On November 6, 2024, the cryptocurrency landscape experienced significant developments, notably influenced by the U.S. presidential election results. The election of Donald Trump as President had a profound impact on the crypto market, among other key events. Below is a comprehensive overview of the most important cryptocurrency news from that day.

Bitcoin Surpasses $76,460 Amid U.S. Election Results

Bitcoin reached a new all-time high of over $76,460, following Donald Trump’s victory in the U.S. presidential election. Investors expressed optimism about potential crypto-friendly regulations under the Trump administration. Analysts highlighted that Trump’s supportive stance on Bitcoin and his previous statements regarding the dollar’s competition with cryptocurrencies have fueled investor confidence. This milestone has not only reaffirmed Bitcoin’s position as a leading digital asset but has also drawn renewed attention from institutional investors, further driving the market’s momentum. Market analysts predict Bitcoin could continue its upward trend in the coming months.

Ethereum Experiences Significant Price Increase

Ethereum, the second-largest cryptocurrency, surged to $2,861.25, reflecting a notable 10% increase. This growth is partly attributed to Bitcoin’s record-breaking performance, which has bolstered overall market confidence. Ethereum’s network upgrades and its transition to Proof-of-Stake are also key factors supporting this price hike. Investors view Ethereum as a versatile asset due to its role in DeFi and NFT ecosystems, making it a critical component of diversified crypto portfolios. With Ethereum’s scalability improvements nearing completion, analysts expect further adoption and price appreciation in the medium term, driven by increased institutional interest.

Crypto-Related Stocks See Notable Gains

Shares of crypto-associated companies, including Coinbase and MicroStrategy, recorded significant gains, reflecting the positive sentiment across the cryptocurrency sector. The surge was driven by Bitcoin’s price rally and the anticipation of crypto-friendly policies under the Trump administration. Coinbase shares rose by 12%, while MicroStrategy gained 15%, fueled by its extensive Bitcoin holdings. These stock movements highlight the growing synergy between traditional finance and digital assets, as investors increasingly value companies with exposure to cryptocurrencies. Analysts suggest that if Bitcoin’s upward momentum continues, related equities could experience sustained growth in the near future.

Altcoins Rally Following Bitcoin’s Lead

Altcoins, including Solana (SOL) and Cardano (ADA), posted double-digit gains in the wake of Bitcoin’s historic rise. Solana surged by 14%, while Cardano climbed 11%, driven by investor diversification. The broader rally reflects renewed interest in altcoins as investors seek high-growth opportunities beyond Bitcoin and Ethereum. These assets, with their unique blockchain use cases and growing ecosystems, are attracting both retail and institutional investors. The rally underscores the interconnectedness of cryptocurrency markets, where Bitcoin’s performance often acts as a catalyst for altcoin growth. Analysts anticipate continued volatility but see long-term potential in high-performing altcoins.

Increased Interest in Crypto ETFs

The spot Bitcoin ETF market saw record inflows following Bitcoin’s all-time high and the U.S. election results. Institutional investors added nearly $500 million to Bitcoin ETFs in a single day, reflecting growing confidence in regulated investment vehicles. ETFs provide a safer, more accessible way for traditional investors to gain exposure to Bitcoin without directly holding the asset. This surge in demand highlights the role of ETFs in bridging the gap between traditional finance and the crypto world. Analysts predict that continued ETF adoption will further drive liquidity and stability in cryptocurrency markets.

Regulatory Expectations Shift with Election Outcome

Donald Trump’s election victory has sparked optimism about regulatory clarity in the U.S. crypto market. Trump’s administration is expected to promote innovation while addressing concerns about fraud and market manipulation. His previous remarks on cryptocurrencies and blockchain technology suggest a balanced approach to regulation. Industry leaders anticipate policies that encourage the development of blockchain-based solutions and attract global crypto businesses to the U.S. The regulatory landscape remains a critical factor for market growth, and Trump’s victory could mark a turning point in fostering a more supportive environment for digital assets.

Institutional Investors Increase Crypto Holdings

Institutional investors have increased their exposure to cryptocurrencies, driven by Bitcoin’s bullish momentum and favorable market conditions. Hedge funds, pension funds, and asset managers are diversifying their portfolios with Bitcoin and Ethereum. Recent surveys indicate that nearly 70% of institutional investors plan to increase their crypto allocations in 2024. The growing adoption of digital assets among institutions is seen as a major catalyst for market growth. Analysts believe that as regulatory clarity improves, more institutional capital will flow into the sector, further legitimizing cryptocurrencies as an asset class.

Mining Companies Report Higher Revenues

Bitcoin mining firms reported increased revenues, buoyed by Bitcoin’s price surge and higher transaction volumes. Companies like Marathon Digital and Riot Blockchain saw double-digit revenue growth in Q4, reflecting the market’s robust performance. Improved mining efficiency and access to renewable energy sources have also contributed to profitability. However, rising mining difficulty and energy costs remain challenges for smaller operators. Analysts suggest that consolidation in the mining industry is likely as larger players dominate the sector. The growing profitability of mining is expected to attract new entrants, further strengthening the network.

You may also like: What is the Impact of Crypto Mining Accessibility on the Market? Is the Attractiveness of Cryptocurrencies Fading?

DeFi Platforms Experience Growth

Decentralized finance (DeFi) platforms, including Aave and Uniswap, saw a surge in activity as investors sought higher yields in decentralized ecosystems. Total Value Locked (TVL) across DeFi platforms increased by 8% overnight, reaching $85 billion. DeFi protocols offer innovative financial services such as lending, borrowing, and staking, attracting both retail and institutional participants. Analysts predict that DeFi will continue to grow as it offers transparent, decentralized alternatives to traditional financial systems. However, security and regulatory challenges remain critical for the sector’s sustainable development.

Stablecoins Maintain Market Stability

Stablecoins, including USDT and USDC, played a crucial role in maintaining liquidity and stability amid market volatility. Transaction volumes for stablecoins exceeded $120 billion in the past 24 hours, underscoring their importance in trading and hedging strategies. These digital assets provide a bridge between fiat and crypto markets, offering a stable store of value during turbulent times. Analysts believe stablecoins will play a pivotal role in future financial systems, particularly as central banks explore digital currencies. Their growing adoption highlights the need for regulatory frameworks to ensure stability and transparency.

Crypto Adoption Expands Globally

Countries worldwide reported an increase in cryptocurrency adoption, with significant milestones achieved in emerging markets. India announced plans to integrate blockchain technology into its financial infrastructure, while Brazil’s central bank revealed a pilot project for a digital real. Additionally, Vietnam saw a 20% increase in crypto wallet downloads over the past month. These developments highlight the global appeal of cryptocurrencies as tools for financial inclusion and innovation. Analysts note that regulatory clarity and improved infrastructure are essential for sustaining this growth, particularly in developing economies.

Blockchain Technology Gains Traction

Blockchain technology continues to gain traction across various industries, with new applications emerging daily. Supply chain management, healthcare, and real estate are among the sectors leveraging blockchain for increased transparency and efficiency. IBM partnered with Walmart to implement blockchain-based solutions for food traceability, reducing waste and improving safety. Meanwhile, healthcare providers explored blockchain for secure patient data management. These use cases demonstrate blockchain’s potential beyond cryptocurrencies, positioning it as a transformative technology for multiple sectors.

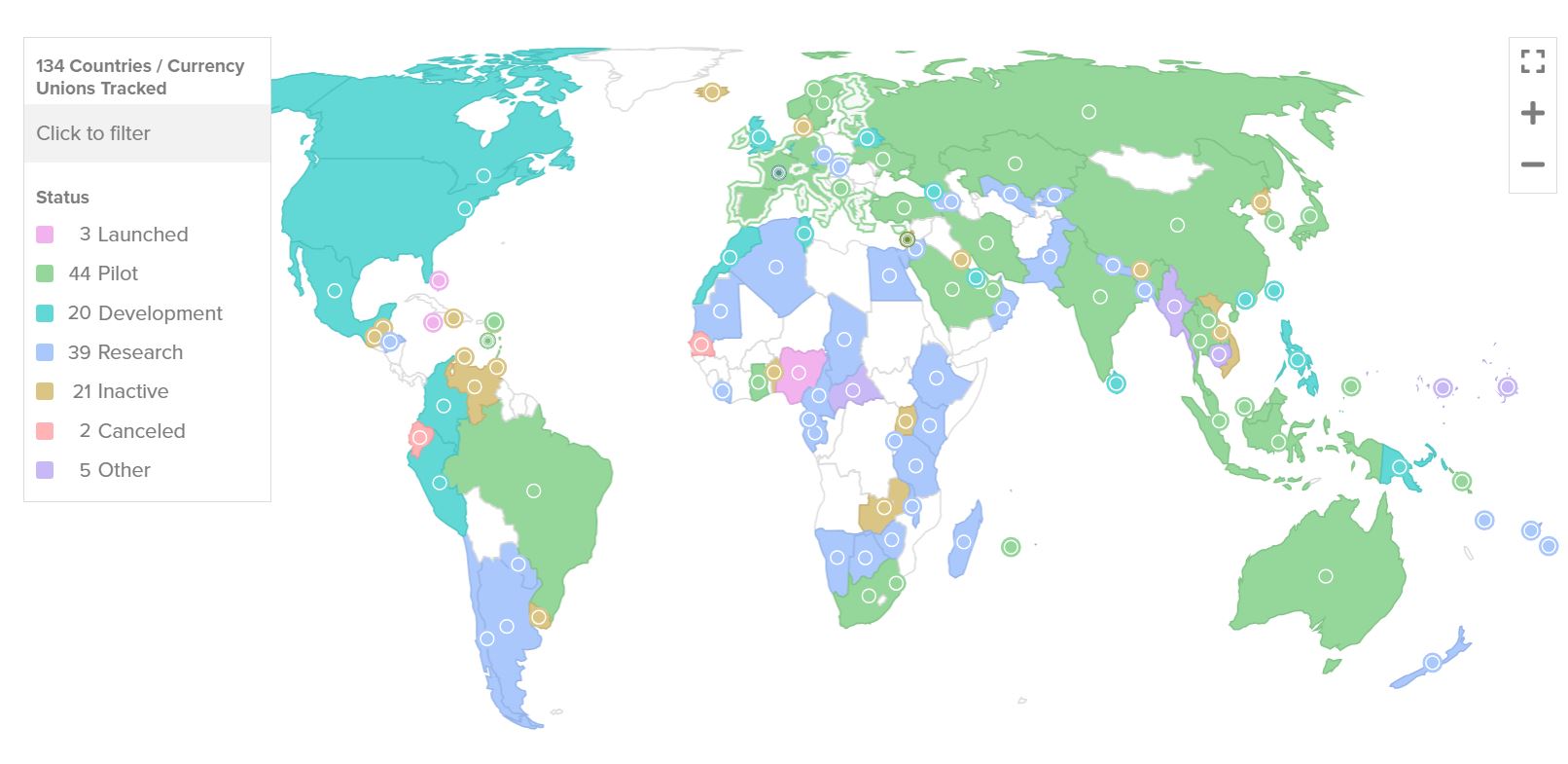

Central Banks Explore Digital Currencies

Central banks around the world accelerated their efforts to develop central bank digital currencies (CBDCs). The European Central Bank (ECB) announced the successful completion of the digital euro’s proof-of-concept phase, while China expanded its digital yuan trials to include international trade. The Federal Reserve indicated plans to release a detailed report on the feasibility of a digital dollar by early 2025. Analysts view CBDCs as a response to the growing influence of cryptocurrencies, offering central banks a tool to modernize monetary systems while retaining control over financial ecosystems.

Cybersecurity in Crypto Under Scrutiny

The growing prominence of cryptocurrencies has placed cybersecurity under the spotlight, with renewed efforts to combat hacking and fraud. Blockchain security firms reported a 25% increase in cyberattacks targeting DeFi platforms and crypto exchanges in Q4 2024. In response, leading exchanges like Binance and Kraken invested heavily in advanced security measures, including AI-driven threat detection systems. Regulators also emphasized the importance of robust cybersecurity frameworks to protect investors and maintain market integrity. Analysts warn that as the crypto market grows, security challenges will intensify, requiring collaborative solutions from industry stakeholders.

Conclusion: The most important cryptocurrency news of November 6, 2024

November 6, 2024, was a landmark day for the cryptocurrency industry, marked by significant legal victories, technological advancements, and regulatory developments. The election of Donald Trump as U.S. President had an immediate and profound impact on the market, highlighting the interplay between politics and digital assets. As the industry continues to evolve, these events underscore the dynamic nature of the crypto landscape and its growing integration into the global financial system.

- Bonk Price Analysis – November 19, 2024: Bark or Bite? - November 19, 2024

- CEO Ripple Labs Criticized for Promoting XRP and CBDCs in Alleged Meeting with Trump - November 18, 2024

- Pepe Price Analysis 18/11/2024: The Amphibian Chronicles - November 18, 2024