Options data suggest BTC has a small chance to trade above the $50,000 price level at the end of next month, data from multiple sources shows.

On Options and how they affect the market

‘Options’ are a financial instrument that derives their value from an underlying asset for a relatively small upfront investment (called a ‘premium’). As the name suggests, holders get the option of buying or selling a certain stock, bond, or crypto, at a later date than the present.

Such a mechanism allows for massive upsides while losses are capped—meaning if holders exercise their options before the strike date, they get to pocket a large amount, and if the trade goes against their intended direction, the option expires worthless and the premium is lost.

“Call” options are those which allow their holders the right to buy an underlying asset at a given price at a predetermined time in the future. “Put” options, on the other hand, allow their holders the right to sell (or short-sell) their underlying assets at a given price at a predetermined time in the future.

BTC options have become a large feature of the crypto market in this regard. Such instruments were a niche feature as early as 2018, but have since picked over the past year.

Derivatives powerhouse Deribit is where much of the options action is present—the exchange processes billions of dollars worth of BTC options each week—while firms like OKEx, LedgerX, and the Chicago Mercantile Exchange are quickly catching on.

Some industry experts use options data to predict market views and provide analysis. This is made possible by looking into open interest data (contracts that have been traded but not liquidated), one that provides a glimpse of where the big money is moving or betting on.

Where is BTC going?

Pankaj Balani, CEO of Delta Exchange, spoke to CryptoSlate in this regard, pointing out various factors that suggest why the asset has a 30% probability of going to $50,000 and beyond next month.

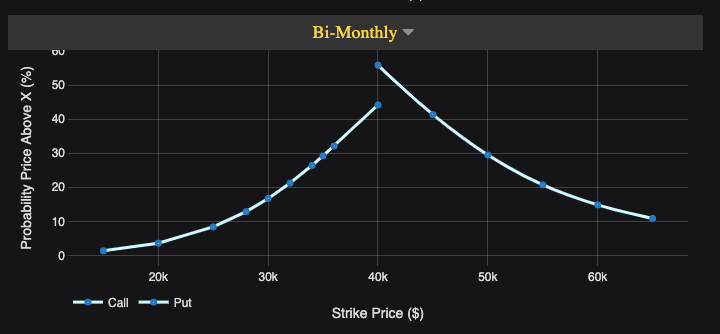

“After a volatile week, BTC has bounced back and is trading close to $39,500 on the spot. Market sentiment remains cautious as traders continue to pay a premium for downside protection on the monthly and quarterly maturities. On the weekly and bi-weekly maturities though, the call implied volatility has started to rise and approach those of Puts,” said Balani in a statement.

He further stated:

“Options market is pricing close to a 30% chance that BTC will be close to $50,000 by the end of July and a 15% chance that it will be close to $30,000 for the same maturity.”

Balani, as the image below shows, noted that the open interest on BTC options for the June expiry is highest at $48,000 strike, followed by the $50,000 strike on the upside.

“This should provide stiff resistance as the BTC price surges,” he said, adding that on the downside, the $36,000 and $32,000 strike Puts have high OIs but are considerably lower than that in $50,000 calls.

“Overall, the signs are bullish for the short-term, but we don’t see the same for longer maturities,” he told CryptoSlate, adding:

“Unless the demand for calls increases at higher prices, accompanied by spot buying and expansion in futures premium, a rally to $45,000 should see more selling come through.”

BTC trades just above $40,000 at press time, with the price level serving as a ‘resistance’ zone. But options traders could just be betting on the many positive fundamental developments for the asset in recent times.

The post BTC options shows 30% chance of BTC trading above $50,000 next month appeared first on CryptoSlate.