC will continue to grow as fast as in the past. But if some money starts to flow from the bond market into digital assets, then BTC will have no trouble reaching a market capitalization of up to $ 10 trillion.

I mean, the bond market is huge. Take a look.

How soon will it happen? Nobody knows. But the inflationary environment certainly points to an earlier time rather than a later one. We’ll see how it ends.

How ASIC orders from institutional miners affect the price for terahash

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 16 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)