Can cryptocurrencies be considered a Ponzi scheme?

7 min readWhen assessing cryptocurrencies from the perspective of whether they could be classified as Ponzi schemes, it is important to understand several key aspects. This article will include analyses and comparisons that will help assess whether cryptocurrencies can meet the characteristics of Ponzi schemes. We will look into the definition of Ponzi schemes, the dependence of cryptocurrencies on the inflow of new investors, marketing strategies that may be misleading, issues with transparency, ethical dilemmas, and comparisons with traditional investment tools.

Definition and Characteristics of Ponzi Schemes

Ponzi scheme is a type of financial fraud where payouts to existing investors depend on financial contributions from newly attracted individuals. This model is unsustainable because it requires a continuous influx of new money to function. Key features of Ponzi schemes include:

- Promised high returns with little or no risk: Investors are enticed by high profits that are presented as virtually guaranteed.

- Ambiguity in investment strategy: Details on how the money will be earned are often vague or completely missing.

- Need for new investors: The scheme relies on a continuous influx of new money to fund payouts.

Comparing these features with cryptocurrencies may reveal similar traits, especially in the context of unclear projects or those hyped as a way to get rich quick.

Dependence on the Influx of New Investors

Many cryptocurrencies exhibit considerable volatility, which can be partly driven by speculative interest from new investors. This influx of new money can temporarily increase the price of a token, creating an illusion of quick wealth, attracting even more speculators. This phenomenon is similar to the mechanism of Ponzi schemes, where new deposits allow the scheme to continue. Case studies like the boom and subsequent crash of cryptocurrencies like Bitconnect show how these patterns can resemble Ponzi schemes.

Marketing Strategies and Excessive Promises

Some cryptocurrency projects use aggressive marketing strategies that promise high returns without a clear explanation of risks. This tactic can obscure the real value and potential of the project, attracting investors who may not fully understand what they are investing in. The similarity to Ponzi schemes is apparent when projects primarily depend on promotion and attracting capital without a sustainable business model or real product.

Unregulated and Misuse

The lack of clear regulation in the cryptocurrency space often allows abuses such as hidden fees, opaque investment structures, and even scams. This situation is reminiscent of Ponzi schemes, where a lack of transparency and regulation facilitates manipulation and exploitation of investors’ trust.

The continuation of this topic will include further analyses and case studies that illustrate how certain aspects of cryptocurrencies can match the characteristics of Ponzi schemes.

Ethical and Moral Dilemma

When assessing cryptocurrencies from an ethical standpoint, questions arise that remind one of the problems with Ponzi schemes. Many cryptocurrency projects are based on the premise of quick profit, which can lead to morally dubious practices, such as exploiting investors’ trust.

Examples of Ethical Dilemmas:

- Market Manipulation: Some groups or individuals may influence cryptocurrency prices through pump-and-dump schemes, a manipulation that can bring quick profit at the expense of less informed or new investors.

- False Promises: Projects that promise revolutionary outcomes or significant technological innovations without solid evidence or a prototype can lead investors to put money into apparently unsustainable ventures.

These ethical dilemmas are concerning because they undermine trust in the entire cryptocurrency ecosystem and may lead to regulatory interventions that could limit innovation and growth in this sector.

Market Reaction and Investment Behavior

The dynamics of the cryptocurrency market can sometimes resemble Ponzi schemes, especially regarding excessive price fluctuations caused by speculation and “FOMO” (fear of missing out).

Analysis of Market Reactions

- Boom and bust cycles: Crypto markets often go through periods of rapid growth followed by sharp declines, which may indicate unsustainability based on speculation rather than real values.

- Speculative investments: Many investors enter the market without a deep understanding of the technology or fundamental values, which can lead to irrational decisions based more on emotions than analytical assessment.

These market reactions not only show similarities to Ponzi schemes but also highlight the need for better investor education and regulation to manage these volatile cycles and protect investors.

Comparison with Traditional Investment Instruments

Cryptocurrencies differ in many respects from traditional investment instruments such as stocks, bonds, or mutual funds. This difference can contribute to the perception of cryptocurrencies as a modern Ponzi scheme, especially among more conservative investors.

Main Differences:

- Regulation and oversight: Traditional financial instruments are usually subject to thorough regulatory oversight, which helps protect investors and maintain market stability. In contrast, cryptocurrencies remain relatively unregulated, increasing the risk.

- History: Traditional investments have a long history of returns and are underpinned by economic principles and business models, whereas many cryptocurrencies are still in experimental stages without long-term proven value.

These differences raise concerns that cryptocurrencies may be risky and opaque for some investors, which is why there is a call for strengthening the regulatory framework and increasing transparency in this sector.

Historical Examples of Ponzi Schemes and Their Impacts

To better understand the characteristics and impacts of Ponzi schemes, it is useful to look at several historical examples. This section will provide an overview of some of the most famous Ponzi schemes and analyze their short-term and long-term impacts on investors and financial markets.

Charles Ponzi and the Original Ponzi Scheme:

-

Charles Ponzi Description: Charles Ponzi, after whom the schemes are named, founded a company in Boston in 1920 that promised a 50% profit in 90 days through international reply coupon arbitrage. The scheme quickly gained popularity and collected millions of dollars from thousands of investment-enthusiastic citizens.

- Impacts: When the scheme collapsed, many people lost their life savings. Ponzi was imprisoned, and his name became synonymous with this type of financial fraud. This case also led to strengthened financial regulation and oversight in the USA.

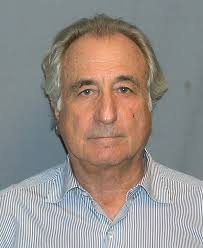

Bernie Madoff and the Largest Ponzi Scheme in History:

-

Bernie Madoff Description: Bernie Madoff ran an investment fund that promised stable and high returns. Madoff’s scheme, which operated from the 1980s until 2008, involved billions of dollars and was considered one of the largest Ponzi schemes of all time.

- Impacts: Madoff’s scheme resulted in an estimated loss of about $65 billion and led to significant financial and emotional damage to thousands of families worldwide. The scheme also influenced regulation and sparked extensive discussions about the need for better oversight over investment funds.

Case Studies of Cryptocurrencies That Exhibited Characteristics of Ponzi Schemes

The cryptocurrency market is known for its volatility, and some cases resemble the characteristics of Ponzi schemes, especially in terms of rapid growth followed by a sharp decline. This section will focus on several cryptocurrencies that have gone through this cycle and will explore the lessons that can be drawn from these cases.

Bitconnect

- Description: Bitconnect was marketed as an investment platform that offered up to 40% monthly returns through a supposed trading bot. The platform promised extremely high returns and used a referral program to attract new investors.

- Impacts: In January 2018, following a series of warnings from regulatory bodies and accusations of operating a Ponzi scheme, Bitconnect abruptly ceased its operations, leading to a sharp decline in the value of its token. Many investors lost significant amounts of money.

OneCoin

- Description: OneCoin was promoted as a new revolutionary digital currency. Behind this project was a strong marketing campaign, including seminars and large investor meetings, which promised wealth and easy profit.

- Impacts: In 2017, it was revealed that OneCoin was actually a Ponzi scheme without real blockchain technology. The founders were charged with fraud and money laundering, again highlighting the risks associated with unverified and opaque cryptocurrency projects.

These two examples show how uncritical belief in excessive promises and lack of regulation can lead to financial disasters in the cryptocurrency sector. The discussion of these cases emphasizes the importance of educating investors. Besides Bitconnect and OneCoin, there are a number of other cryptocurrency projects that have been identified as potential Ponzi schemes or that have exhibited similar characteristics.

Plustoken

- Description: Plustoken was a platform that claimed to offer cryptocurrency wallet services with high returns for storing coins on its platform. They claimed to use sophisticated trading algorithms to generate profit.

- Impacts: The exposure of the scheme led to the arrest of several leadership members and the loss of billions of dollars invested by people around the world.

MiningMax

- Description: MiningMax was a project that promised high returns from cryptocurrency mining, but in reality, it was a scheme that required investments into “mining packages” without a real basis.

- Impacts: Returns were paid out from the deposits of new investors, and overall more than $200 million was collected before the scheme was exposed and several of its operators were arrested.

MMM Global

- Description: MMM Global was a reincarnation of the older Ponzi scheme MMM, which ran in the 90s. This new project adopted cryptocurrencies as a method for deposits and promised incredible returns to investment users.

- Impacts: The project quickly spread globally but eventually collapsed, leaving behind a large amount of financial losses among naive investors who were attracted by promises of easy profit.

Cloud Token

- Description: Cloud Token was another cryptocurrency project that claimed to offer profits from trading cryptocurrencies using artificial intelligence and robots. Investors were attracted by high monthly returns and referral programs.

- Impacts: Like many similar schemes, Cloud Token collapsed when it was impossible to pay out promised returns from real profits, leading to large financial losses for users.

Arbistar

- Description: Arbistar was a project that claimed to provide automated tools for cryptocurrency arbitrage, promising stable returns from price differences between exchanges.

- Impacts: Returns were actually paid from new deposits, and when new investors stopped coming, the scheme collapsed, leaving many investors without their deposits.

GainBitcoin

- Description: GainBitcoin offered a “cloud mining” program that promised investors could “mine” bitcoins without needing to own mining hardware, simply by investing money into the scheme.

- Impacts: Once new investments stopped coming in, it was impossible to continue paying out returns, leading to a widespread financial scandal and subsequent arrest of the founders.

Conclusion

Overall, this article provides a comprehensive view on the arguments why cryptocurrencies could be considered Ponzi schemes. Analysis of various aspects of the cryptocurrency market highlights potential risks and calls for reflection on how these technologies should be regulated and integrated into the broader financial system to preserve their innovative power while protecting investors.