Table of Contents

In the last 24 hours, we see further profit-taking in the digital currency market. XRP crashes by around 3%, bringing the weekly losses to almost 8%. Things just weren’t going well for XRP recently. Because the top 10 coin performed worse than the broader market. While there have always been narratives and bullish trends for other cryptos, the sideways movement for XRP remains pronounced. So now XRP is falling below $0.55 again. Here the price is approaching an important support and on-chain data does not necessarily give hope for a trend reversal. At the same time, the US Securities and Exchange Commission (SEC) is intensifying its action against Ripple Labs. So is there now a risk of a mega crash for XRP?

Too many XRP holders with profits: Is there a risk of a crash?

Despite the rather weak price development, over 80% of all XRP holders are in the profit zone with their position. This is a critical value according to Santiment analysts. Because a too high proportion of holders with profits increases the risk of a sell-off. After all, many holders find it psychologically easier to sell a position at a profit than to realize losses. Ergo, the high share of “Existing Supply in Profit” could encourage further sales.

💰 #Bitcoin (83%), #Ethereum (84%), and #XRPLedger (81%) have their respective supplies in historically high risk profit levels compared to their averages that hover in the 55%-75% range dating back to 2018. #Crypto can absolutely still climb due to more exposure from pic.twitter.com/ADmMcl5zhO

— Santiment (@santimentfeed) January 18, 2024

SEC headwinds are increasing again

The legal situation surrounding Ripple has recently worsened again as the US Securities and Exchange Commission (SEC) is pressing ahead with its lawsuit against the company with increased vigor. Recently, the SEC asked a New York court to require Ripple to disclose additional documents regarding its financial condition and sales activities. This marks a resumption of SEC activity in a case that had taken a back seat in recent months. This was all about the Bitcoin spot ETF – apparently the SEC now has enough time for Ripple Labs again.

The company Ripple Labs, which suspended its plans for an IPO in the US due to the ongoing legal dispute, is now considering alternatives abroad. Because the regulatory landscape in the USA remains hostile to crypto for the time being. Although Ripple was successful in parts of the proceedings, the legal dispute remains unresolved and the trial is scheduled to continue in April.

The SEC has stepped up its regulatory efforts and taken legal action against leading US crypto exchanges such as Coinbase and Binance in addition to Ripple. This indicates an increasing intensification of regulatory measures in the cryptocurrency sector, which poses new challenges for Ripple and the entire industry.

Ripple Explores Global #IPO Amid Regulatory Struggles, Buys Back $1 Billion in Shares

In a strategic move driven by regulatory concerns, #Ripple contemplated an initial public offering (IPO) outside the U.S., citing a “hostile” stance from the #SEC

More:… pic.twitter.com/coThM0lVPx

— fiatleak (@fiatleak) January 17, 2024

Legal uncertainty hovers over Ripple

The ongoing legal uncertainty regarding XRP, caused by the ongoing proceedings against Ripple, will also affect XRP in 2024. Because stability remains a key factor in the markets. Uncertainties, particularly of a legal nature, often lead to hesitation and caution among investors.

The ongoing case against Ripple, the company behind XRP, creates an atmosphere of uncertainty. This uncertainty manifests itself in the form of reluctance to invest or even withdraw capital, which weighs on the price of XRP. Ergo, XRP was unable to reach a new ATH even in the last bull market.

Until final legal clarification is reached, XRP remains in a state of uncertainty, which may have a detrimental effect on its price. 2024 is also likely to be difficult for XRP in many parts.

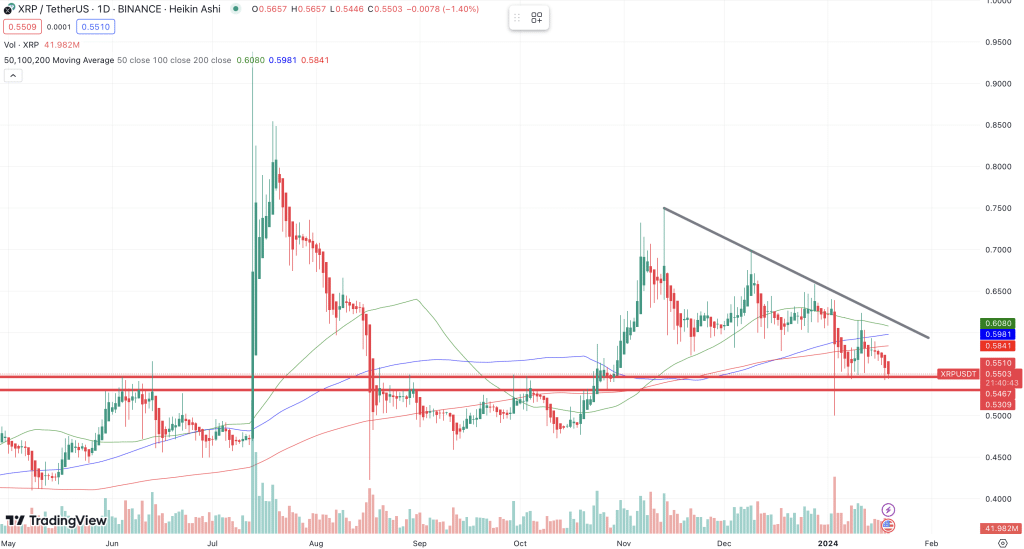

Sideways range still intact: This price mark is crucial

Today, the XRP price is down 3%. If you look at the last seven days, the loss in value adds up to around 8%. This development indicates a continued downward trend. Currently, XRP is moving towards a significant support zone, which is between $0.53 and $0.55. In addition, XRP is currently below the important moving averages. Investors are initially bearish and wait for a technical trend reversal. Alternatively, bullish candlesticks at support could encourage a trend reversal.

Of course, XRP will not become worthless in the near future and a price target of $0 is unlikely. But the truth is that things aren’t really looking good for XRP at the moment. The simmering legal dispute with the SEC and an unconstructive starting point in terms of charts require consolidation. A purchase is probably not necessary in the short term, other altcoins offer the better CRV.

Crypto exchanges with the lowest fees 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024

- Memecoins more popular than Bitcoin? Striking results from a Binance survey - December 20, 2024

- Bitcoin breaks records: Bigger than gold ETFs and now the top 7 asset worldwide - December 20, 2024