After a fall from 9.5 BTC / EH in May to a minimum of 2021 5.6 BTC / EH, the yields of BTC miners for exahash returned to the level recorded in mid-2020.

Mining revenues gradually started to increase two months after the start of the migration process from China due to a massive crackdown on mining activities. According to recent on-chain data from the Glassnode analysis platform, mining revenues increased by an incredible 57%, which is similar to the levels recorded in mid-2020.

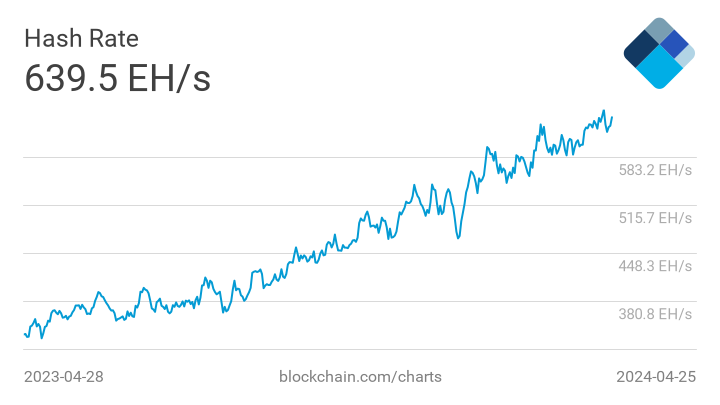

In early May, the network hashrate flew to the top 180 EH / s. However, after a massive crackdown on cryptocurrency mining in China, the number has fallen by more than 50%. Thus, for the first time in about ten years, BTC experienced the longest series of negative adjustments to the difficulty of mining.

The Chinese FUD forced the miners to relocate

Recall that the Chinese government has ordered every mining facility in the country to cease operations. Several companies in China’s top mining provinces had to stop their services, and most companies migrated back to Europe and the United States. However, this event caused a rapid decline in the BTC hashrate.

After the intervention, the difficulty of mining decreased significantly, which resulted in an immediate increase in the profitability of miners located in other countries.

Over the last two months, the hashrate has gradually climbed back and has now recovered by 25% from the lows recorded in June. This suggests that approximately 12.5% of affected miners are back online. At the time of writing, the metric shows a speed of 117 EH / s.

Miners’ revenue back to 8.8 BTC / EH

According to Glassnode, the primary reason for the recent increase can be attributed to the difficulty of the network, which in turn affects the amount of power invested in terms of BTC’s income.

Since the last halving in May 2020, miners’ incomes have fallen from around 9.5 BTC / EH to a minimum this year of 5.6 BTC / EH in May. However, migration from China, where more than half of the total population of BTC miners lived, helped to recover the difficulty of BTC mining and increased miners’ yields to approximately 8.8 BTC / EH.

In addition, such increases allow miners to reduce the amount of BTC they have to sell in order to finance their expensive business, which could also have a further positive effect on the price of BTC itself. In fact, a new accumulation phase of miners seems to have begun, who had to liquidate part of the previously accumulated BTC throughout June to cover all expenses.

Glassnode supplies:

“The net growth in miners’ balances has now reached + 5k BTC per month, indicating a net reduction in sell pressure from miners.”