Table of Contents

Central banks around the world are exploring the potential of Central Bank Digital Currencies (CBDCs) as tools to modernize financial systems. But what if we looked beyond the technology and saw CBDCs as a potential remedy for some of the most pressing economic challenges of our time? From declining purchasing power to inefficient social benefits distribution, CBDCs might represent a transformative shift in how we manage the economy.

Macroeconomic Stability on Steroids

Faster and More Precise Monetary Policy

Traditional central bank tools—like interest rates and quantitative easing—are often slow and imprecise. CBDCs, on the other hand, enable immediate and targeted interventions. A central bank could directly influence the velocity of money through programmable features of digital currency.

Example: The central bank could issue a certain amount of digital currency to citizens with a 30-day expiry. If not spent, the funds vanish. This would effectively stimulate spending and boost economic activity.

Taming Inflation and Deflation

CBDCs allow for finer control of money supply without relying on intermediaries (like commercial banks). If the economy risks overheating, CBDCs can be removed from circulation quickly. In a downturn, fresh liquidity can be rapidly injected directly into users’ wallets.

Cracking Down on the Shadow Economy

CBDCs could bring greater transparency to financial flows. This would make it harder to launder money, evade taxes, or commit fraud, helping strengthen government budgets and reduce economic leakage.

Boosting Individual Purchasing Power

Faster and More Targeted Crisis Aid

The COVID-19 pandemic made it painfully clear: the speed of aid distribution is critical. In many countries, people waited weeks for financial support. With CBDCs, governments could send real-time financial assistance directly to digital wallets.

Example: During a lockdown, the government could issue a “digital voucher” worth, say, $500, which can only be spent on food, housing, or medicine—ensuring the aid serves its intended purpose.

Personalized Subsidies and Smart Discounts

With programmable money, governments could easily implement differentiated VAT rates or targeted subsidies. For instance:

- Low-income households could automatically pay lower taxes on essential goods.

- Students could receive a “scholarship credit” spendable only on educational resources.

- Families with children could get grocery discounts applied in real-time at checkout.

Lower Costs for Financial Services

In many regions, underprivileged populations lack access to affordable banking and pay high fees for basic transactions. A CBDC could be completely free or extremely low-cost, increasing real disposable income for millions of people and boosting financial inclusion.

In Summary: CBDCs aren’t just a digital replacement for cash. They have the potential to reshape how we fight inflation, reduce poverty, distribute aid, and modernize economic systems from the top down and the bottom up.

A Social Welfare Revolution Powered by CBDCs

No More Fraud, No More Paperwork

The current welfare systems often suffer from inefficient distribution, delays, and abuse. With CBDCs (Central Bank Digital Currencies), social benefits could be automated, time-limited, and tied to specific purposes.

Example: A housing allowance could be programmed to work only with approved landlords, ensuring the funds are spent as intended.

Universal Basic Income (UBI)

CBDCs could be the ideal tool for implementing a universal basic income. Digital wallets tied to each citizen could automatically receive a recurring amount—with no bureaucracy and no eligibility conditions.

Such a system could help:

- Reduce income inequality

- Support consumption

- Restore dignity to the unemployed

Transparency and Traceability

Every transaction made through a CBDC system can be tracked and audited. This makes corruption harder and ensures that funds go exactly where they are supposed to.

Smarter Governance and Fiscal Policy

Automated Tax Collection

CBDCs could allow for automatic deduction of taxes from income or purchases. This would cut administrative costs, speed up tax collection, and minimize tax evasion.

Real-Time Policy Adjustments

Governments could monitor consumer behavior and spending patterns in real time. This enables dynamic adjustments to welfare programs or economic regulation—with far more precision than ever before.

What Could Go Wrong? Risks and Challenges

Of course, every coin has two sides—and CBDCs are no exception.

Concerns Over Digital Surveillance

One of the biggest concerns is that CBDCs could give the state unprecedented access to citizens’ financial lives. Combined with programmability, this raises fears of potential abuse—such as blocking transactions based on “undesirable” behavior.

Threat to Commercial Banks

If people are allowed to hold digital currency directly at the central bank, we could witness a massive outflow of funds from commercial banks—especially during times of crisis or instability.

Technological Vulnerability

Any cyberattack or system outage could cripple the economy. That’s why it’s crucial to build a secure, resilient, and redundant infrastructure that can withstand attacks and disruptions.

CBDCs Around the World – Who’s Leading the Race?

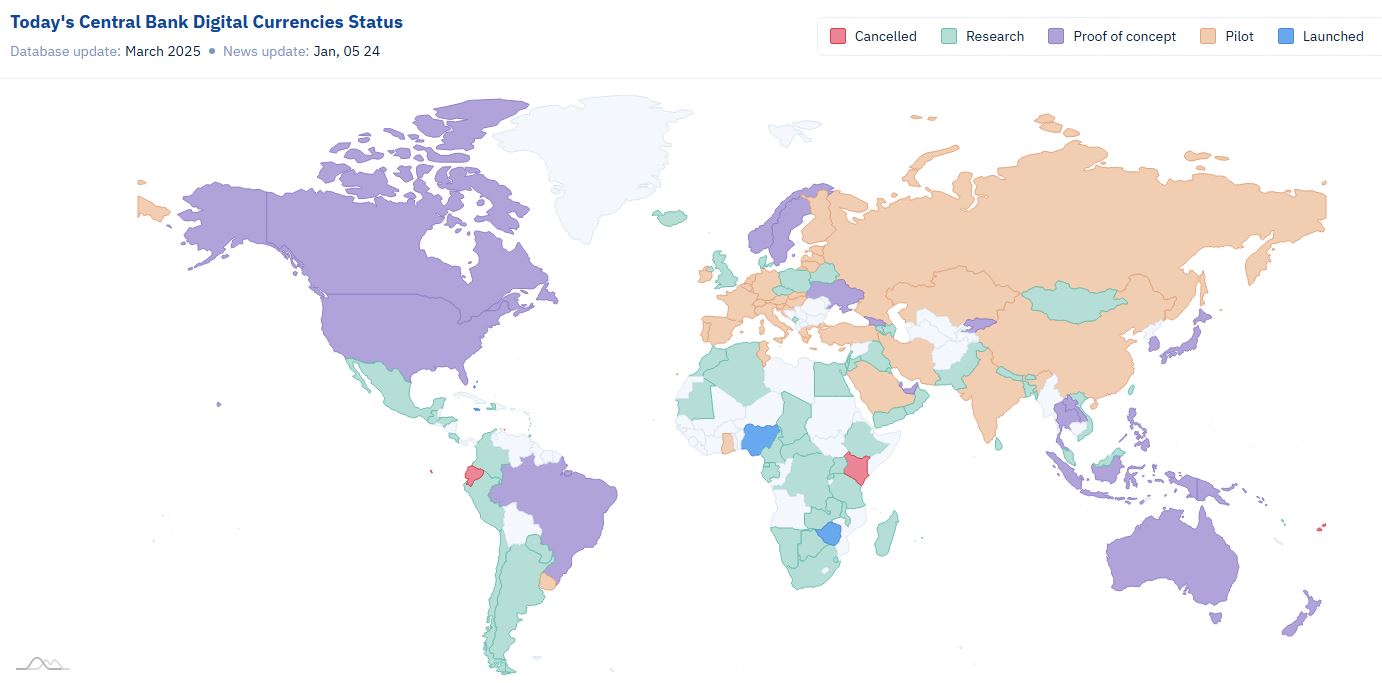

The map below shows the global progress on CBDCs as of March 2025. It clearly illustrates that CBDCs are no longer just a theoretical discussion, but a worldwide race unfolding in several phases.

Let’s Take a Closer Look: Who’s Leading the Global CBDC Race, Who’s Testing, and Who’s Already Gone Live?

China – Digital Yuan Goes Full Speed Ahead

China is the undisputed global leader in the rollout of a central bank digital currency. Its digital yuan (e-CNY) is technically still in the pilot phase—but it’s already being used across multiple regions and major cities.

It’s used for:

- Public transportation payments

- Selected retail purchases

- Government subsidies and welfare

China’s digital yuan isn’t just about tech. It’s also a powerful geopolitical tool, aimed at boosting monetary sovereignty and reducing dependence on the US dollar. Subtle? Not exactly.

The Bahamas – The First Country to Launch a CBDC

The Bahamas made history by launching the Sand Dollar in 2020, becoming the first country in the world to roll out a live CBDC. Despite having a small economy, it serves as a real-world lab for digital currency innovation.

CBDCs help in:

- Bringing financial access to remote islands

- Direct government aid delivery

Sometimes, small islands make big waves.

Nigeria – Official Launch, But Facing Headwinds

Nigeria launched its eNaira, but adoption remains sluggish. The reasons? Lack of public trust in the government and unclear benefits for the average citizen. Turns out, people aren’t eager to go digital if they think Big Brother is watching.

USA – Still in “Proof of Concept” Limbo

The United States hasn’t launched a CBDC yet. However, pilot projects led by the Federal Reserve and MIT (Project Hamilton) are exploring a potential digital dollar.

Key obstacles:

- Privacy concerns

- Impact on commercial banks

- Political polarization

In short: everyone’s arguing, and nobody wants to be first to press the “mint” button.

European Union – Digital Euro on the Horizon

The European Central Bank (ECB) is in advanced research stages for a digital euro, currently running pilots with multiple commercial banks and eurozone member states.

The vision?

-

To complement cash, not replace it

-

To serve as an optional, privacy-conscious, and secure payment method

Sounds very European, doesn’t it?

Sweden – Europe’s CBDC Pioneer

Sweden, already nearly cashless, has been developing its e-krona since 2020. The country leads Europe in CBDC development, aiming to fully replace physical money while maintaining sovereignty over payment infrastructure.

If IKEA made monetary systems, it’d probably look like this.

Other Notable Players

-

Russia is testing a digital ruble, with pilot programs running since 2022.

-

India is piloting a digital rupee for both retail and wholesale use.

-

Thailand and Vietnam are deep into pilot testing.

-

South Korea is developing a solution with a focus on anonymity and scalability.

-

Japan is cautiously exploring, having launched a proof-of-concept phase.

Who’s Opting Out?

Countries like:

-

Germany (temporarily),

-

Switzerland,

-

Chile

have taken a more conservative stance or paused development, citing questions about necessity and technological feasibility.

What’s Next? Will Most Nations Launch a CBDC?

All signs point to yes. Within the next five years, most major economies are expected to have some form of CBDC in place—whether it’s a full launch, advanced pilot, or institutional test.

Final Thoughts: Currency of the Future or a Digital Dystopia?

CBDCs hold the potential to solve key structural problems—from inefficient welfare systems to strengthening purchasing power and macroeconomic control. They could help create a faster, fairer, and more transparent economy.

But let’s not forget the fine print: privacy concerns, cybersecurity risks, and a redefinition of commercial banking are very real challenges.

One thing is clear: CBDCs are not just a tech trend. They are a transformational tool that could revolutionize not just how we pay, but how modern societies function.

If implemented wisely, CBDCs could become the tide that lifts all boats—not just those already sailing the luxury yacht of wealth.

- How CBDCs Could Solve Economic Problems: A Revolution in Monetary Policy and Everyday Life - March 27, 2025

- Bitcoin Near Mining Costs as Meanwhile Open Interest Hits $32 Billion – Perfect Buy Opportunity or Crash Incoming? - March 27, 2025

- 75% Chance Bitcoin Will Hit New All-Time High in 2025? Here’s Why That’s Not Just Wishful Thinking - March 26, 2025