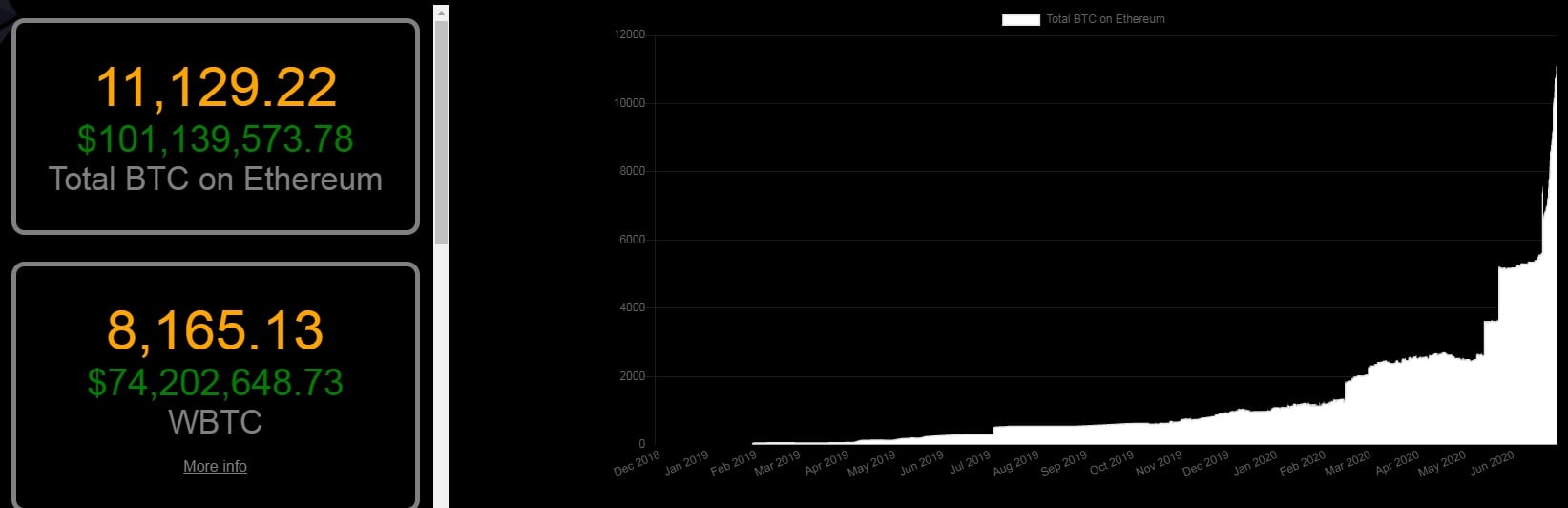

The total amount and value of tokenized Bitcoin on the Ethereum blockchain has sharply increased since mid-May, with over $101 million worth of BTC now held in tokens such as Wrapped Bitcoin (WBTC), renBTC, HBTC, imBTC, sBTC and others.

WBTC and similar tokens represent Bitcoin on the Ethereum blockchain. One tokenized BTC equals one “regular” BTC; Bitcoin can be converted into these tokens, and vice-versa.

To achieve this, users lock up their BTC on the Bitcoin blockchain using specialized custodian services or smart contracts. After that, the corresponding amount of tokenized BTC is created on Ethereum, which can then be used on its blockchain.

WBTC surges in the past month

WBTC, being the most popular tokenized Bitcoin by far, accounts for the lion’s share of this niche—there are currently around 8,200 BTC converted into Ethereum tokens, worth roughly $74.9 million, according to DeFi Pulse. Notably, the amount of Bitcoin locked as WBTC has surged sharply over the past month and a half.

On May 11, the amount and value of WBTC tokens locked in Ethereum saw a new all-time high—at the time, at least—reached around 1,300 tokenized Bitcoin—or $11.4 million in total. Since then, the number of WBTC has grown more than sixfold to hit 8,200.

RenBTC, another tokenized Bitcoin that was launched in mid-May, is currently in second place, with just over 1,000 tokens on Ethereum right now (worth around $9.9 million according to Etherscan).

The third, fourth and fifth places are occupied by HBTC, imBTC and sBTC, accounting for 710 ($6.45 million), 608 ($5.53 million) and 512 ($4.65 million) tokenized Bitcoin, respectively.

Other tokens amount to nearly $350,000 worth of Bitcoin or less.

DeFi driving tokenized Bitcoin adoption?

One of the main reasons for the surge in tokenized BTC is likely down to the growth of decentralized finance (DeFi) applications.

DeFi has come into the spotlight in recent weeks, after lending platform Compound’s COMP token became the largest DeFi token by market capitalization in just one day in mid-June, increasing its price by 62%.

Since Bitcoin doesn’t have the DeFi infrastructure that allows Ethereum token holders to lend their assets and receive passive yields, it appears that Bitcoin holders are turning to wrapped BTC tokens in order to use their assets in the rapidly growing DeFi market.

You might also like: Coin Metrics Finds the ‘Coinbase Effect’ Is Actually Pretty Lame

- Russia to Slap a 15% Tax on Crypto Gains – The Bear Wants Its Share - November 20, 2024

- 70% of Airdrop Tokens Are Profitless—Here’s Why Your Freebies Might Be Worthless - November 19, 2024

- The Most Important Cryptocurrency News of November 14, 2024 - November 15, 2024