In the first half of this year, 37 new crypto exchange-traded funds (ETFs) and exchange-traded products (ETPs) were listed worldwide and a total of 877 new products were launched, according to research firm ETFGI.

The 37 new crypto ETFs and ETPs show that interest and investment in digital assets is growing. This latest increase in new issuance represents a new record, surpassing the previous high of 808 new ETFs launched during the same period in 2021.

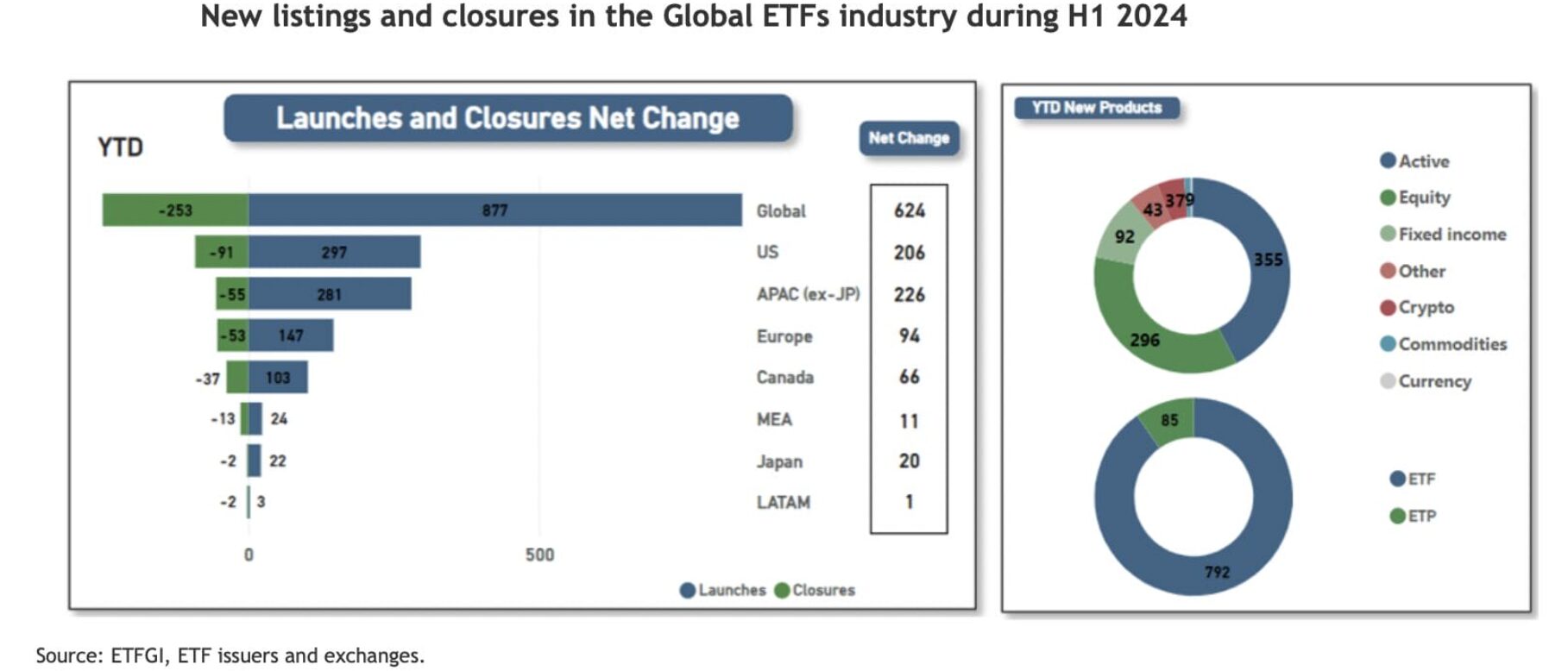

Taking closures into account, there was a net increase of 624 products in the first half of the year, with 253 ETFs closing during that period, ETFGI notes.

Many crypto products allow investors to invest in digital currencies without directly owning the underlying assets, providing a convenient and regulated way to participate in the crypto market.

US market leads with number of new crypto

In January, the Securities and Exchange Commission (SEC) finally approved a number of applications for Bitcoin ETFs. In July, a number of Ethereum ETFs were also approved.

BlackRock continues to dominate the market in terms of new additions. BlackRock has launched 44 new products and is the world’s largest ETF manager by AUM. The latest figures show that the company has 3.5 trillion USD under management in global ETF investment vehicles through December 31, 2023.

The US led the way with 297 new products, closely followed by Asia-Pacific (excluding Japan) with 281 and Europe with 147. The US also saw the most closures, with 91 ETFs closing, compared to 55 in Asia-Pacific and 53 in Europe.

The distribution of new launches varies between regions and reflects the global reach and different market interest in ETFs and ETPs. A total of 219 providers contributed to the new launches. This shows the increasing competition in the ETF market.

The ETFs and ETPs are available on 35 exchanges worldwide and offer investors a range of different strategies and asset classes. The 182 closures were associated with 73 providers on 29 exchanges, showing that there is a continuous evaluation of the products.

The data shows that the new ETFs and ETPs encompass a diverse mix of investment strategies. There are 355 active funds, 296 track equity indices and 92 track fixed income indices.

ETFGI reports that active funds in particular are gaining in appeal as investors seek to outperform market benchmarks through clever management and strategic asset allocation.

The launch of 37 new crypto ETFs and ETPs in the first half of 2024 also shows the increasing acceptance of cryptocurrencies as part of diversified investment portfolios. The products are attracting great interest from both institutional and retail investors.

- Trump’s inauguration is approaching, but crypto promises may take a while - January 14, 2025

- Fidelity: 2025 will be the year of global Bitcoin adoption - January 14, 2025

- Ethereum: Inflation continues, but bulls continue to target $20,000 - January 14, 2025