A recent report from CryptoQuant, released on Thursday (30/05), suggests that the cryptocurrency market is still far from reaching a peak. Everything indicates that it is not yet time for investors to sell their Bitcoins.

The market intelligence firm analyzed whether Bitcoin was approaching a “distribution zone” or market peak, or whether current prices still represent a good buying point for investors.

MVRV: The definitive indicator

Tarek On-Chain, an authorized analyst, mentioned that there is only one indicator that can determine the best stock for long-term investors currently.

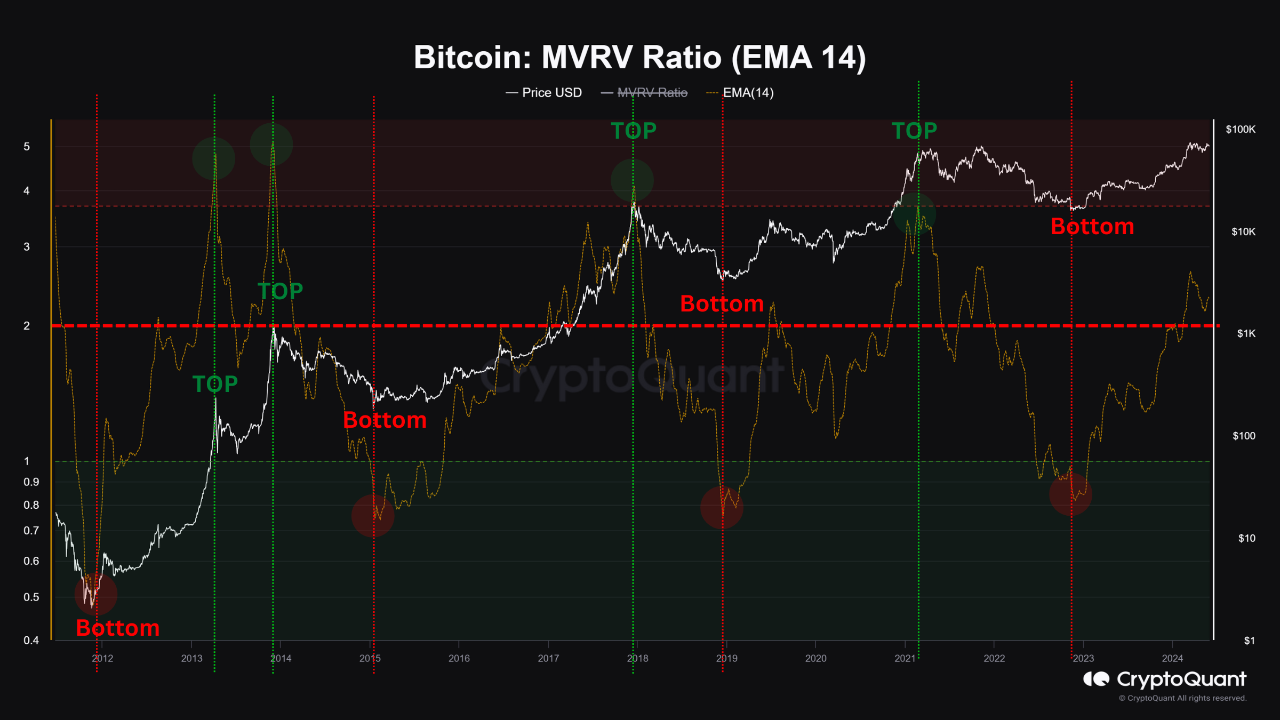

“The MVRV (Market Value to Realized Value) indicator provides an extremely accurate alert for Bitcoin price tops and bottoms.”

Bitcoin’s MVRV indicator is a classic on-chain metric that measures the relationship between Bitcoin’s market value and its “paid-in capital”. Market value, a more familiar financial metric, represents the combined total value of all Bitcoins in circulation based on Bitcoin’s current market price. By contrast, paid-in capital calculates the value of all coins based on the last time each coin was moved on the blockchain.

Generally, MVRV is used to measure the degree of profit that Bitcoin investors hold, assuming that the realized price of each coin equals the entry point of a specific buyer. For example, a ratio of 2.0 means the currency has doubled in value since the last purchase.

Don’t sell your Bitcoins yet, advises CryptoQuant

Throughout Bitcoin’s history, the MVRV index has generally remained above 1.0, with the exception of the bear market in late 2022. According to Tarek, values below 2.0 generally indicate that Bitcoin is in an accumulation zone and “still below its true value”.

In contrast, bull cycle peaks usually occur when the value exceeds 3.5, which means the network has profits of 250%. The more unrealized profits increase, the more long-term holders who are in profit are incentivized to start redeeming their money.

Currently, Bitcoin’s MVRV index is at 2.3.

“This means we are still some way off the peak, and the price will reach a new high this cycle, which could be above $100,000,” wrote Tarek. “Exit should only begin when the indicator approaches a value of 3.”

In its most recent weekly report, CryptoQuant said bulls have little to worry about regarding the bankruptcy of Mt. Gox, which recently began moving coins on-chain in preparation for payments to creditors. The distributions, expected later this year, will put more than 141,000 BTC back into the network’s circulating supply.

“There is no immediate selling pressure for Bitcoin from these movements, as the transfers occurred within the addresses of the same entity (Mt. Gox Rehabilitation Trustee) and are not yet available to the open market,” the firm wrote.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024