Table of Contents

BTC (BTC) decreased considerably last week. The losses continued on the morning of May 17, culminating in BTC reaching its lowest price since February.

However, BTC has reached the support line of a descending channel and is expected to bounce upwards.

Weekly BTC drop

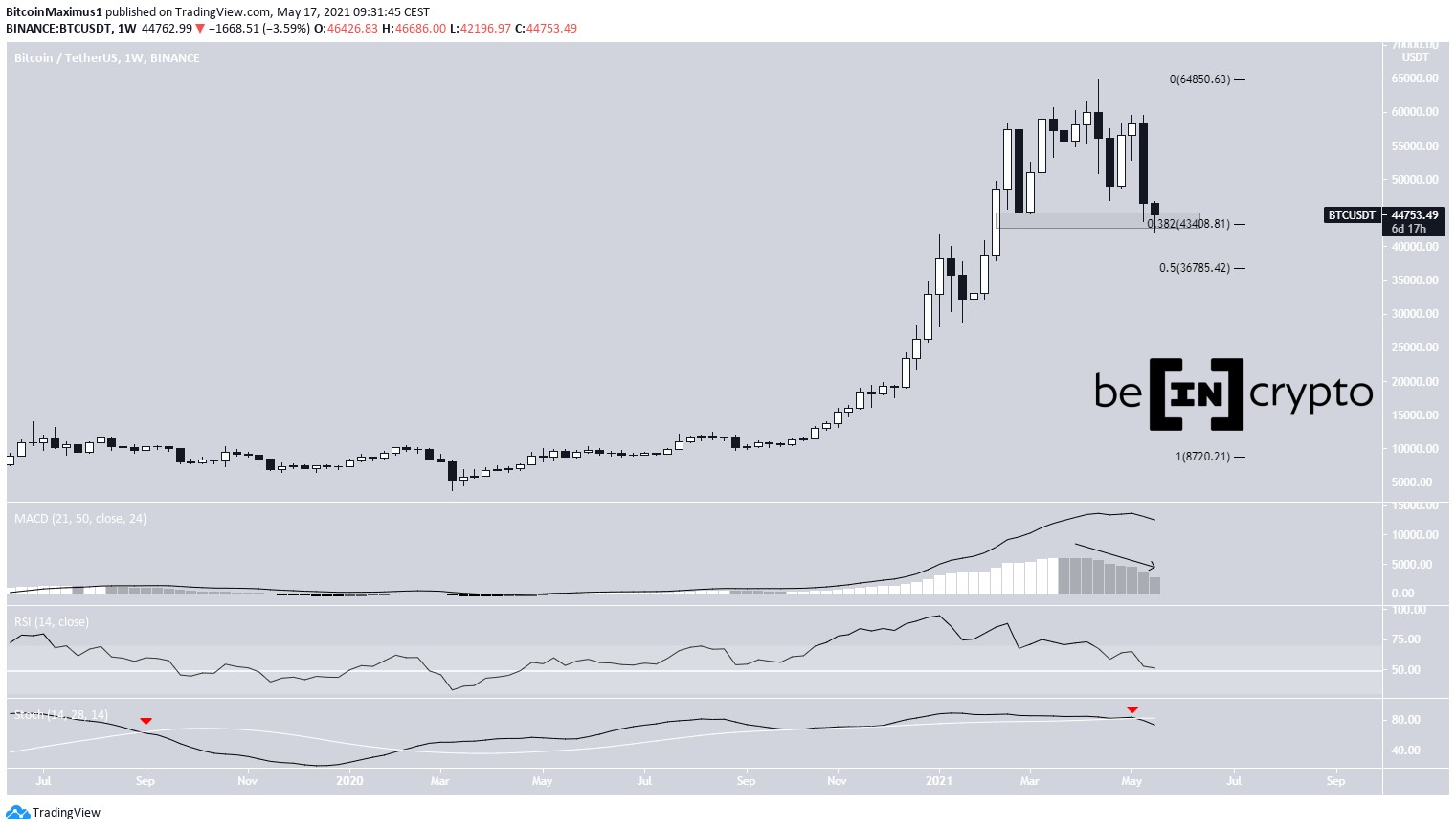

BTC decreased considerably last week, falling from a high of $59,500 to a low of $43,825. This was the lowest price levels for BTC since February.

At the time of press, BTC was trading above a strong support level at $43,400. This is both a horizontal support area and the 0.382 Fib retracement level when measuring the most recent portion of the upward movement.

If the price breaks down, the next support area would be found at $36,785.

Technical indicators in the weekly time frame are bearish. The MACD has generated several lower momentum bars and the Stochastic oscillator has made its first bearish cross since September 2019 (red arrows). However, the RSI is still above 50.

Potential channel

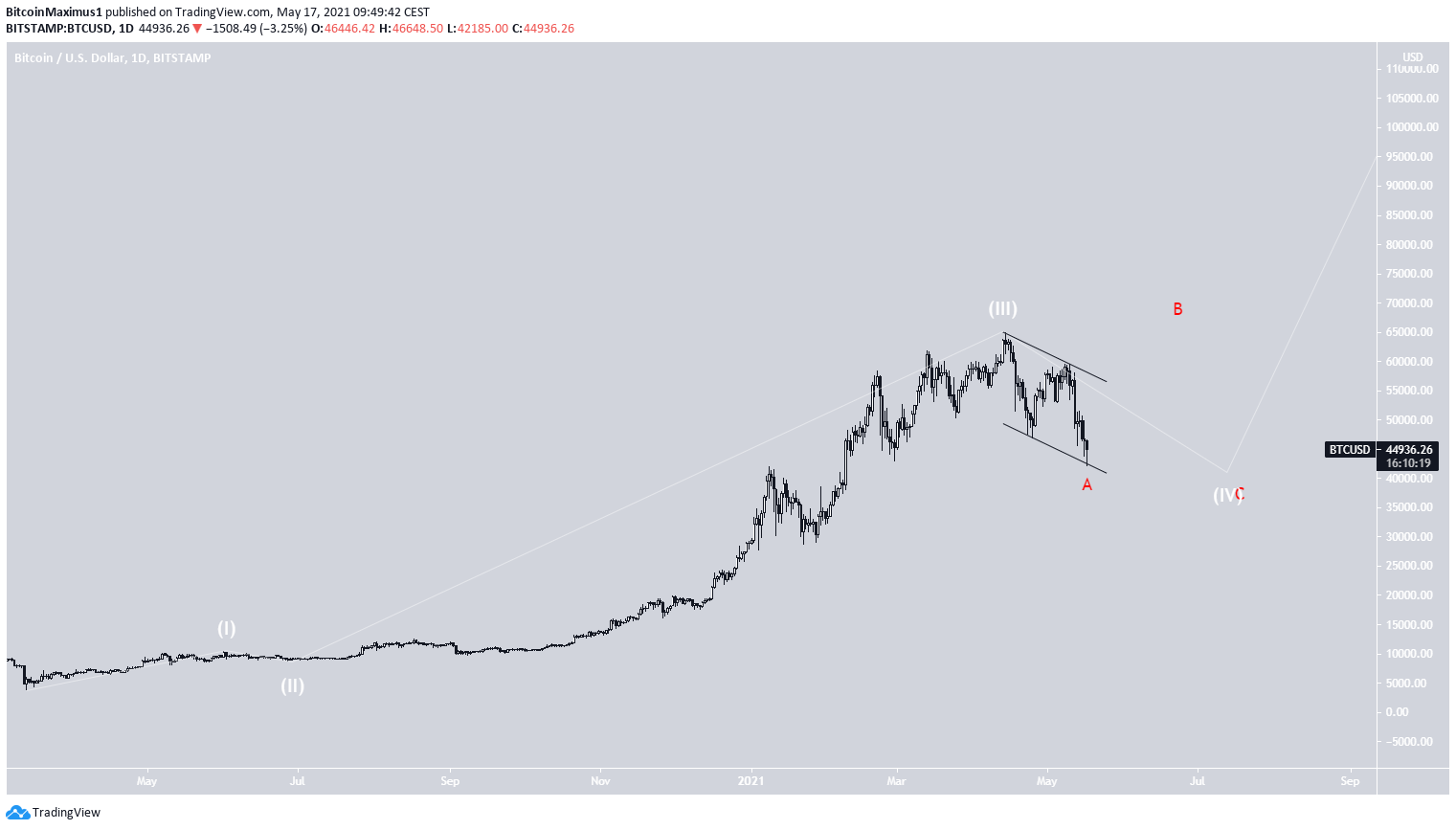

The daily chart provides some mixed signals.

On the bearish side, the MACD is decreasing and is in negative territory. In addition, the Stochastic oscillator has made a bearish cross while the RSI is falling.

However, both the RSI and MACD have generated bullish divergences, a potential sign of a trend reversal.

BTC is trading inside a descending parallel channel, in what is likely a corrective movement. It reached the support line of this channel yesterday and created a long lower wick. The price is now moving upwards.

The main resistance area is found between $49,000-$51,000.

In addition, the short-term MACD and RSI have generated bullish divergences. Therefore, it’s possible that the price will bounce from the current level.

BTC wave count

The wave count also supports the possibility that BTC has reached a low with a bounce at the support line of the channel.

The downward movement could have potentially been a zig-zag A-B-C correction, where waves A:C had a nearly 1:1 ratio. This is very common in such corrective structures.

The longer-term count suggests that the movement inside the channel is only the first part (red) of a longer-term corrective structure. The structure is likely the fourth wave (white) of a bullish impulse that began in March 2020.

Therefore, a period of consolidation is likely before another upward move. This could potentially take BTC to a new all-time high.

Conclusion

It’s likely that BTC is close to or has already reached a bottom after bouncing off the support line of the channel.

Therefore, an upward movement towards the $49,000-$51,000 resistance area is expected. Eventually, a breakout from this zone is probable.

For BeInCrypto’s previous BTC (BTC) analysis, click here.

The post BTC (BTC) Drops Sharply but Maintains Long Term Support appeared first on BeInCrypto.