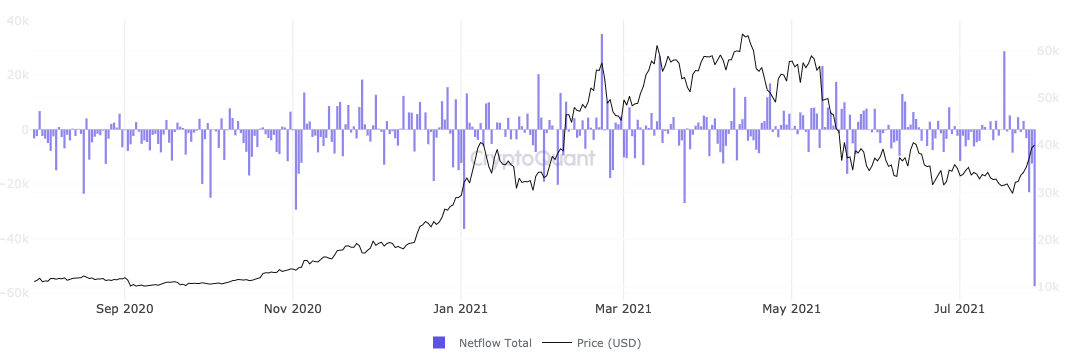

BTC is disappearing from the exchanges, yesterday marked records outflow of 57,000 BTC in one day

3 min readThe supply of BTC on crypto exchanges is long-term market mood indicator. If the number of BTC on the exchanges increases, it can be assumed that its owners plan to sell it, otherwise they would have no reason to transfer it to the stock exchanges.

Conversely, if long-term creditors buy the BTC they plan to hold, they will often convert it off the exchanges to their own wallets. Yesterday was an ebb 57,000 BTC from the exchanges in a single day, to which the rise in the price of BTC up to the upper limit of the channel, in which it has been operating for several months since its previous fall, also contributed.

BTC is now holding around after the rebound $ 40,000, which is close to the resistance band between 41-42k. They also support this growth on-chain data which revealed that crypto exchanges are occurring to extensive BTC selections.

A large amount of BTC is disappearing from the exchanges

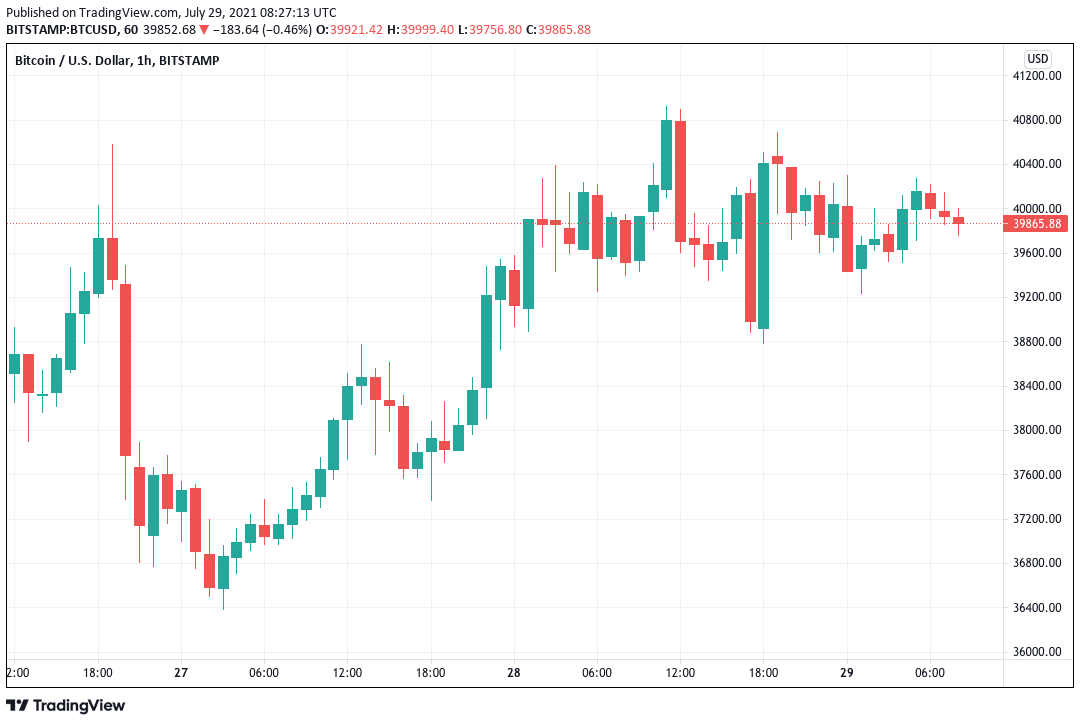

During Thursday, the upper limit of the trading zone is tested again, as evidenced by data from TradingView.

Growth slowed at the beginning of the week, when BTC reached just below several weeks’ highs $ 41,000 on most exchanges. This was followed by a decline to $ 38,800, from where BTC then returned to the psychological limit $ 40,000, which is currently struggling to maintain it, which would turn it from resistance to support.

Even during the growth of this week, however, the data on Thursday show that the demand for BTC is not slowing down even at its rising price. This trend is evidenced by data shared by companies Bybt and CryptoQuant which pointed to the largest one-day outflow for the whole year. Total 57,000 BTC left cryptocurrency market in one day.

Thanks to this outflow, balances on exchanges have returned to the levels most recently observed in mid-May, just before a significant price correction, before BTC began to turn downwards after reaching an all – time high around $ 64,500.

Building strong support

However, despite the high interest in BTC, investors are not rushing and waiting for a higher minimum to be created before it can continue on its way up.

“I think the market has to go down to form a higher minimum before continuing up.” summarized the current situation of the popular twitter trader Pentoshi.

“Simply put. I was bullish from 29.6k until resistance, but today signals to me that we need to go lower for a higher minimum. “

This higher minimum, ie an upward reflection earlier than the previous decline, could occur anywhere in the range between $36,000 to $ 32,500.

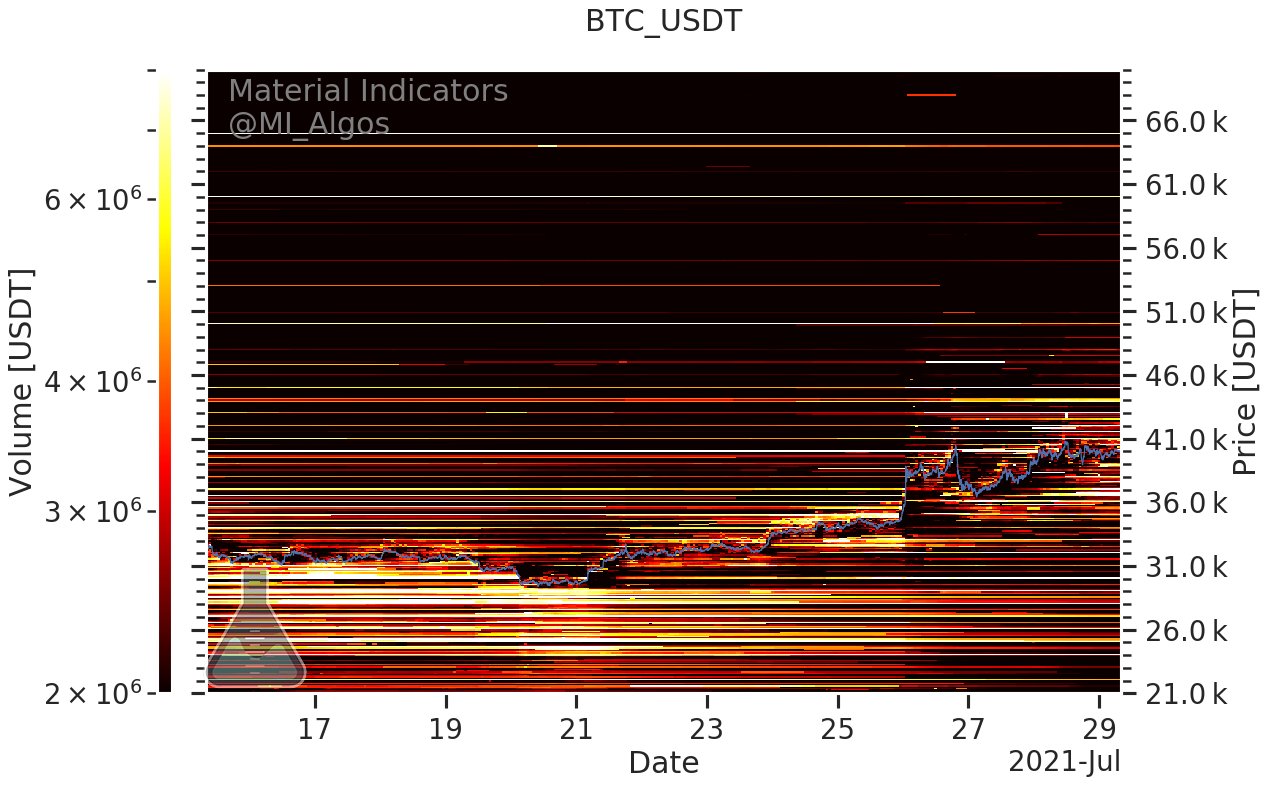

The growing interest is also confirmed by data from order books on the leading stock exchange Binance, where the range of the spot price narrowed, while buyers and sellers pushed on both sides to $ 40,000.

With the growing demand for BTC and its withdrawal from the stock exchanges, we can expect increasing pressure on the growth of its price in the coming days and weeks. We’ll see if the bulls have enough strength.