Bitcoin too expensive, is Lightning good alternative?

3 min read

A transaction on the main BTC network to buy a coffee, for example, is expensive. You would also have to wait almost 70 minutes for the confirmation. The coffee would have been cold, the morning had already turned to noon. Not really an alternative to the classic banking system. Here, too, transfers sometimes take quite a long time, while the money is “on hold” at the weekend.

Under the premise of solving this problem, the Lightning network was implemented in 2018 and included in the original blockchain. A total of one million transactions per second should be possible thanks to the technology.

BTC main layer too expensive

To the According to the Glassnode analysis tool there are more and more large transactions on the BTC mainnet. Around 63 percent of all on-chain transfers were worth US$ 10 million or more.

This momentum has been steadily increasing since the second half of 2020. This proves that (very) large transactions are now mainly taking place on the BTC main network. For investors who have little capital or want to buy a coffee in a beach bar in El Salvador, the horrendous fees are simply too expensive.

Lightning’s steady growth

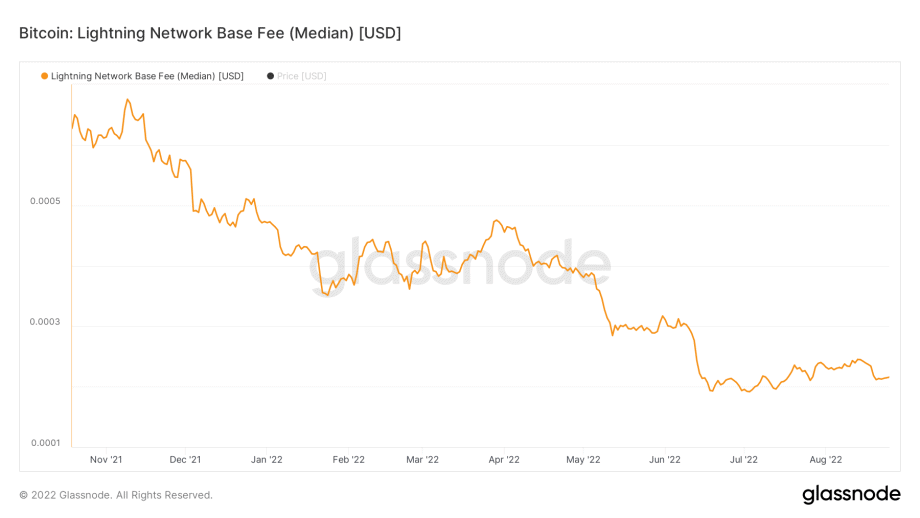

Since the transfers in the Lightning network are processed “off-chain”, there is no need to wait for confirmation. The basic properties of the BTC main layer remain and secure the layer 2 solution. The Lightning network is therefore considered a promising solution that will improve the BTC blockchain in the long term. Buying a coffee through Lightning would cost an average fee of $0.00022 as of today – negligible; trend falling.

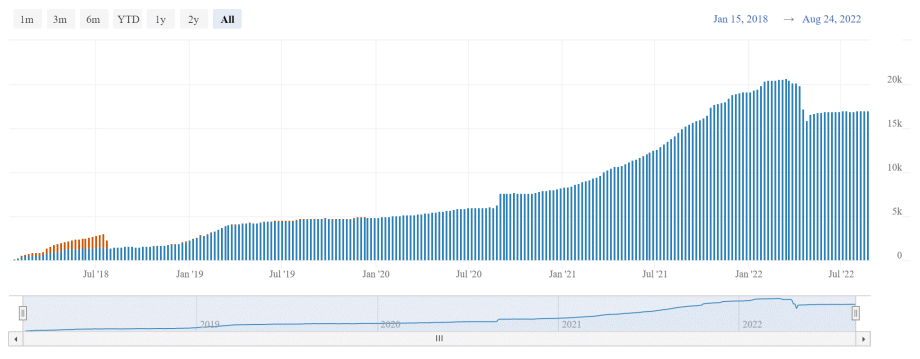

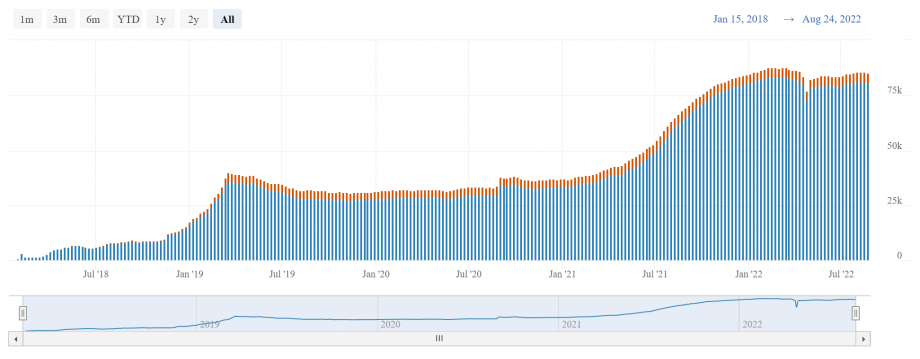

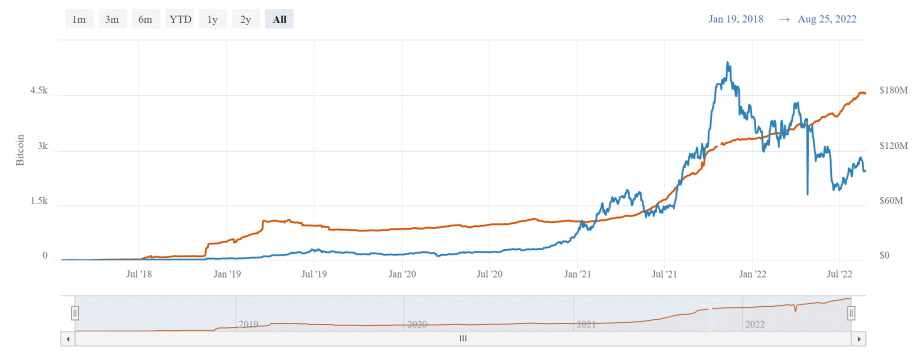

As costs fall, key clues continue to rise. on BitcoinVisuals, an online portal that provides BTC network visualizations, shows the history of the Lightning Network since the beginning of the technology. So now, after more than four years, there are 17,000 nodes. These nodes serve as validators. They store a copy of the blockchain and verify transactions. The following applies: the more nodes a network has, the more decentralized it is. The ETH blockchain is verified by almost 10,000 nodes.

The channels opened since the launch are also increasing in tandem with the new nodes. A Lightning channel always exists between different parties. The coffee purchase can be used as an example again, in which a channel is opened from the private wallet to the wallet of the café.

The network capacity, i.e. the BTC contained in the protocol, offers exciting insights. As with the previous graphs, a dip can be seen in early July after BTC price fell below $20,000. Interesting: The amount of “deposited” BTC has even increased in this context.

Alternative to the financial system?

The steady growth of the BTC Lightning network is impressive. The payment alternative is not only used in the South American El Salvador. In the USA, for example, Jack Mallers announced the implementation of the scaling solution in the existing payment structures at the BTC Miami Conference 2022. Gaming giant Square Enix recently invested in it Zebedee company and wants to build BTC-based play-to-earn functions.

Although the $100 million currently in the log is a vanishingly small amount compared to payment giants like Visa or Mastercard, adoption and usage of the network is growing rapidly. In just under five years, the BTC Lightning network has developed into a serious alternative to the existing financial system.