As a record $6 billion worth of BTC options near expiry this Friday, the cryptocurrency market may be in for turn in favor of the bears.

Applying “Max Pain”

According to data from cryptocurrency market analysts Bybt, the market faces a record $6 billion worth of BTC (BTC) options coming to expiration this Friday.

The gigantic figure is a direct result of a sustained increase in open interest on BTC options market-wide. In fact, open interest ballooned to $13.5 billion as BTC rose past the $60,000 mark. This is an increase of over 60% in just two months.

Indeed, as it stands, the data show that the contracts set to expire on March 26 contain 100,400 BTC. The amount represents nearly half of all such contracts set to expire within the next fortnight.

Many in the options trading community suggest that BTC’s recent tumble to the low $50,000 levels might be the result of options traders pushing the price lower ahead of the expiration.

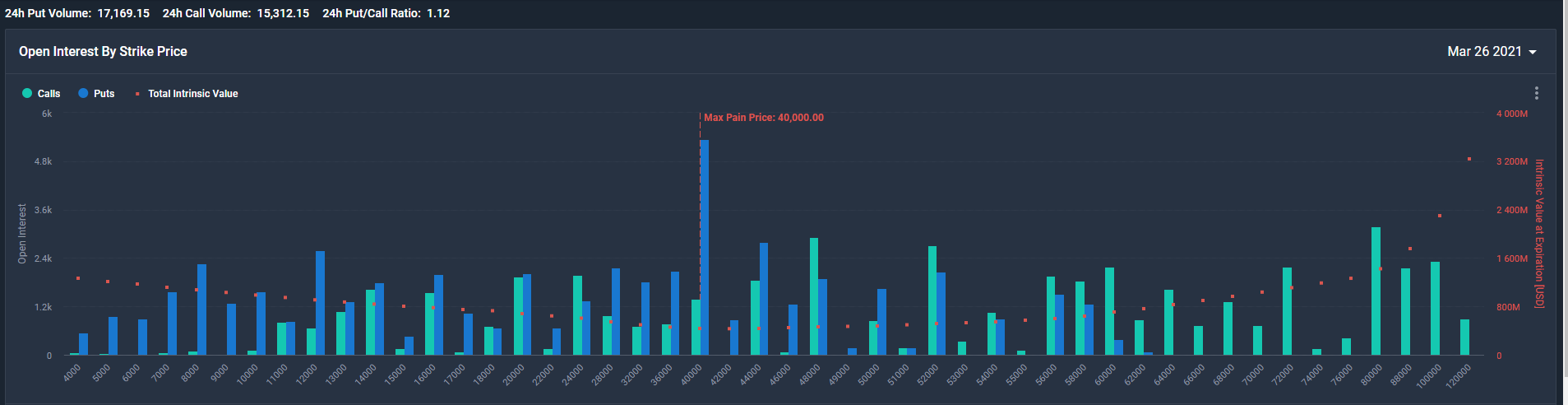

This is colloquially known as a “max pain” operation. The hypothesis is that sizeable traders in options markets push their prices to levels that cause the market to suffer the most loss before expiration.

They then take advantage once the expiration is over, buying or selling the asset depending on the price level.

This point is around $40,000 on Deribit. Whilst this does mean that level might be in sight for Deribit’s options traders, any pressure this might exact on BTC’s price will disappear after expiration.

Is A Correction Due?

Several prominent cryptocurrency market analysts point to this event as a potential trigger for a wider market correction.

On December 16th last year, as BTC broke through the $20,000, former White House communications director, Anthony Scaramucci, said he though the top-cryptocurrency was due for a correction.

Many others agreed with his sentiment, citing the near 700% gain BTC experienced in 2020 alone. However, since soaring past that $20,000 mark, BTC has tripled in value, setting a new all-time high of $61,711.87 earlier this month.

Accordingly, the rapid surge attracted investors keen to capitalize on the top cryptocurrency’s stellar performance.

This, critics of the correction opinion suggest, may prevent such a correction for a while if sustained. Moreover, the wider cryptocurrency market has a severe supply issue on its largest exchanges.

With a contracted supply and increased demand, the argument against even a short-term sustained correction holds credibility.

Buy The Dip Still In-Play?

As a matter of fact, the effects of cryptocurrency derivatives markets on the underlying asset price are still up for debate. Indeed, if anything, their effect is temporary.

Moreover, whilst a $6 billion expiration is no idle event, looking more closely into the options market uncovers a slight bias towards the bulls. Just weeks ago, when BTC set a new all-time high, it also wiped out most of the bearish “put” options.

This leaves a situation in which the bullish “call” options slightly dominate the options market. Against the context of rising positive sentiment in BTC’s spot market, this event will likely only have a temporary effect.

The post BTC Stumbles as $6 Billion Options Near Expiration appeared first on BeInCrypto.