A strong performance from Cardano this week puts its year-to-date gains at just under +1,000%. Analysts attribute this to the anticipation of the Alonzo upgrade, which will bring smart contract functionality to the blockchain.

This comes as Input-Output Global CEO Charles Hoskinson continues to sound the alarm on Tether, calling the fiction of its 1:1 dollar backing over and exposed for all to see.

Recent weeks have seen U.S authorities signal an increasingly hard line against stablecoins in general. But Hoskinson thinks regulators are hesitant to act until a suitable replacement emerges.

With Circle, the firm behind rival stablecoin USDC, continuing to make moves, is it just a matter of time before the hammer comes down on Tether?

Tether under fire

Recently, Hoskinson unloaded on Tether, calling it a faith-based cryptocurrency. He added that this setup is the opposite of how cryptocurrencies should operate. As in, users must trust the claims rather than look to the fundamentals.

Specifically, he was referring to the details contained within its first report. A condition of its settlement with the New York Attorney General was the production of regular reports, including on its reserve allocation.

This report showed that less than 4% of the three-quarters of its reserves it calls “Cash & Cash Equivalents & Other Short-Term Deposits & Commercial Paper,” relates to actual dollars.

Speaking to Bloomberg, Hoskinson took the opportunity to continue his attack, saying an operation as large as Tether should abide by the same reporting requirements and regulations as (say) a similar-sized bank.

“Normally when you have $60 billion or more under management and there’s a very strong promise you’ve made to get that money — that you’re backed — you’d be U.S.-regulated. You’d have to file reports to somebody, you’d have a custodian involved. And there’s restrictions on behavior and proper compliance people and so forth.”

But, cognizant of the risks involved with punishing Tether to the full extent of the law, Hoskinson said regulators are reluctant to make a move. Or at least until a replacement takes over Tether’s role.

“I’d think regulators would be hesitant to strike Tether until there’s some replacement for it, like USDC, and Tether’s prominence is waning. It could have existential damage to the crypto markets, kind of like when Lehman Brothers failed in 2008.”

The start of this week saw Circle boss, Jeremy Allaire, announce plans to become a national digital currency bank. This would operate under the supervision of the Federal Reserve, the U.S Treasury, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation.

In turn, if the plans come to fruition, one would assume its USDC token would leapfrog Tether and assume its role as the primary liquidity source for crypto markets.

Short term outlook for Cardano

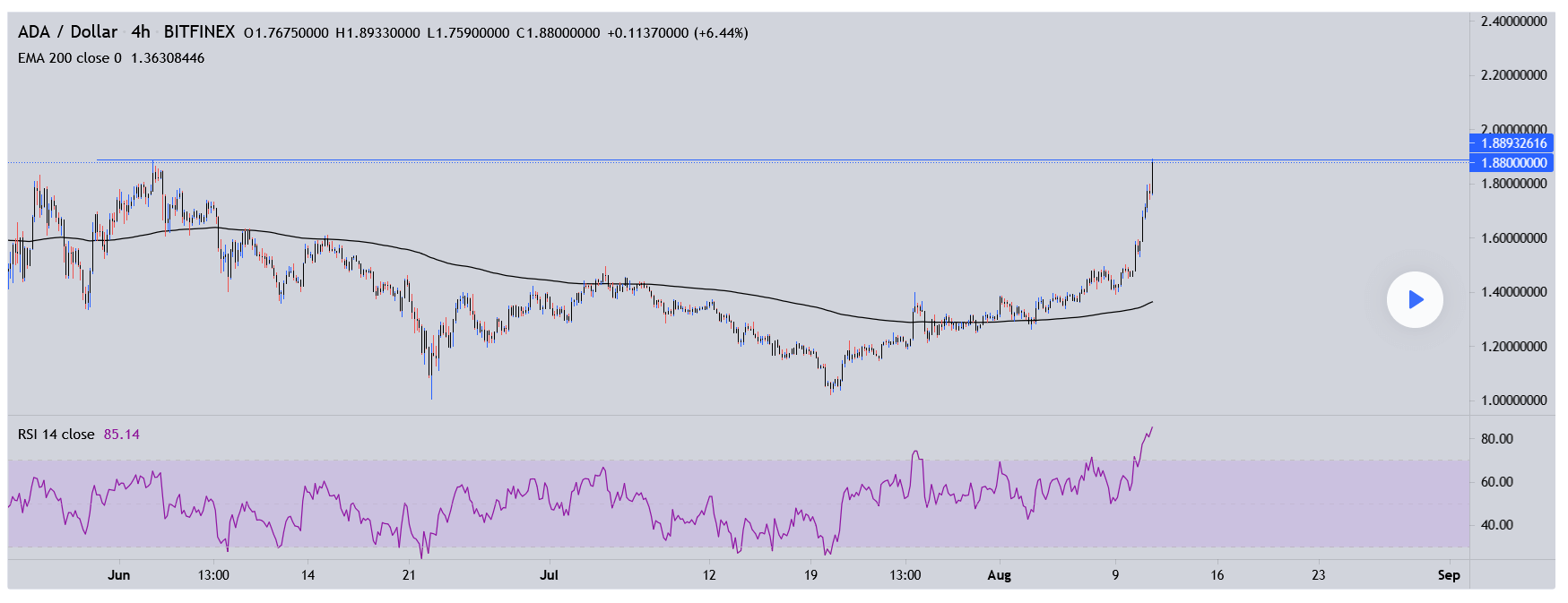

This week has seen a huge breakout for Cardano, gaining 20% since Tuesday, taking ADA to $1.76 at the time of writing.

However, analysis by DJW1998 warns that bulls could take a breather to regroup at this point. A four-hourly chart shows ADA being rejected at $1.89, a previous resistance area established in early June.

DJW1998 also notes RSI deep in overbought territory, signaling a possible cooling off period.

“As you can see from the chart price has rallied back up to a previous high where price was rejected.

Price on the RSI is sitting in the overbought area significantly currently showing an 85 reading which could be a sign price is about to reverse to the downside.”

Nonetheless, as Alonzo is yet to be released, buyers are expected to show up in the run-up to its launch in the coming weeks.

The post Cardano founder says the Tether fiction is over as ADA tears higher appeared first on CryptoSlate.