It was a difficult second quarter for crypto investors. The Bitcoin price could not hold its all-time high of 73,750 USD, which was reached in March of this year, and has since fallen by almost 20%. Ethereum is also trading well below its all-time high. However, the third quarter could be much more bullish again. July already brings good news for Ethereum, while the Bitcoin price could come under pressure again in July. Investors should definitely keep an eye on the following events.

Mt.Gox creditors receive Bitcoin payout

Confirmed true by @Reuters

Under Japanese Law aka like FTX, Mt Gox creditors will get $483 per Bitcoin in Bitcoin. Thats 0.008 $BTC per $BTC held at the time. The $9b becomes only $72 million paid to customers.

Thoughts: Now will the exchange, the attorneys, the government of… pic.twitter.com/GtASPpiMu1

— MartyParty (@martypartymusic) June 24, 2024

Apparently only part of the debt is actually to be paid out in Bitcoin. In addition, the Bitcoin price is expected to rise again significantly in the second half of the year and could even break the 100,000 USD mark, so that some of the investors who have already achieved high returns in recent years could continue to hodl in order to make even more out of their investment.

US government and German BKA sell Bitcoin

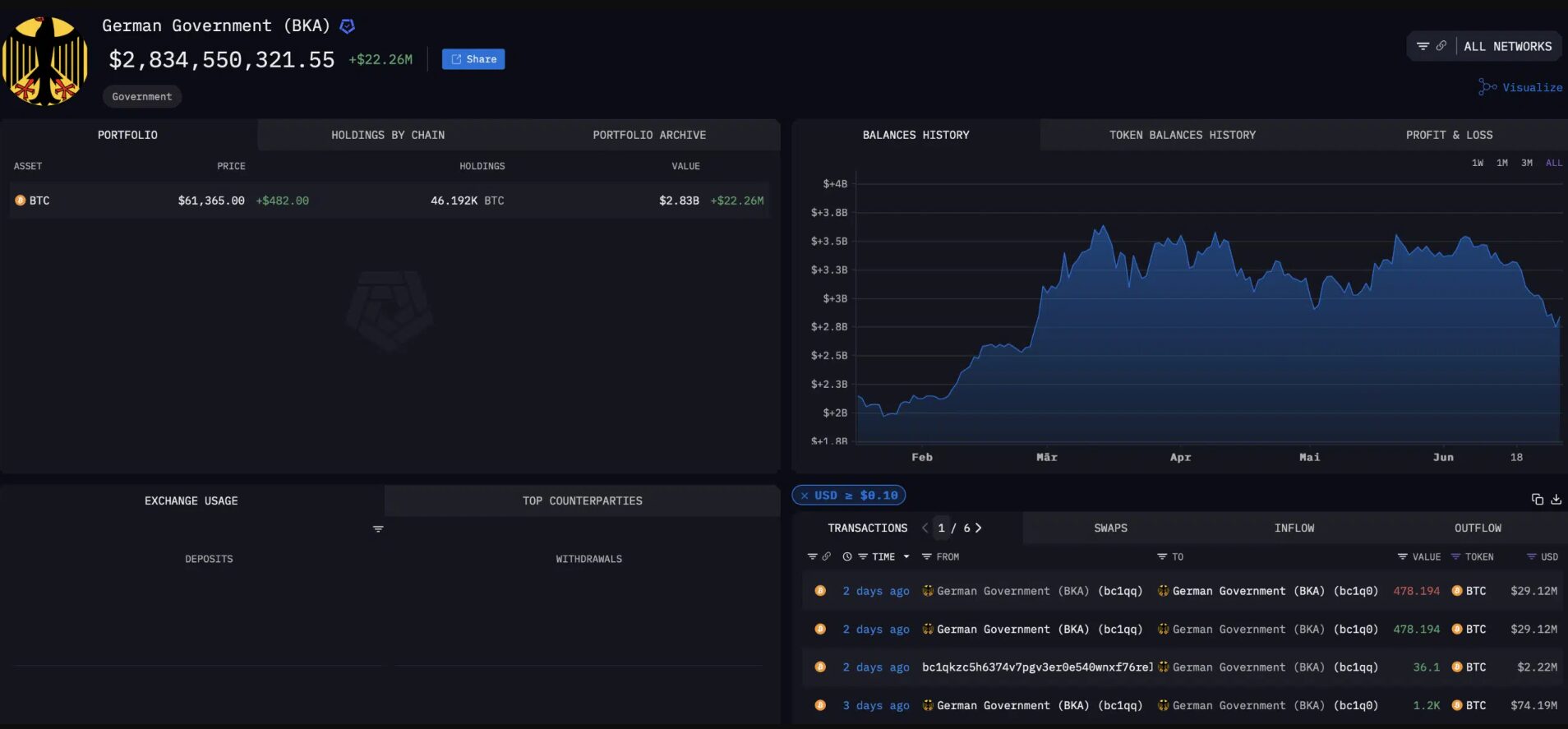

The German Federal Criminal Police Office unexpectedly acquired Bitcoin worth over 3 billion USD. Not through a smart investment and long-term hodling, but through the seizure in the case of the illegal streaming website Movie2k. At the time, 50,000 Bitcoin were seized, which are now worth over 3 billion USD. The BKA has already sold some of them, sparking concern that there will be further sales in July. After all, the Federal Criminal Police Office still has Bitcoin worth over 2.8 billion USD.

(BKA Wallet – Quelle: Arkham Intelligence)

The sales to date have been divided into several millions, so it is unlikely that the BKA will suddenly make a transaction with the remaining 2.8 billion USD and thereby put pressure on the price. However, further sales of between 50 and 150 million USD per day are to be expected. With a trading volume of over 20 billion USD in one day, however, investors could absorb this.

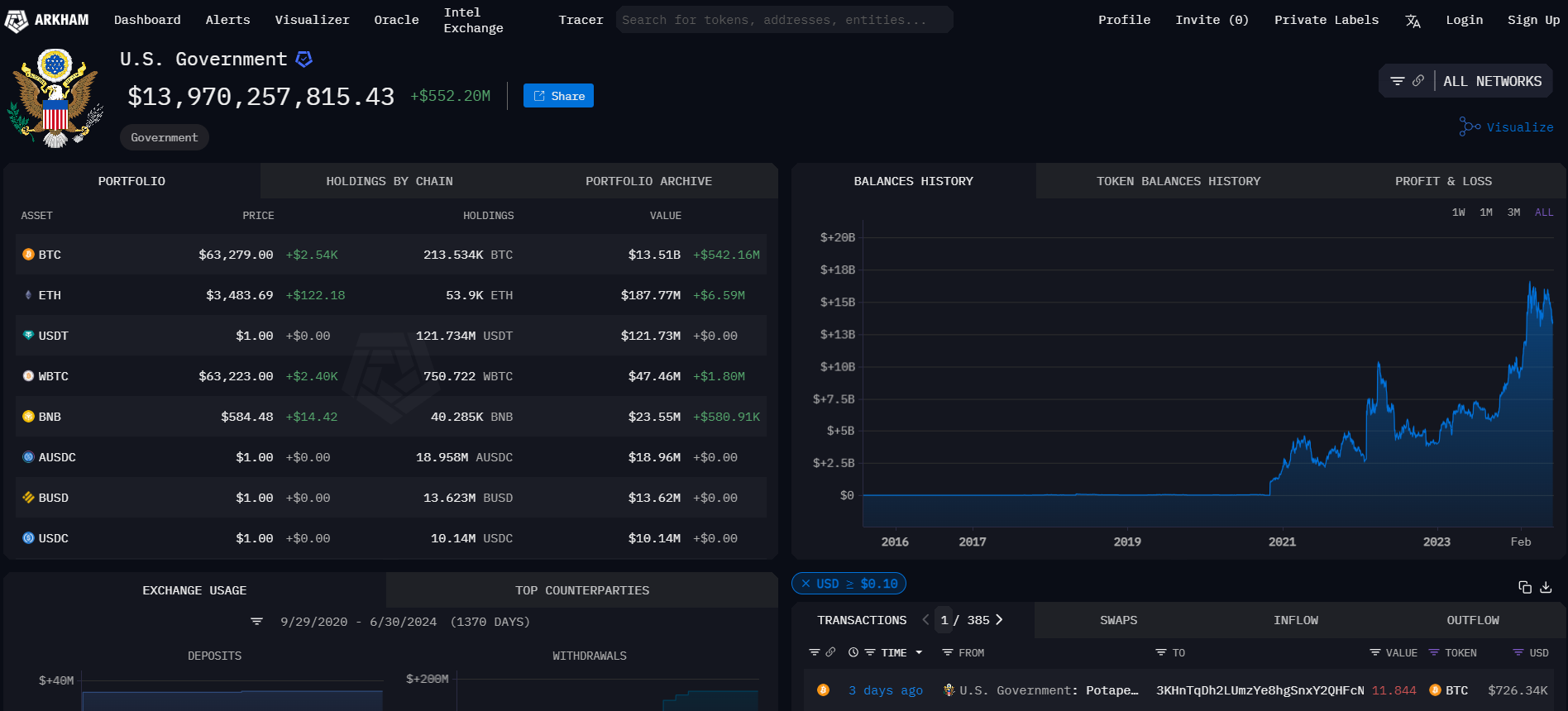

The USA holds significantly more BTC than Germany. Here, too, the government has not invested itself, but has confiscated the Bitcoin in various crimes. The USA owns BTC worth over 13 billion dollars and also began selling some of it in June, so investors here too fear further sales in July.

(US Government Wallet – Source: Arkham Intelligence )

The US government has already sold large amounts in June, with the wallet showing a transfer of over 4,000 Bitcoin worth over 240 million USD and one of over 11,000 BTC worth 726 million USD. The pressure here could therefore increase in July before the big bull run finally starts. For Ethereum (ETH), on the other hand, things could start to look up sooner.

Ethereum ETFs before approval

After the Spot Bitcoin ETFs, which were launched in the US in July this year, were already a great success and exceeded all expectations, expectations for the Ethereum ETFs are also very high. These are still scheduled to hit the market in July, although July 2, which was originally mentioned as a possible date, is unlikely to hold. Investors and analysts are expecting billions of dollars in capital inflows, so it is very likely that ETH will outperform BTC in July.

#ALTSEASON start next week with $ETH ETF launch.

Mark my words.

— Sensei (@SenseiBR_btc) June 29, 2024

- Bitcoin Whales Cash In Millions Amid Recent Rally - November 20, 2024

- Hidden Pattern on XRP Charts Suggests a 500% Surge – Is It Finally Moon O’Clock? - November 20, 2024

- $PNUT Up 325% In 7 Days, Heading To New Record – Will This New Altcoin Be The Next Hot Deal? - November 19, 2024

![BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features in [current_date format=Y] 28 BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features](https://cryptheory.org/wp-content/uploads/2024/11/4-5-120x86.jpg)