Table of Contents

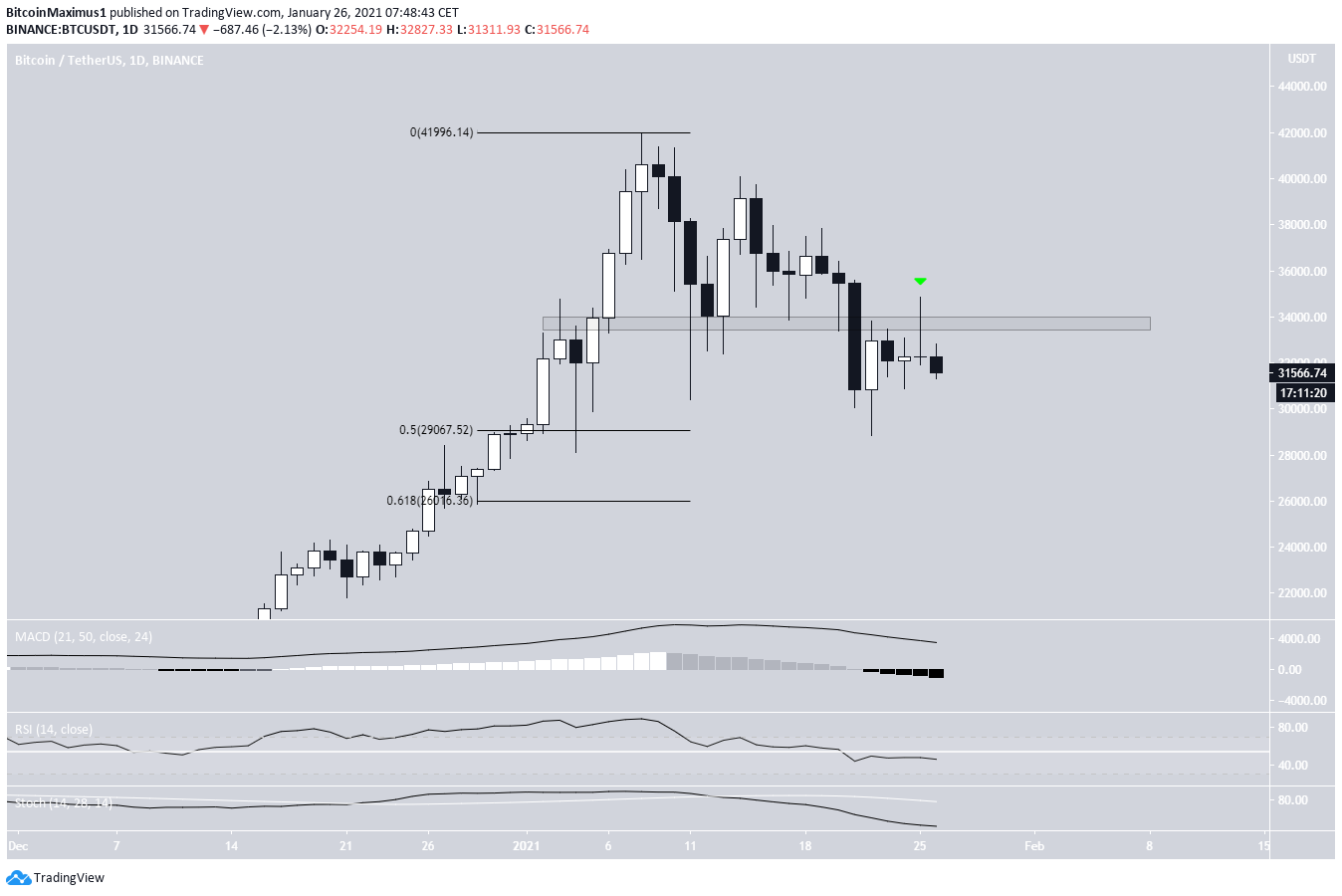

The Bitcoin (BTC) price began a significant upward movement on Jan. 25, but was rejected by the $33,700 resistance area and has been dropping since.

Despite the considerable decrease, Bitcoin is expected to find short-term support and make another attempt at moving above this resistance area.

Bitcoin Gets Rejected

Bitcoin began an upward movement yesterday, increasing all the way to a high of $34,871. This caused a breakout above the $33,700 resistance area, which was the previous breakdown level.

However, BTC was pushed back down and left a very long upper wick — a sign of significant selling pressure. This served to validate the $33,700 area as resistance and BTC is now trading below it.

Until it manages to move above this level, the trend is considered bearish. This is also supported by the bearish readings from technical indicators.

If BTC falls again, the next closest support areas are found at $29,000 and $26,000 (0.5 and 0.618 Fib retracement levels respectively).

Parallel Channel

The six-hour chart shows that BTC is possibly trading inside a parallel channel.

Parallel channels are often corrective movements, and the rejection from the midline along with the bearishness in the daily time-frame also reiterates this possibility.

The two-hour chart shows that BTC has reached an important support area between the 0.5 and 0.618 Fib retracement levels. These supports could initiate a reversal, at least in the short-term.

Despite this, technical indicators do not yet suggest that an upward movement is likely.

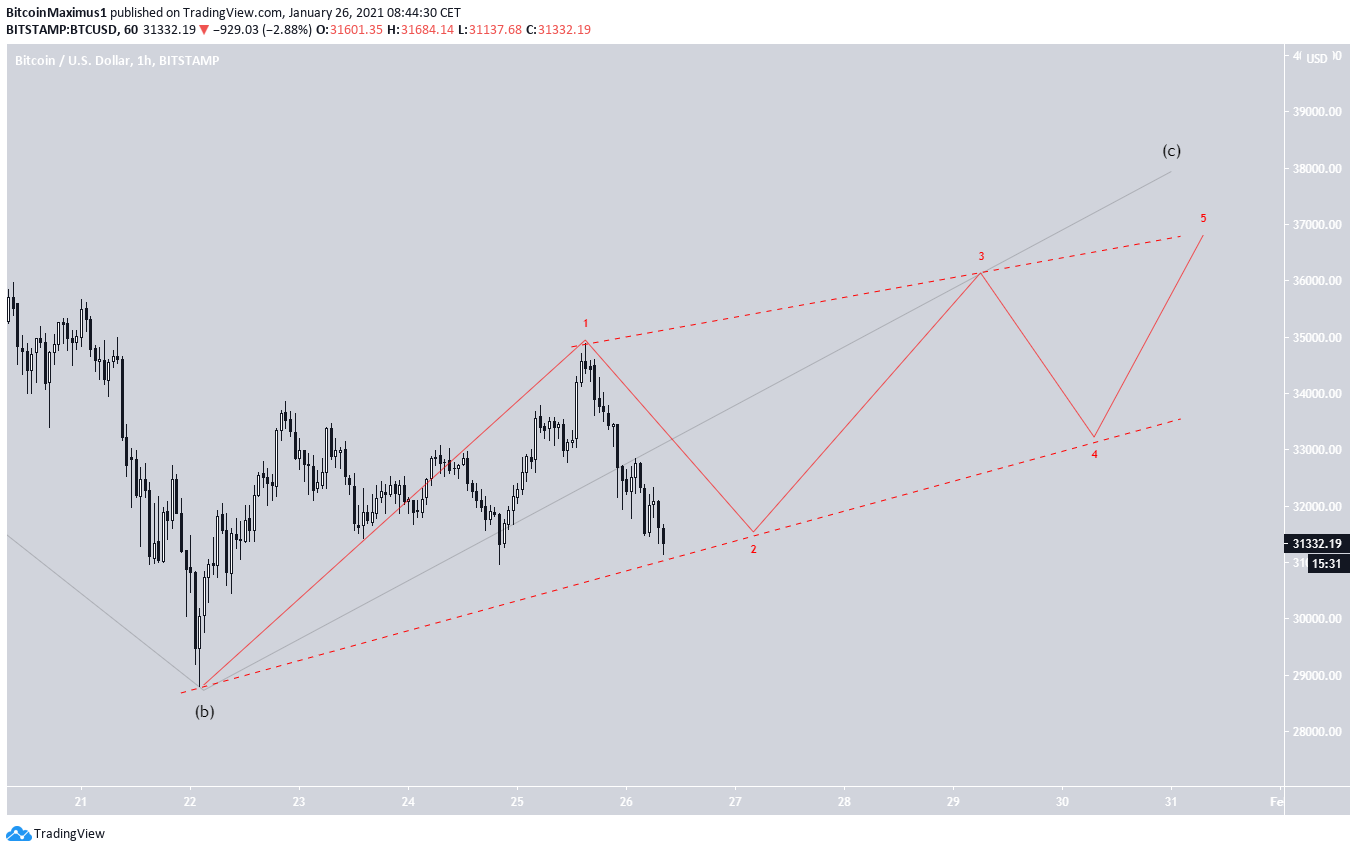

Wave Count

The wave count suggests that BTC is in the B wave of an A-B-C formation which began with the all-time high price of $41,950 on Jan. 8. Since then, BTC has been mired in a long-term corrective structure.

It’s likely that BTC is at the final stage of the B wave, which has a preliminary target of $38,000, at the resistance line of the parallel channel.

BTC could decrease towards the aforementioned $26,000 support area after.

The sub-wave formation shows that the B wave consists of an A-B-C structure (shown in black), in which BTC is in the C sub-wave.

If the C sub-wave high develops to $38,000, this would create a running flat correction, after which a significant decrease would be likely.

And finally, the C sub-wave seems to be an ending diagonal. This is because the first impulsive move (labeled as 1) has a three-wave structure instead of five waves.

Therefore, while the exact shape of the wedge is not yet determined, we would expect BTC to trade in an ascending wedge before breaking down.

Conclusion

Bitcoin is expected to gradually increase towards $38,000 before eventually breaking down. Despite the likelihood of a short-term increase, the long-term trend is probably still bearish.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

The post Bitcoin Slips Back Toward $30,000 — Can it Rebound? appeared first on BeInCrypto.