BTC is in the zone of extreme greed for the first time in three months

2 min readExtreme greed is back

The BTC Fear and Greed Index estimates the general sentiment associated with primary cryptocurrency in several respects. These include surveys, volatility, volume, comments on social networks and more.

Provides results from 0 – extreme fear to 100 – extreme greed. What usually leads to the biggest changes in metrics is the price of the asset. As a result, the index was deep in a state of extreme fear with a low of 10 for many weeks after BTC began its decline in mid-May.

However, the situation began to change after BTC bounced off its local bottom below $ 30,000. The index entered the greed zone for a while, but only around 50. It has now jumped into the extreme greed zone at 76. This coincides with BTC’s latest rise, adding several thousand dollars in a matter of hours and reaching $ 48,000 for the first time since mid-May. .

Similarly, Ethere’s fear and greed index is very close to such a state of extreme greed. The second largest cryptocurrency has recently been on the move, and in less than a month it has almost doubled in value.

ETH Fear and Greed Index is 75 ~ Greed pic.twitter.com/n66fiPCoQG

– ETH Fear and Greed Index (@EthereumFear) August 14, 2021

What they say about the price of BTC on-chain data

It’s also worth checking out some metrics that could provide an overview of what might happen next. Apart from the technical aspects, some data suggest that large investors are not selling now.

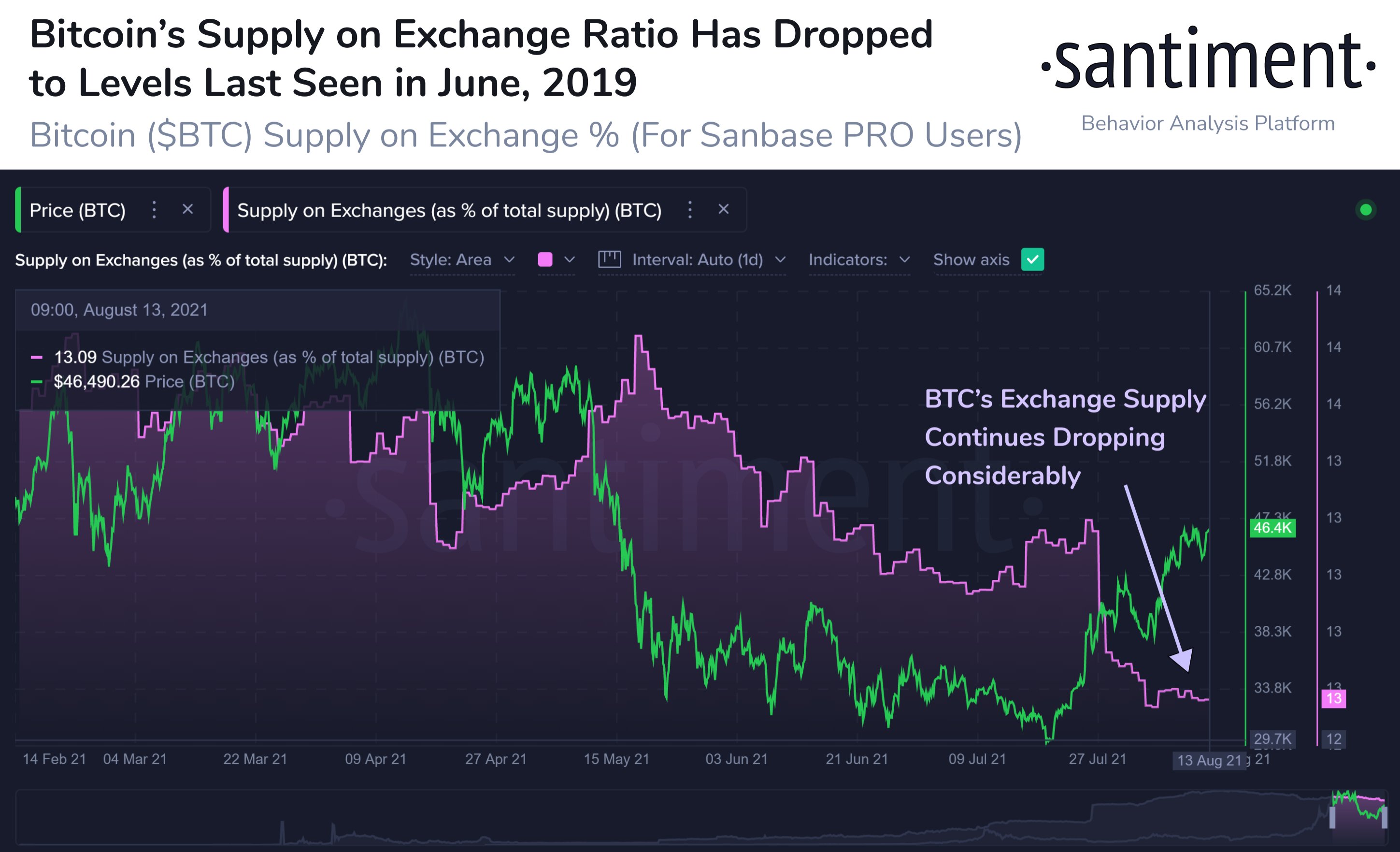

According to the analyst firm Santiment, BTC’s offer on the digital asset exchanges has dropped significantly over the last two weeks. The platform classified it as an “encouraging sign for the bulls.”

“Traders are moving more of their funds into cold wallets. This intended mentality reduces the risk of future big sales. ”

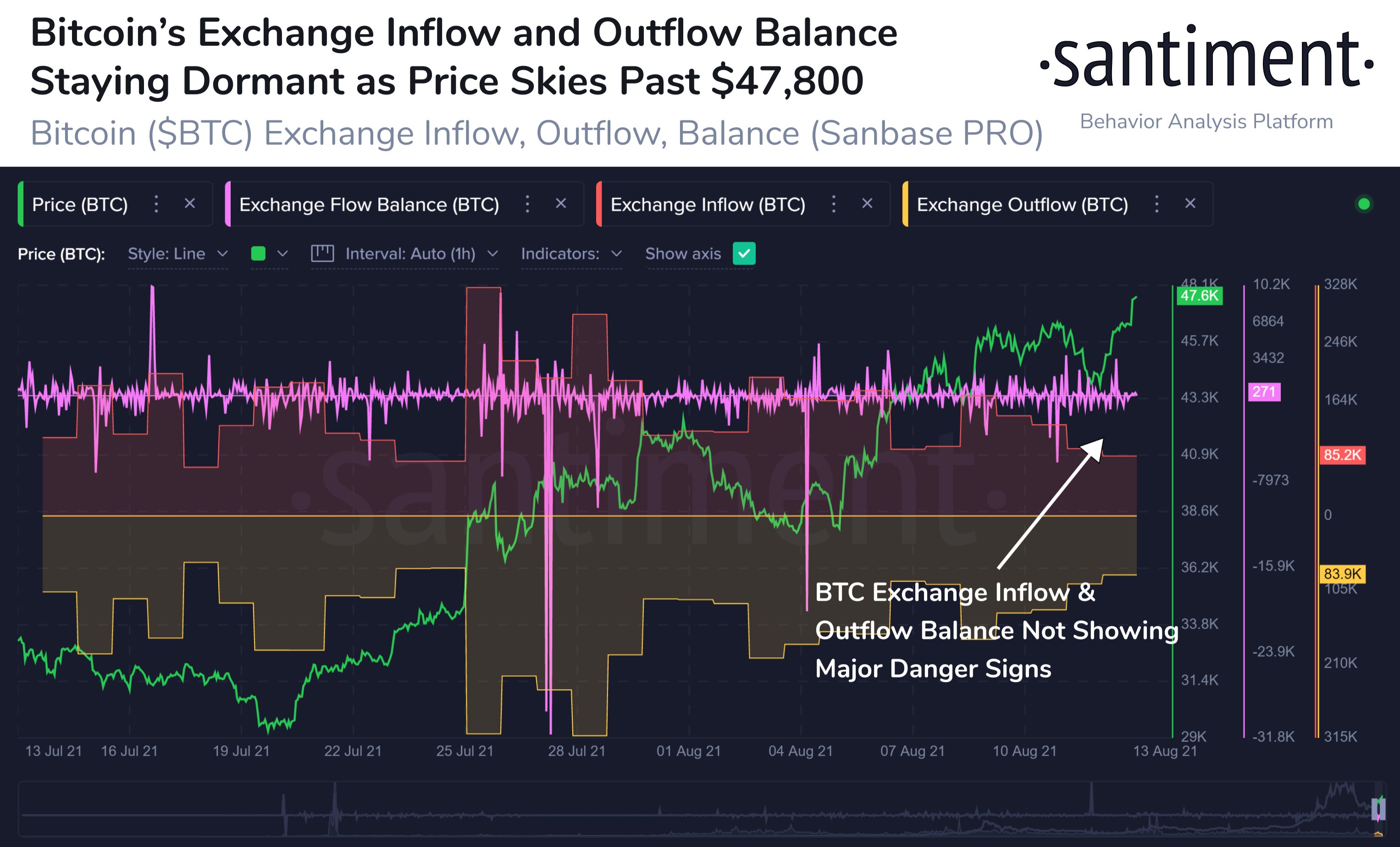

Another confirmation that investors are not in the selling mood comes from the influx of BTC to the stock market, which has been declining recently. Therefore, after a 60% increase in BTC in three weeks, Santiment stated that there is a “possibility that BTC will return to ATH levels again.”