Today, 85% of cryptocurrencies are in negative territory, and among these, DeFi tokens are decreasing significantly.

Among the big ones, only Bitcoin is moving above parity. Out of the top 20, only LEO token (20th position) has a positive balance in the 24 hours.

Even on a weekly basis, scrolling through the ranking, LEO together with Bitcoin gain over 2%: they are the only ones to have a positive weekly balance.

When comparing them with the other two of the first three, Ethereum has been losing more than 9% since last Friday. Same fate for XRP.

Bitcoin’s dominance continues to grow and has risen to over 63% in recent hours, the highest level since July.

Capitalisation remains at the levels of yesterday: under $390 billion. Bitcoin, with a market cap above $245 billion, is maintaining the highest levels of the last two years in terms of total capitalization.

Overall volumes remain significant and well sustained above $130 billion. Analyzing the actual trades, those of the main exchanges during the day, Bitcoin continues to maintain a volume value above $2.5 billion as it did yesterday.

Ethereum, instead, returns to trade just under 800 million dollars. This indicates that traders in recent days are particularly active and prefer to continue to pay attention to Bitcoin rather than the rest of the industry.

Among the few signs above parity is ABBC Coin (ABBC), which has risen by 5% even though it has been under attack from speculation for several days now, which causes the token prices to fly and fall on alternate days.

Dash, among the few climbing, scores a performance of +2%.

DeFi tokens decreasing

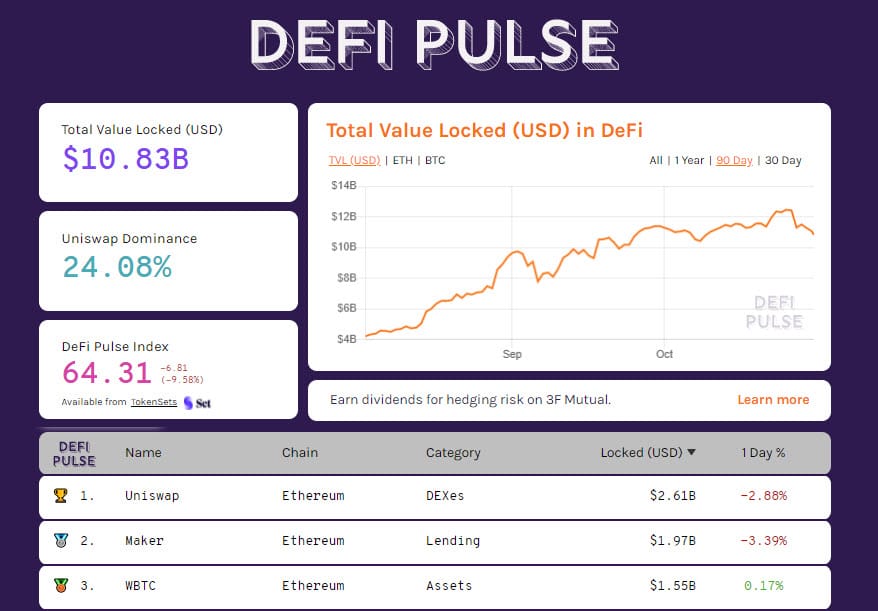

On the other hand, decisive declines for the entire DeFi ecosystem. The worst DeFi tokens include Ampleforth (AMPL), Synthetix Network (SNX), Yearn Finance (YFI), Ren, Uniswap (UNI), Band Protocol (BAND), with declines of over 15%.

This particular phase of weakness, which comes after weeks of non-stop climbs, can also be seen on the total value locked in DeFi protocols, with TVL falling below $11 billion for the first time after three weeks.

Bitcoin (BTC)

Bitcoin in the last few hours continues to swing above the psychological threshold of $13,000. This threshold was also tested yesterday, with strong defence from the purchases that are honourably defending the psychological level of $13,000. The weekend will be important to understand whether the $13,000 psychological support will also confirm the technical aspect.

A possible break down could also cause a movement that would not find particular support until $12,300. Therefore it is necessary during the upcoming weekend not to create particular phases of tension.

A recovery above $13,650, levels that in these hours are seeing increases in position by operators in options, could give a boost to attack and exceed the maximums of Wednesday, which are also the maximums of the year.

Ethereum (ETH)

Ethereum is suffering from the lack of hold of the $390 support that is pushing ETH to test the next support in the $365-370 area.

Any failure to hold this support would open the way to dangerously test the dynamic support that has supported the upward trend of the last 7 months, which passes in the $345 area.

The post Decrease for DeFi tokens: drops of over 15% appeared first on The Cryptonomist.