Quick take:

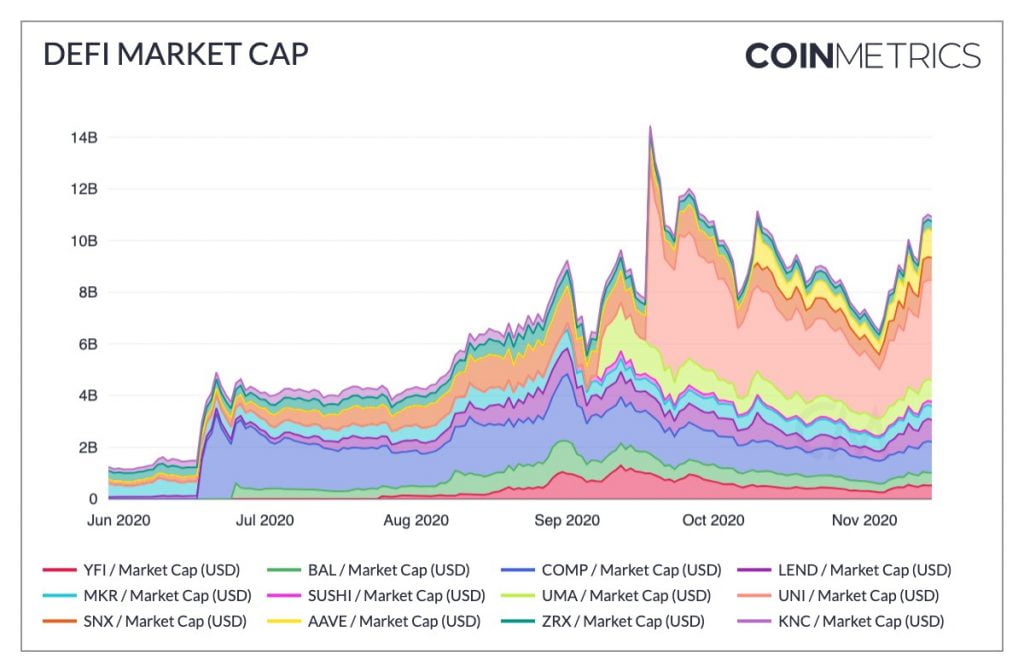

- According to Coinmetrics, the combined market cap of popular DeFi tokens has increased with Bitcoin’s recent surge

- The total value locked in DeFi is still above $13 Billion

- The total value locked in UniSwap has exhibited a sharp decline since it ended its token rewards program

The DeFi realm of the crypto-verse is once again showing signs of life. According to a report by the team at CoinMetrics, the combined market cap of popular DeFi tokens has seen a turn around following the recent market surge by Bitcoin and Ethereum.

…DeFi market cap has started to turn back around. After reaching a local low on November 4th, DeFi market cap has returned back to late September levels following a surge from BTC and ETH. If BTC and ETH continue to rise, DeFi could be a big benefactor.

The increased value in the DeFi market cap can also be visualized via the following chart, also from the report by the team at Coinmetrics.

Uniswap Experiences a Drop in Total Value Locked

To note is that the resurgence of DeFi tokens has occurred as the total value locked in UniSwap, experienced a significant drop since the protocol halted its token rewards program two days ago. According to the team at DappRadar, the total value locked has dropped by 45% since its all-time high of $3.3 Billion. The latter value was experienced three days ago.

The team at DappRadar also highlighted a significant drop in Uniswap’s liquidity as explained below.

Uniswap’s liquidity plunges 40% after the decentralized exchange ended its token rewards program on Monday afternoon. Uniswap’s #TVL is down a total of 45% since having an all-time high of $3.3B just 3 days ago. It now sits at $1.76B.

At the time of writing, the total value locked on Uniswap has further dropped to $1.33 Billion partly due to both Bitcoin and Ethereum suffering significant losses after today’s massive crypto market correction.