Table of Contents

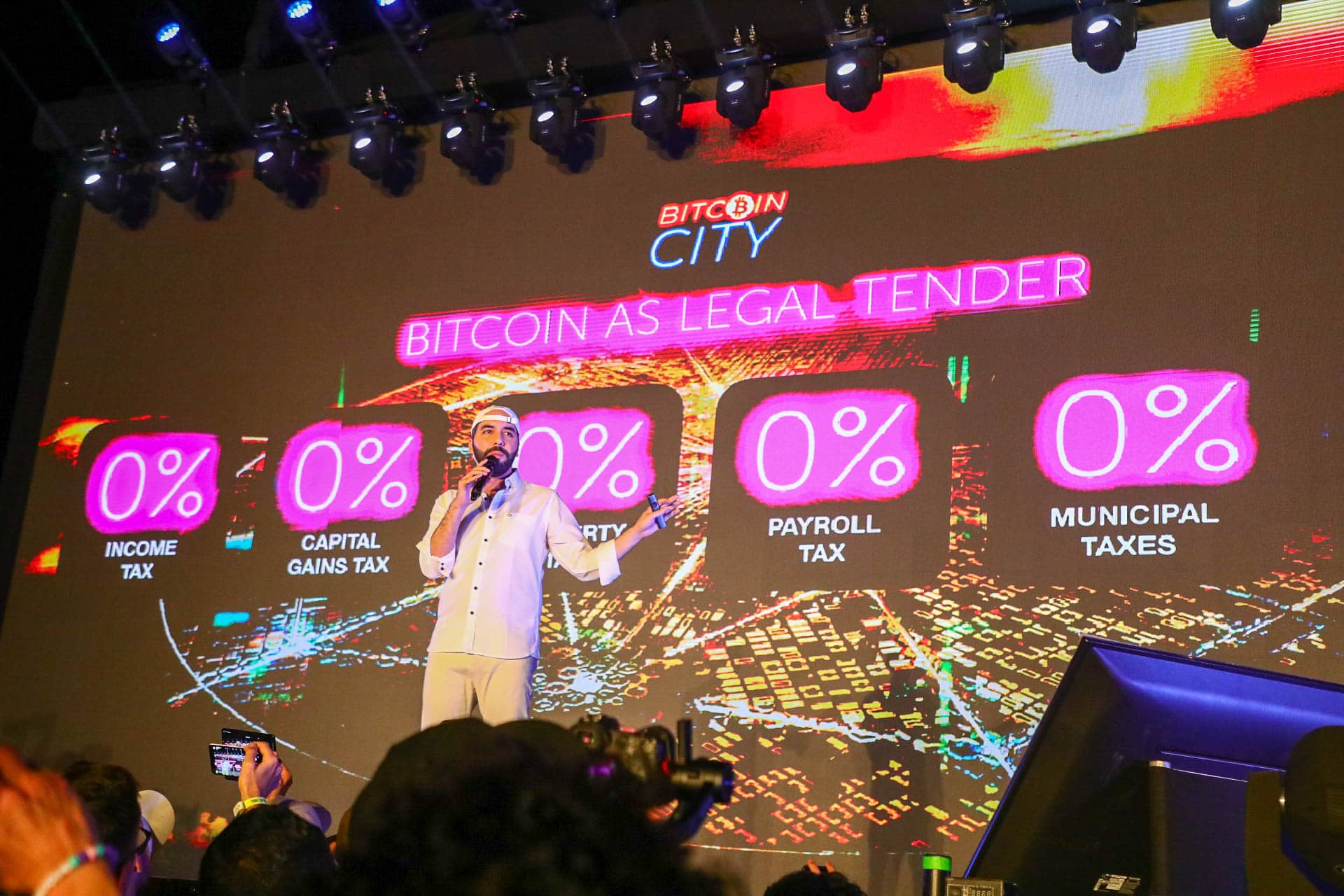

On Saturday, November 20th, the President of El Salvador, Nayib Bukele, presented the so-called BTC Bond. This is a government bond with an issue volume of one billion US dollars, the money of which is to be invested in BTC and infrastructure projects, more precisely the construction of a city. What to think of the government bond and what investors should consider when making an investment.

When Nayib Bukele presented the BTC government bond, the mood was like at a pop concert. We were there and reported about it. The President of El Salvador presented the BTC City project as part of a stage show. A special economic zone or crypto tax haven in your own country. The new city is to be financed with the help of several government bonds. The first bond is structured as follows:

The BTC Bond at a glance – the most important numbers

- Volume: $ 1 billion

- Coupon: 6.5 percent

- Usage: $ 500 million in BTC and $ 500 million in infrastructure (building BTC City)

- Duration: 10 years (end of 2032); Interest paid annually in January

- Service provider: Blockstream (structuring), Bitfinex Securities (trading venue and issue) and Liquid Network (protocol)

- Payment options: US dollars, USDT and BTC

- Minimum investment: $ 100

BTC profits are also to be partially repaid to investors after a five-year holding period. From the 6th year onwards, these could increase the yield on the bond like a kind of dividend from BTC price gains.

The great diversionary maneuver by Nayib Bukele

With the “Bitcoinization” of the entire economy of El Salvador, President Bukele dares a risky diversionary maneuver. The economically troubled country, whose existing bonds are listed at junk level and have to pay interest above 10 percent, are now to be replaced by BTC government bonds. The fate of El Salvador depends less on political fate than on the future BTC exchange rate.

Should the full bond volume be placed, then one could – in a figurative sense – say that BTC has a much higher credit rating than El Salvador. After all, the interest rate on BTC government bonds is around half that of previous government bonds. The message from Bukele: Forget the real creditworthiness of El Salvador. With this diversion, the president succeeds in cutting the cost of debt by around half – other heads of state are likely to be jealous.

Gambling like Michael Saylor

With its BTC government bond, El Salvador is copying a form of currency betting that Microstrategy CEO Michael Saylor in particular made known. He also issued bonds in US dollars, thus building up US dollar debts, in order to then invest the capital in BTC. Bukele and Saylor are equally betting that the US dollar will continue to lose value against BTC and that the debt will melt away and currency gains will arise.

At this point it is very important not to compare the BTC Bond with government bonds that are only denominated in their own local currency and that do not make their repayment dependent on currency speculation. Strictly speaking, El Salvador could also invest the money – at least half of the $ 500 million – in an equity fund. The intention would be the same. The term BTC bond is also only partially correct, as it is, strictly speaking, a US dollar bond.

New trend soon among emerging markets?

In relation to the overall market, the issue volume of one billion US dollars is irrelevant. Nevertheless, this is no easy feat for the economically tiny country. The GDP is just $ 24 billion. If one were to put the amount of the bond in relation to the GDP of Germany (3.8 trillion US dollars), this would correspond to a bond of over 150 billion US dollars. Positive effects on GDP of this magnitude are quite conceivable for El Salvador.

As inconceivable as such bond issues would be for economically strong nations – their borrowing costs are negligible anyway – this gamble could find favor with other emerging countries. The temptation to save interest with a BTC bond and to pay off debts with price gains and to make investments could spread to other emerging countries with poor credit ratings and currencies. As promising as BTC’s future may be, in the end it is a bet on a single asset. It has little to do with a maximally diversified Norwegian sovereign wealth fund.

El Salvador: The Latin American Answer to Switzerland and Singapore?

In addition to currency speculation, the BTC government bond is primarily about location marketing and the establishment of new industries. With the help of cheap electricity, a maximally open-minded crypto regulation and tax rates like on the Caribbean islands, El Salvador offers good conditions to become an economic wonderland.

Controversial companies such as Bitfinex, which is also behind the stablecoin company Tether, have the BTC Bond a playground to try out everything possible with crypto. Libertarian crypto fantasies mix with autocratic state structures. Risks and opportunities are equally high for companies, citizens and the state.

USA are not very enthusiastic

The BTC government bond is an affront to the US dollar. Bukele is confident of victory in Saylor-style, according to the motto: In the end, BTC wins against any fiat currency anyway.

The reaction to this stance already followed in the spring of this year when El Salvador announced the introduction of BTC. The IMF and World Bank raised their index fingers and the rating agencies did the rest, and graded the creditworthiness of the small country down. How much of it is purely politically motivated and how much out of economic conviction can be passionately argued about. In any case, the prices of the existing government bonds are falling south and have lost more than 30 percent of their value since the beginning of the year.

Conclusion on the BTC government bond

Given a certain BTC positivism, Bukele’s strategy can be described as ingenious. If the BTC bet works, then El Salvador can increase its prosperity more than any other country in Latin America in the next few years. However, investors should consider carefully whether they should really invest in the new bond. If El Salvador fails with its crypto plans, the probability of default of the bonds is extremely high. If El Salvador succeeds in the economic miracle, in which the BTC price continues to rise correspondingly, then a direct investment in BTC would be more lucrative than the government bond. For bond fans with an emerging market focus and crypto enthusiasm, the BTC Bond may be worth a look. Everyone else just buys BTC.

5 promising NFT games for 2022

- Ripple’s Latest Move: Is ‘Ripple Custody’ the Game Changer for Crypto Storage? - March 18, 2025

- Is Bitcoin Ready to Hit a New All-Time High? Analyst Predicts $126,000 Before June - March 17, 2025

- Crypto Whales Scooped Up $815 Million in Ethereum in Just 5 Days – Do They Know Something We Don’t? - March 17, 2025