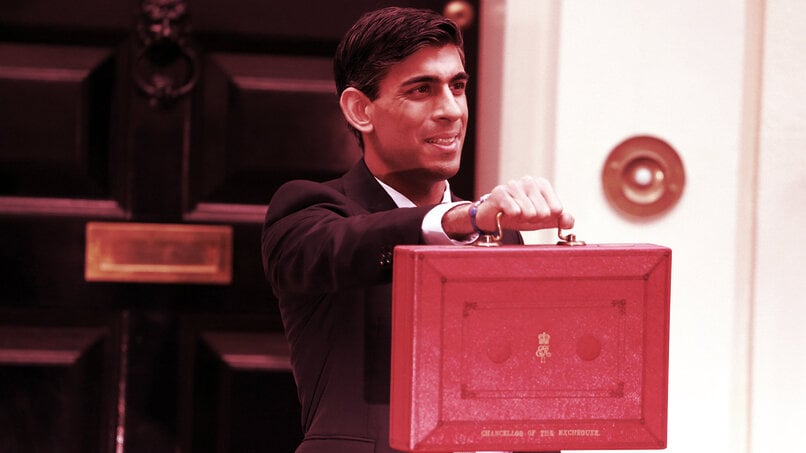

The UK Chancellor of the Exchequer Rishi Sunak has today announced a freeze on the capital gains tax threshold for the next five years. This means the UK’s Bitcoin holders won’t get hit by a massive tax bill, as was previously expected.

Sunak had reportedly been considering an increase to capital gains tax as a way of easing the economic impact of the government’s massive borrowing—up to £280 billion so far—during the COVID-19 pandemic. Last year, he asked the Office for Tax Simplification to review the tax and it recommended raising it in line with income tax, effectively doubling rates, and reducing the tax threshold considerably. If these changes had been implemented, a £50,000 profit on an investment for a higher-rate taxpayer would have gone up from £7,500 to £19,000—a 150% rise.

Currently taxpayers are only liable for capital gains tax on any gains above £12,300, and there is a capital gains tax at 10% for basic-rate taxpayers (those in the UK that earn up to £50,000 in annual income). There is also a threshold of 20% for higher-rate taxpayers that earn over £50,000.

According to HM Revenue and Customs, Bitcoin holders are liable to pay capital tax gains when they sell their Bitcoin, exchange it for another cryptocurrency, use it to pay for goods or services, or when they give it away to someone else. So, if these tax changes had been introduced, they could have had serious implications for Bitcoin owners—particularly since the price of Bitcoin has shot above £36,000 this year.

As announced today, the capital gains tax threshold will stay the same at £12,300 until 2026. While it hasn’t been reduced, it is also a stealth tax because it hasn’t been increased in line with inflation.

Sunak did not mention any rises in capital gains tax itself (how much gains are taxed above the threshold) and neither does the 2021 budget. This means, however, that changes to capital gains tax could still happen down the line.

In addition to a freeze on the capital gains tax exemption threshold, Sunak has placed a freeze on Pensions Lifetime Allowance and Inheritance Tax thresholds, also for the next five years.

Elsewhere in the Budget speech, Sunak said the £280 billion of support the government has issued during the COVID-19 represents the highest borrowing rates of a UK government outside of wartime. The damage of COVID-19 has been “acute,” he added.

However, there are signs for optimism. Sunak also said the Office of Budget Responsibility predicts the British economy will be back to its pre-COVID-19 levels by the middle of next year.