SPONSORED POST*

Will Bitcoin’s Bull Run continue straight through 2021, or is it about to suddenly end in a crash?

If you already own BTC, then you have plenty of options of what to do with it. The simplest, is to HODL, placing it in a wallet and holding onto it, taking no notice of the short-term ups and downs, but rather, waiting for it to continue its appreciation over the long term. This is a comparatively safe choice, but it means your savings are sitting there idly doing nothing, while they could be working on your behalf. Alternatively, you can take a more active approach. If you only have a small sum to invest, day trading on the exceptionally volatile crypto markets might seem attractive but, as with any get-rich-quick scheme, it is as equally likely to lead to the loss of all your funds as it is to make you a cryptocurrency millionaire.

The lowest-risk crypto investment option

Whether or not you already own Bitcoin, another cryptocurrency, or just a small sum of fiat currency that you want to put into savings, one opportunity outshines all the others for its value as a secure investment channel. Crypto arbitrage allows you to exploit the lucrative nature of the crypto exchanges without incurring the risk that comes from trading on crypto market volatility, as it involves profiting from crypto market inefficiencies, across exchanges. For a brief period only, a cryptocurrency can be available at different prices at the same time. To make money a crypto arbitrage trader will seize this temporary window of opportunity, buying the coin on the exchange with the lowest price and then instantly selling the coin on the exchange with the highest price before the market adjusts and the price difference disappears.

Crypto arbitrage is not just used by retail crypto investors, but also by mutual funds, exchange-traded funds, and institutional investors. It has successfully gone mainstream and is widely considered to be one of the lowest-risk types of investment.

Risk is further reduced, and profits increased, with the use of an automated platform, since this affords a speed and efficiency that humans can’t achieve and ensures that you can exploit crypto arbitrage opportunities in a split second, buying and selling a coin across exchanges within incredibly short time-frames before the price inefficiency resolves itself. For example, one of the most well-known crypto arbitrage platforms on the market is ArbiSmart, an EU licensed, fully automated AI-based system. You simply deposit funds in either fiat or crypto, and the platform takes over from there. It is connected to 35 different exchanges which it scans, 24/7, to identify and take advantage of price inefficiencies the second they arise, handling a huge volume of trades simultaneously.

A passive income that doubles your BTC profits

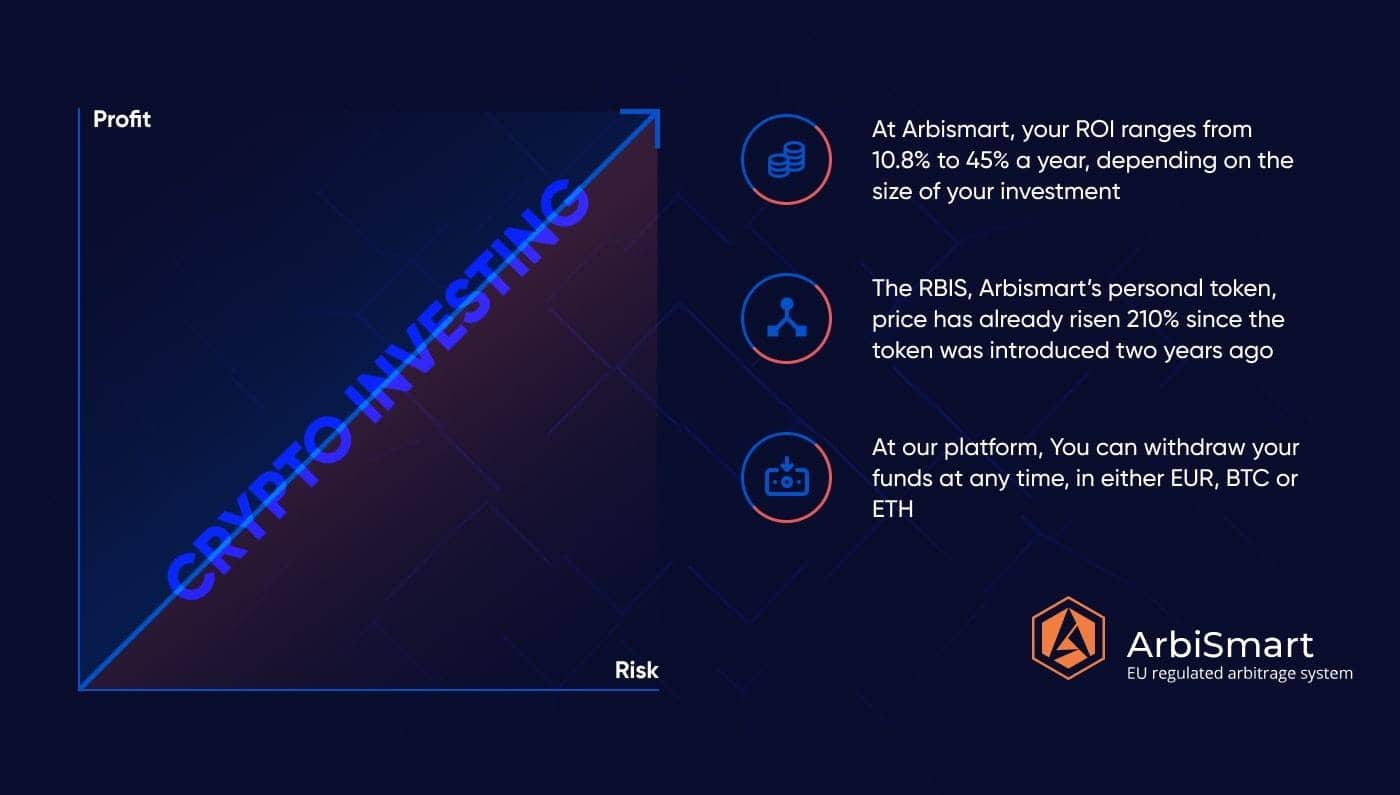

If only greater safety meant enhanced profitability. Unfortunately, the reverse is more often the case, as higher risks tend to correlate to higher returns. However, when it comes to crypto arbitrage, you get the best of both worlds. With the better platforms, your passive profits can be substantial. At ArbiSmart, for example, your ROI ranges from 10.8% to 45% a year, depending on the size of your investment. Moreover, profits are guaranteed, and you can check out their Accounts page if you want to know, in advance, precisely how much you can expect to make on a monthly and annual basis.

Compound interest will supplement profits, so within two years you can double your passive income without any effort. Your return on investment is further increased by the growing value of RBIS, the native token of the ArbiSmart platform. The RBIS price has already risen 210%, since the token was introduced just two years ago. Also, according to projections based on its current trajectory, in line with the steady acceleration in company growth, by the end of 2021, it will have gone up by 3,000%. While you can withdraw your funds at any time, in either EUR, BTC or ETH, as long as they are held on the platform you can earn generous capital gains from the rising value of the token, in addition to your passive profits from crypto arbitrage trading.

Implementing a crypto arbitrage strategy as safely as possible

As we’ve established, crypto arbitrage is exceptionally low risk, particularly when compared to other forms of digital currency investing. However, any time you dip a toe into crypto waters you need to be sure that you are taking every possible precaution, particularly when considering the fact that the crypto arena is critically under-regulated. Conditions are ripe for abuse, in a market that is highly anonymous, digitized, and self-governing, with legislation only being put in place gradually as various countries try to keep up with the rapid developments in the crypto world.

Your only option, if you wish to invest with complete peace of mind, is to choose a fully EU licensed crypto arbitrage platform. You also need to see what people are saying about your chosen platform and dismiss any company that is facing any legal charges, has a reputation for not meeting its profit guarantees, fails to provide prompt withdrawals, or is inaccessible, when contact is attempted.

Let’s take a closer look at what kind of protections a regulated financial services provider can offer. For example, as an FIU licensed company, ArbiSmart must adhere to rigorous EU regulations to maintain its regulatory status. This includes maintaining a secure, functional platform and software, having a dedicated KYC team to ensure compliance with all AML/KYC procedures, providing client capital insurance protection in the case of a hack, holding sufficient operational capital, separating company and client bank accounts, as well as undergoing regular external audits.

There has also been no hint of scandal relating to ArbiSmart in the industry news or on social channels favored by the crypto community, such as Reddit and Telegram. In fact, press coverage over the last couple of years, since the company was established has been overwhelmingly positive and consumer review sites such as Trustpilot, have given it an excellent rating, with reviewers noting the reliable returns as well as the stellar support.

Whether you only have a modest sum to invest or are placing a substantial amount of your capital in crypto arbitrage investing, the advantages are undeniable. Like no other form of BTC investing it offers a high degree of security, a level of risk that is close to zero and exceptional passive profits that can reach up to 45% a year, all without any effort required.

Learn more about crypto arbitrage here, or jump in and start putting your Bitcoin to work right now.

*This post has been paid. The Cryptonomist didn’t write the article nor has tested the platform.

The post Want to Benefit from the BTC High but Don’t Have a Lot to Invest? This Is What You Need to Do appeared first on The Cryptonomist.