Table of Contents

The BTC dominance rate (BTCD) has been following a descending resistance line since January and was rejected by it on July 20.

It is possible that BTCD has reached a local top and will soon break down from its short-term pattern.

Descending resistance line

Since January, BTCD has been decreasing alongside a descending resistance line. It has been rejected by it thrice (red icons), most recently on July 20.

Technical indicators in the daily time-frame are relatively neutral. The MACD has lost its strength and is trading exactly at the 0 line. The RSI is slightly above 50, and while the Stochastic oscillator has made a bullish cross, it has also generated bearish divergence.

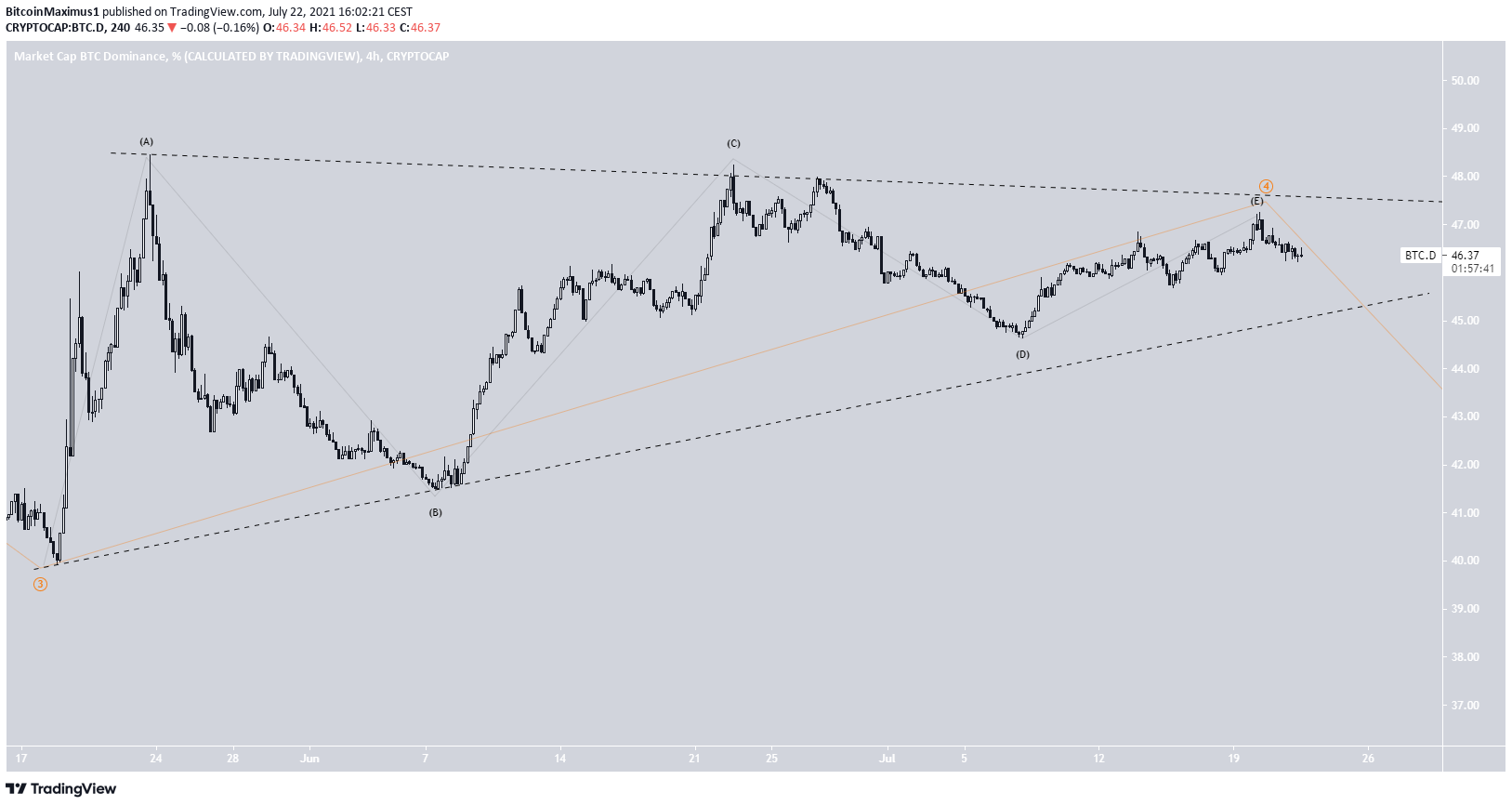

Symmetrical triangle

The shorter-term six-hour chart shows that BTCD is also trading inside a symmetrical triangle. It is approaching the point of convergence between resistance and support. Therefore, a breakout/down from the pattern is eventually expected.

Due to the readings from the daily time-frame, a breakdown would be more likely.

While the short-term RSI is neutral, the MACD is bearish and has given a bearish reversal signal.

If a breakdown occurs, the closest support would be at 43%, the 0.618 Fib retracement support level.

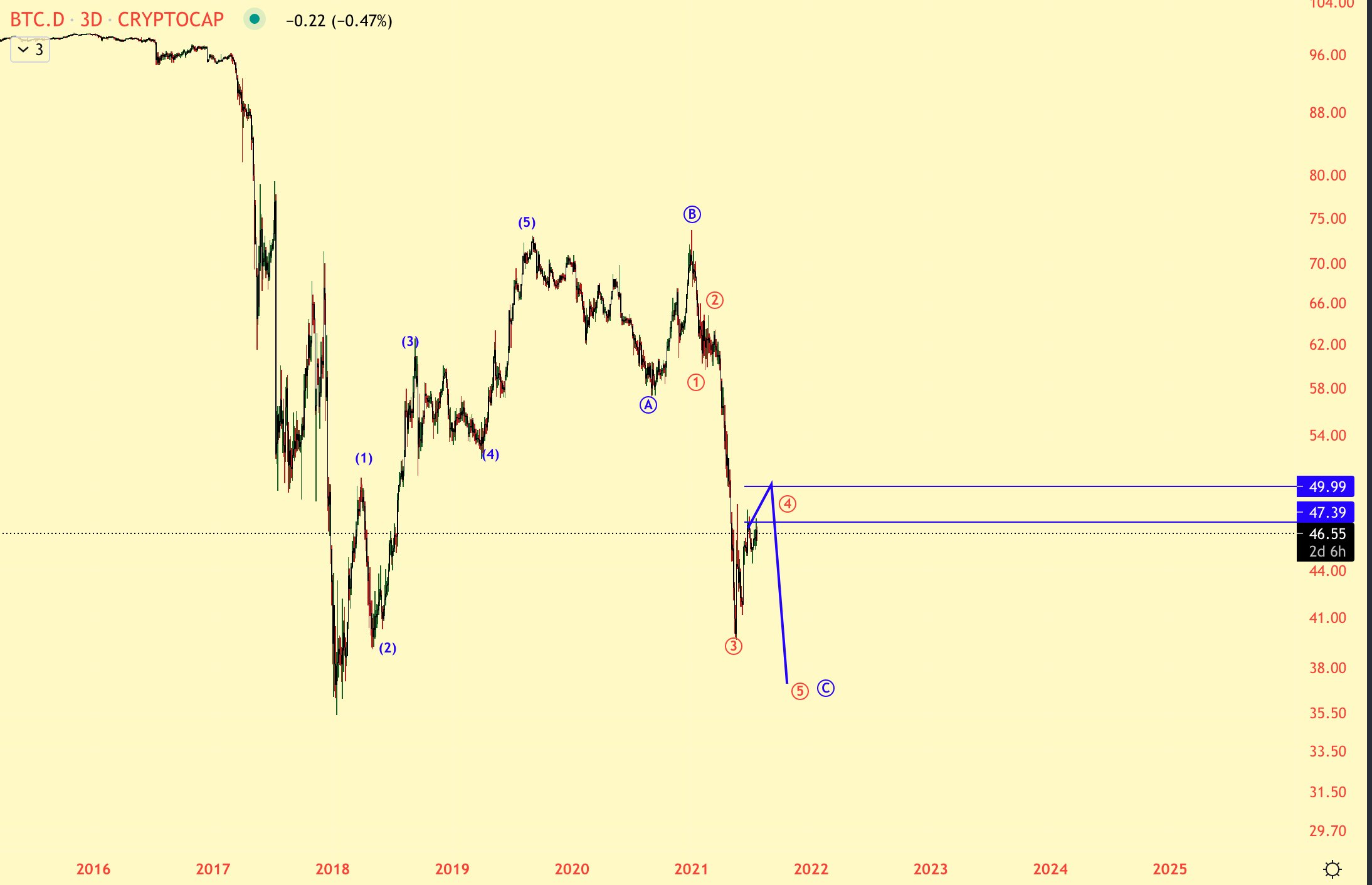

Wave count

Cryptocurrency trader @Altstreetbet outlined a BTCD chart, stating that another wave down towards a new all-time low is likely.

The most likely wave count indicates that BTCD has just completed wave four of a bearish impulse (orange).

The most likely target for the low of the entire movement is between 33.7-34.7%. The target is created by using a Fib projection on waves 1-3 (orange), and by using the length of wave 1 (black).

The shorter-term 4-hour chart shows that wave four took the shape of a symmetrical triangle.

BTCD has just completed sub-wave E and could break down in the near future.

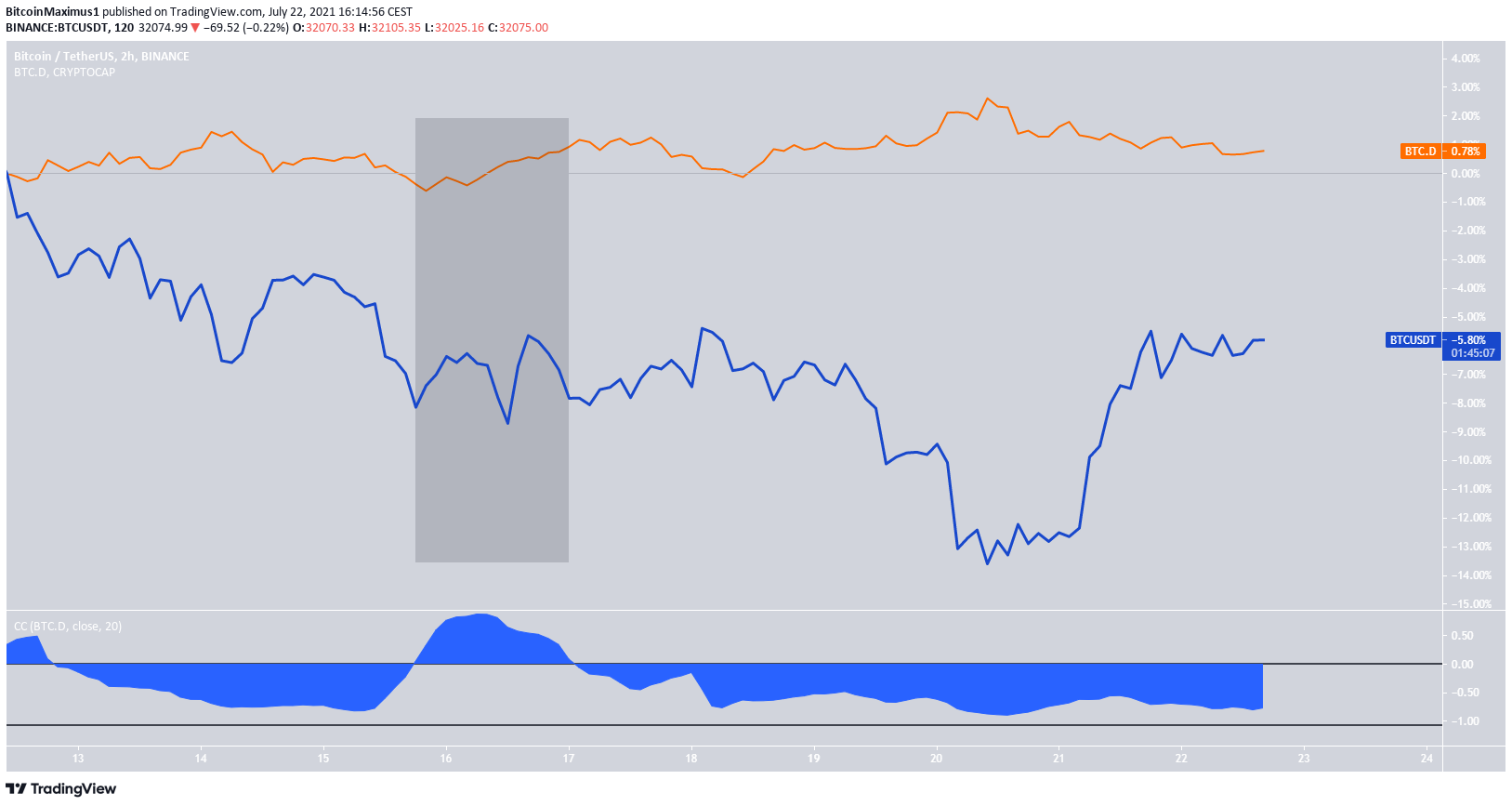

Relationship to BTC

With the exception of July 15-16, BTCD (orange) has had a negative relationship with BTC (blue) since July 12. This means that an increase in the price of BTC has caused a drop in BTCD.

This is also visible by the correlation coefficient, which is very close to -1, indicating a nearly perfect negative relationship.

If the relationship holds, a continued increase in the BTC price would be required in order for BTCD to fall to the given target.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post BTCD Could Have Reached A Local Top – Will Alts Rally? appeared first on BeInCrypto.