The popularity of NFTs skyrocketed in 2021 and gained massive proportions in 2022. According to a report by Chainalysis, at least $44.2 billion worth of cryptocurrencies were sent to contracts associated with NFT markets and collections.

However, just like any new technology, non-fungible tokens are being targeted by malicious actors for illicit activities. The two main ones identified by Chainalysis were:

- “Wash trading”: technique to artificially increase the value of NFTs;

- Money laundering through the purchase of NFTs.

Wash trading

In a nutshell, wash trading is a market manipulation technique where an investor simultaneously sells and buys the same asset to create false and misleading activities regarding the asset’s value and liquidity.

In the case of NFT wash trading, the goal is to make the NFT look more valuable than it actually is.

“In theory, this would be relatively easy with NFTs, as many trading platforms allow users to trade by simply connecting their wallet to the platform, without the need to identify themselves.”

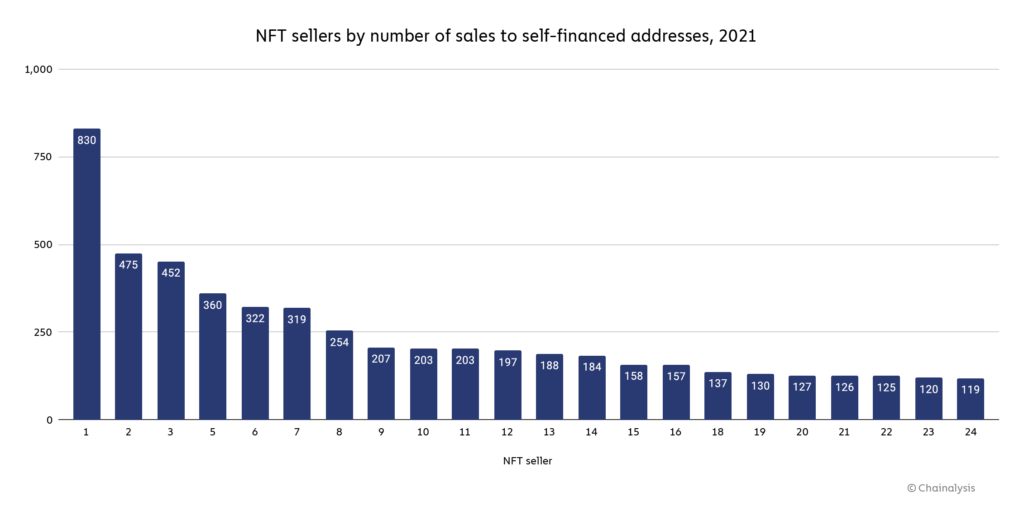

However, blockchain analytics allow you to track this activity. As the research firm highlighted, analyzes show that some NFT sellers have carried out hundreds of wash trades.

In the report, Chainalysis shows the case of “Vendor 1” who made 830 sales to addresses that he himself controlled.

In the case of this seller, despite numerous attempts to raise the price of the NFT, the activities did not pay off. After all, andle spent more on transaction fees ($35,642) than it made on sales ($27,258).

High profits with Wash trading

Extending this analysis to 262 users who sold an NFT to a self-funded address more than 25 times, Chainalysis noted that:

“Most NFT laundering operators have not made a profit. But successful NFT launderers have profited so much that, as a whole, this group of 262 profited immensely overall.”

“More generally, wash trading on NFTs can create an unfair market for those who buy artificially inflated tokens. And their existence can undermine trust in the NFT ecosystem, inhibiting future growth. We encourage NFT markets to discourage this activity as much as possible,” concluded Chainalysis.

Money laundering with NFTs

As for “traditional” money laundering, Chainalysis noted that, while small, it is visible in the NFT market. This activity has some bearing on the history of money laundering with works of art.

“But while money laundering in physical art is difficult to quantify, we can make more reliable estimates of NFT-based money laundering thanks to the inherent transparency of the blockchain.”

As Chainalysis found, the amount sent to NFT markets by illicit addresses reached $1.4 million in Q4 2021.

Additionally, in the same quarter, $284,000 worth of cryptocurrencies were sent to NFT markets from sanctions risk addresses.

All this activity represents a tiny fraction of the $8.6 billion in cryptocurrency money laundering in 2021. However, it is something that needs to be monitored:

“However, money laundering and, in particular, transfers from sanctioned cryptocurrency companies, pose a major risk to building trust in NFTs. This should be monitored more closely by markets, regulators and law enforcement.”

Who benefits from the virtual El Dorado?