The pre-programmed inflationary mechanism of the SUSHI token, designed to incentivize liquidity providers, could harm regular holders.

Although SushiSwap’s protocol is already active and attracted over a billion worth of liquidity, a Glassnode analyst said that its governance token SUSHI is still highly overvalued. By exploring the economics behind SUSHI’s value, he outlined a fair price of $0.31 per coin.

SUSHI (Still) Overvalued

Launched as a Uniswap fork less than a month ago, SushiSwap took the DeFi world by storm. What gasped massive attention was the introduction of a governance token called SUSHI. This lured investors as besides just receiving fees by providing liquidity like on Uniswap, they also get 0.05% of the fees converted back to SUSHI and distributed among SUSHI holders.

The explosive start resulted in SUSHI’s listing on several prominent cryptocurrency exchanges, including Binance, and an all-time high of nearly $12.

However, the subsequent controversy when one of the lead developers sold-off his tokens for $14 million worth of Ethereum brought SUSHI’s price to about $1.2 last week. However, approximately six days later, the developer returned the funds into the treasury.

Despite this massive price decrease in a relatively short time, Glassnode analyst Liesl Eichholz believes the SUSHI token is still overvalued. The primary issue he brought out is the rate of inflation.

He admitted that inflation is not necessarily a negative feature, as it was incorporated into the system by design to incentivize investors to provide liquidity actively.

Nevertheless, he added that “anyone holding SUSHI without providing liquidity will be diluted. As such, investors looking at buying SUSHI should do so with caution and with an understanding of the risks behind the underlying token mechanics.”

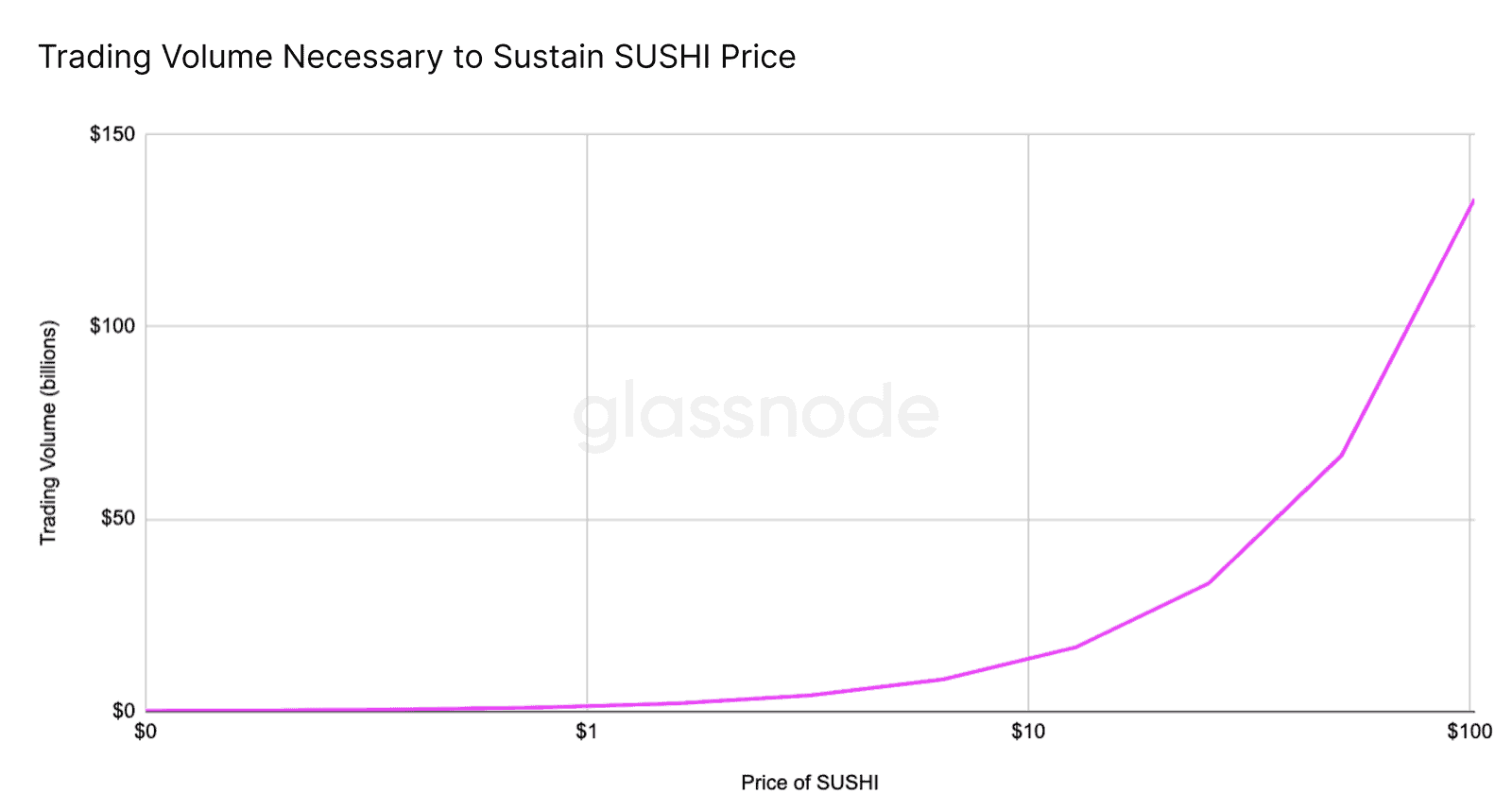

Insane Trading Volume Needed For SUSHI To Surge

The analyst further explained that SUSHI’s price is strongly correlated with the trading volume on the recently launched SushiSwap protocol. Due to the inflationary mechanism, the “value flowing into the token must match the value of new SUSHI entering circulation.”

“In other words, if there is sufficient demand to buy up 100% of new SUSHI tokens, there will be no inflation of supply in relation to demand; rather than the token price decreasing, the market cap should increase to account for the inflated supply.”

Reasoning with the chart above, Eichholz claimed that the SUSHI token needs “insane” trading volume to sustain a price of above $10.

“In reality, assuming that SushiSwap captures a more realistic daily trading volume of $400 million, the sustainable price for SUSHI would be $0.31 – a full 97% lower than its all-time high of $11.93.”

As of writing these lines, 31 cents is roughly 85% below the current market price of SUSHI. However, CoinGecko data reveals that the 24-hour trading volume on SushiSwap is less than $250 million.