Table of Contents

The Chainlink (LINK) price has broken down from a short-term parallel ascending channel but is still trading inside a longer-term channel.

If the price were to break down from the longer-term channel, it would likely confirm that the trend is bearish and the price is heading lower.

LINK Long-Term Rejection

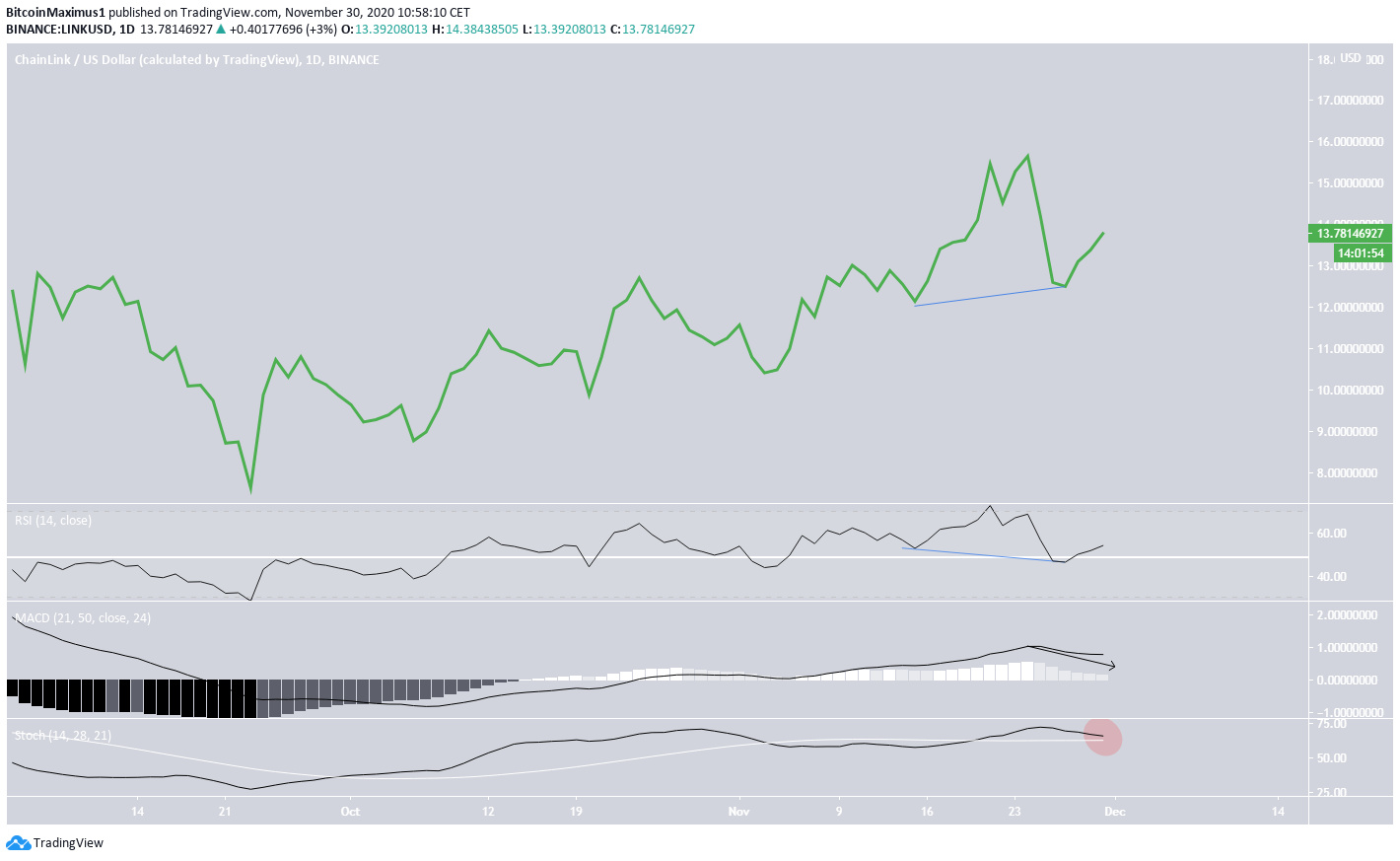

During the week of Nov. 23-30, the LINK price created a small-bodied bearish candlestick with wicks on each side. The price failed to reach a close above the previous support area at $14 and instead created a long upper wick and fell back to validate the area as resistance.

Even though the RSI is above 50 and the MACD is above 0, the Stochastic oscillator has made a bearish cross. This is a sign that the long-term trend might be bearish, especially if LINK fails to reclaim the $14 area.

LINK Resumes Channel Trading

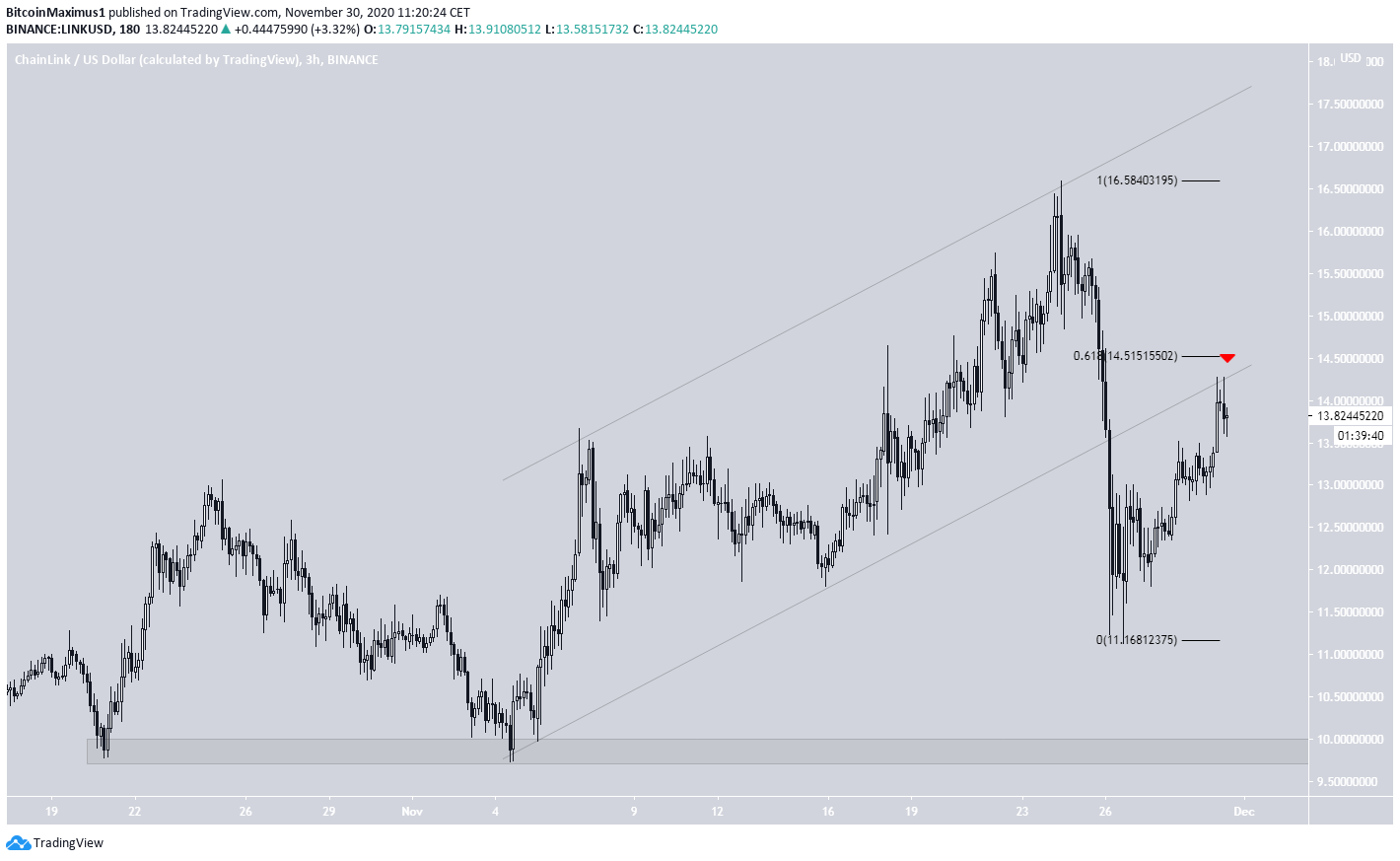

The LINK price has been increasing since reaching a low of $7.22 on Sept. 23. The upward movement culminated with a high of $17.30 on Nov. 24.

While the increase was substantial, the price was rejected by the 0.618 Fib retracement level of the entire decrease and fell sharply afterward.

While the LINK price initially broke out from the level, it failed to reach a close above it and created a long upper wick instead. In addition, the movement since making the lows has been perfectly contained within a parallel ascending channel, indicating that it is likely a corrective movement.

At the time of press, LINK was facing resistance from the middle of the channel.

Technical indicators provide mixed signals:

- For the bullish case, there is a hidden bullish divergence in the RSI, which is above 50.

- For the bearish case, both the MACD & Stochastic oscillator are decreasing.

However, the Stochastic oscillator has not yet made a bearish cross, nor is the MACD negative.

A breakdown from the aforementioned parallel channel would likely cause both of these events to occur and confirm that the trend is bearish.

Potential Rejection

Cryptocurrency trader @CryptoTony_ stated that the current price level of $14 will be a major determining factor for the direction of LINK’s trend.

The level is the middle of the channel we have outlined, increasing its significance.

A closer look at the price movement shows that LINK has already broken down from a shorter-term parallel ascending channel and is currently in the process of being rejected from its support line.

The current price level is the:

- 0.618 Fib retracement of the most recent decrease.

- The middle of a long-term parallel channel.

- The support line of a short-term parallel channel.

A rejection could cause a drop all the way to the $9.90 support area.

Wave Count

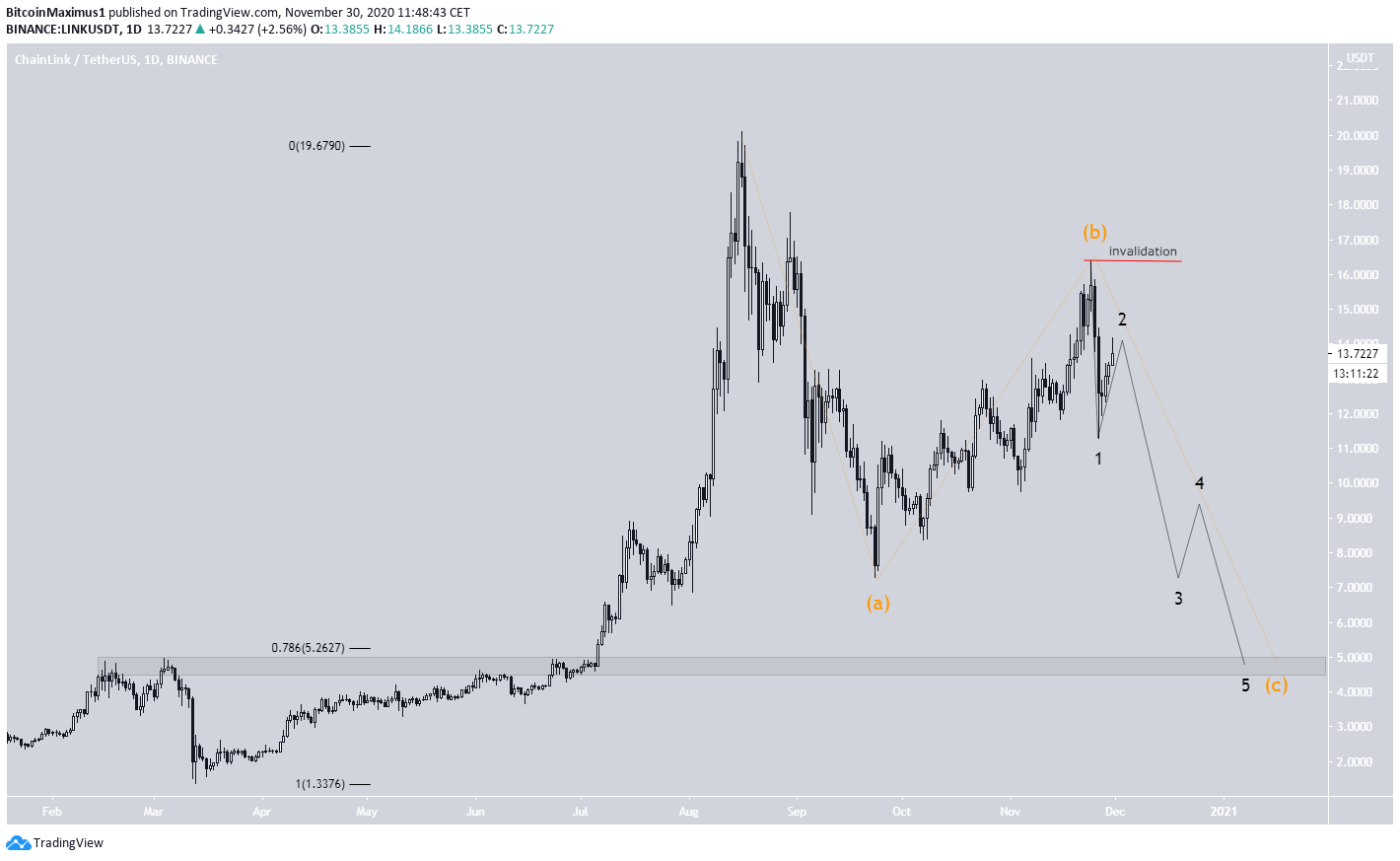

Measuring from the $20.11 high reached on Aug. 16, LINK seems to be trading in the C wave of an A-B-C corrective structure (shown in orange below). The sub-wave count is shown in black.

If the count is accurate, LINK is nearing the completion of its second sub-wave, after which a sharp drop will likely follow. In the most bearish scenario, the entire downward move would take LINK back to the range of $5-$5.26.

An increase above the B wave high of $16.39 (red line) would invalidate this particular wave count.

Conclusion

LINK is trading at a crucial resistance level, which is expected to reject the price and initiate a downward move.

Successfully reclaiming the $14 area would put the bearish outlook in doubt.

For BeInCrypto’s latest Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

The post Chainlink (LINK) Falls Putting Bullish Structure In Doubt appeared first on BeInCrypto.