Developer activity in the cryptocurrency sector is massively declining

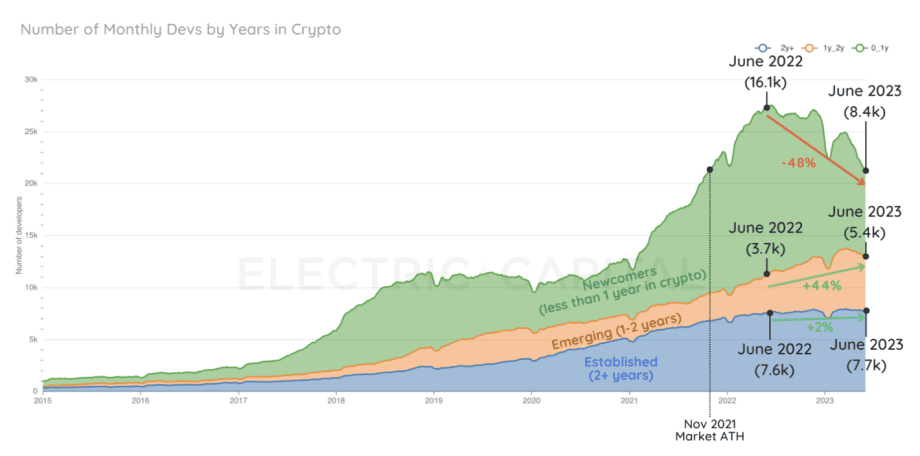

3 min readIf you look at the Bitcoin course alone, you might think that the bear market is almost over. However, the remarkable annual rally may be deceptive, as the number of active developers in the crypto sector has fallen by 22 percent year-on-year. The current one shows that Electric Capital report. The semi-annual analysis of the venture firm reveals a drop from 27,200 to 21,300 active crypto programmers within a year.

Developer activity is massively declining

Since May 2022, there has also been a clear decline in new crypto developers, according to the report. The number of newcomers fell from 5,900 to 2,900 developers. One reason for this could be the newly emerged AI hype, which is increasingly attracting talented programmers. A survey conducted by the US bank JPMorgan in February also confirms that artificial intelligence could overtake crypto this year. According to this, 53 percent of the institutional investors surveyed found that AI was the most important technology of the next few years – well ahead of the blockchain, for which only 12 percent of those surveyed spoke out.

“Bearmarket Builders” remain

The crypto market has also been in a bear market since May 2022, which historically has always resulted in exits, according to Electric Capital. In view of past cycles, however, the current decline is not unusual. In general, the activity of crypto programmers can be measured via “commits” in open source management systems such as GitHub. Accordingly, one can determine since when and how often a developer has been active for a specific network.

The report shows that inexperienced developers in particular are currently leaving the crypto sector, while the “old hands” continue to build diligently. According to this, programmers who have more than 12 months of experience in the crypto sector make up a good 80 percent of the total commits measured. For this reason, too, the general decline in activity should not be interpreted too negatively. On the contrary: among this group there was even an increase of 16 percent compared to the previous year. So, those who have been there for a longer period of time seem to remain loyal to the crypto sector, despite the turbulence of the bear market.

These projects are the fastest growing

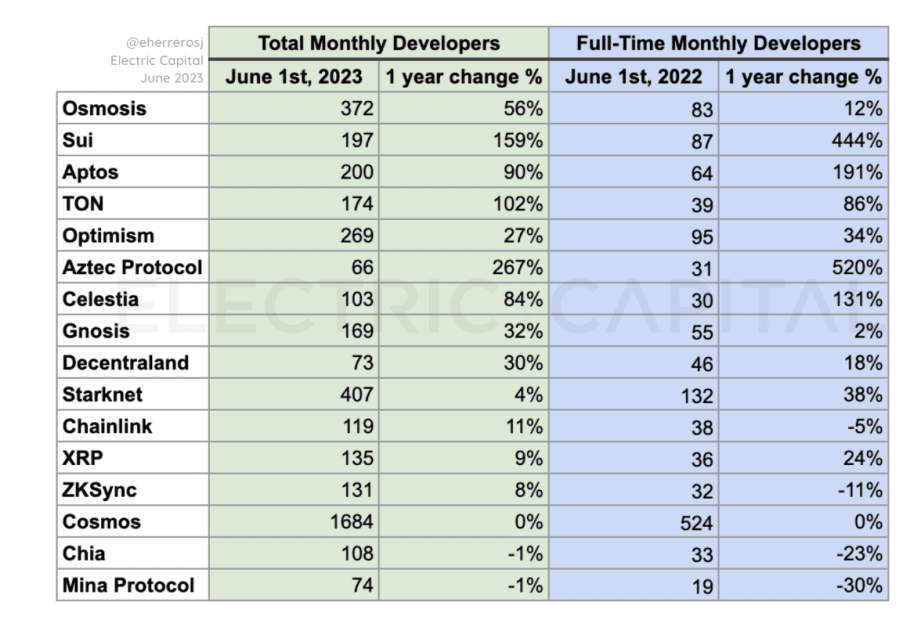

A look at specific projects in the sector shows that new Layer 1 and Layer 2 networks in particular are growing strongly. Sui, Aptos, Celestia and Aztec Protocol stand out here.

However, Ethereum remains the undisputed number one in many metrics. The Layer 1 network is still the first port of call for 16 percent of newcomers. Ethereum also has by far the most developers since launch, followed by Polkadot, Cosmos and Solana. Of course, it should be borne in mind that the blockchain is also a few years older. Along with this dominance has come the popularity of projects built on the Ethereum Virtual Machine (EVM), including Avalanche (AVAX), Polygon (MATIC), and the BNB-Chain (BNB). Developers programming on Ethereum can switch between these platforms relatively easily, which has allowed them to grow rapidly in recent years.

Finally, the general trend can also be followed with regard to the last three months, e.g. via the weekly increase or decrease in commits artemis. Here, too, a strong decline can be seen, with some projects even well over 25 percent. Ethereum, Polkadot, Cosmos, Solana and Bitcoin emerge as the blockchains with the highest activity.