Uniswap (UNI) has bounced at the $17.50 support area and created a higher low.

PancakeSwap (CAKE) returned near its listing price at $9.44, before bouncing.

0x (ZRX) has been increasing since May 24, but is still facing resistance at $1.28.

UNI

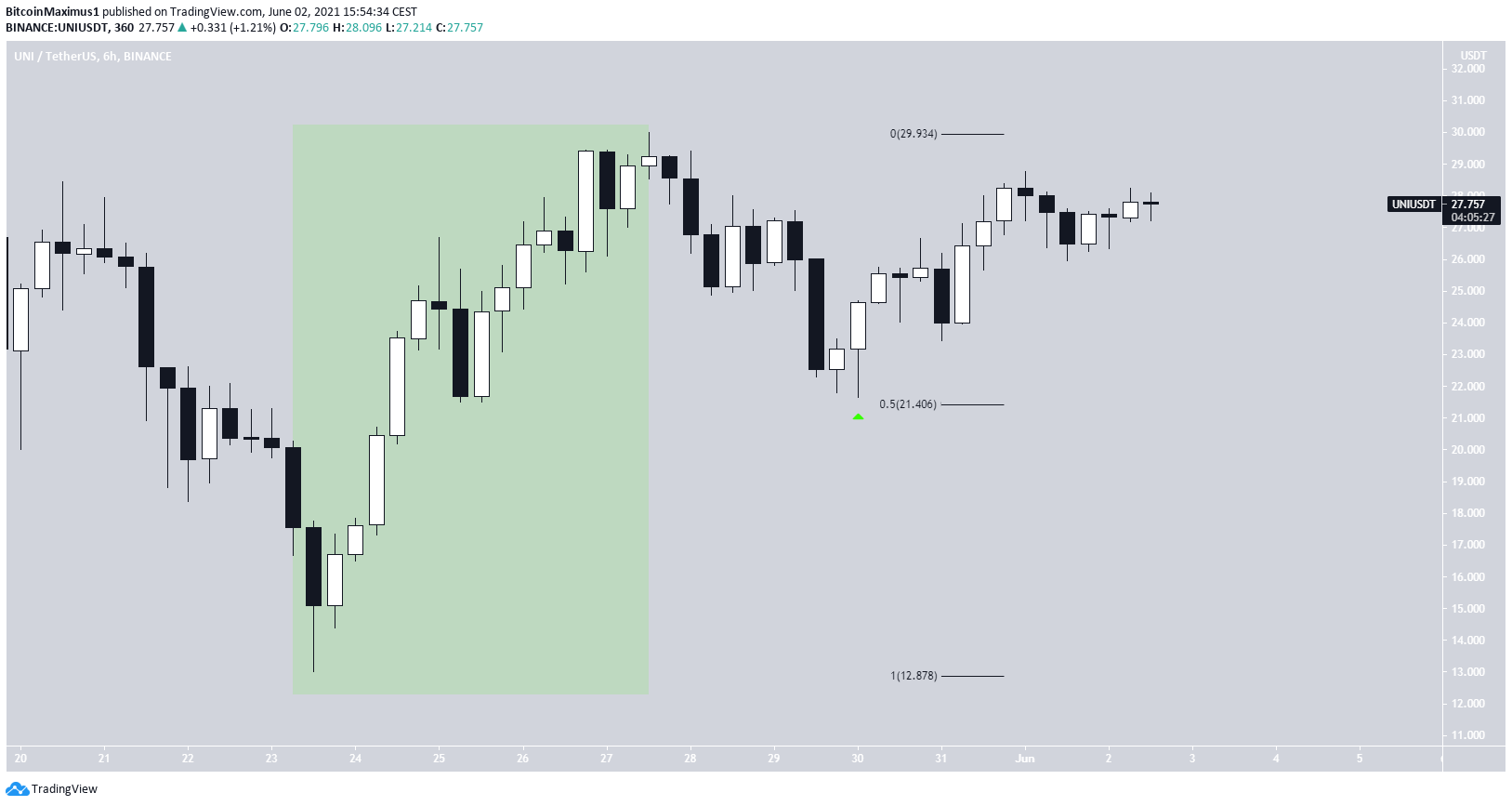

UNI has been moving upwards since May 23, when it reached a low of $13. It created a bullish engulfing candlestick the next day and proceeded to reach a high of $30 three days later.

While it was rejected by the 0.5 Fib retracement resistance at $29, it created a higher low and is currently making another breakout attempt.

Technical indicators are bullish. The MACD has given a bullish reversal signal and the Stochastic oscillator has just made a bullish cross. In addition, the RSI is close to moving above the 50 line.

However, UNI has to break out above the $29 resistance area in order to confirm its reversal.

The shorter-term six-hour chart supports this possibility. The movement since the lows looks impulsive (highlighted in green) and the token has made a higher low right at the 0.5 Fib retracement support level.

This supports the possibility that UNI will eventually break out above the $29 resistance area.

Highlights

- There is support at $16.50.

- Technical indicators in the daily time-frame are bullish.

CAKE

CAKE has been moving downwards since April 30, when it reached an all-time high price of $44.27. The decrease was very sharp, resulting in a low of $9.44 being reached on May 23.

This took the token closer to its listing price, validating the $9.50 area as support once more. It indicated a decrease of 80%, in only 23 days. However, it created a long lower wick and initiated a bounce afterwards.

Technical indicators are showing some bullish signs, but have not confirmed the reversal yet. A bullish cross in the Stochastic oscillator (green) and an RSI movement above 50 would indicate that the trend is bullish.

While CAKE is in the process of moving above the minor resistance area of $20, there are numerous resistances left to clear, before the trend can be considered bullish.

The most crucial ones are found at $26.8 and $31, respectively, created by the 0.5-0.618 Fib retracement resistance levels.

Highlights

- There is support at $9.50.

- There is resistance at $26.8 and $31.

ZRX

ZRX has been increasing since initiating a bounce, on May 24. It created a higher low, on May 30.

Similarly to CAKE, technical indicators are showing bullish signs. However, they have yet to confirm the bullish trend reversal. A bullish cross in the Stochastic oscillator (green circle) and an RSI movement above 50 would indicate that the trend is bullish.

Despite this, there is an important resistance area at $1.28. The same area previously acted as support. Until ZRX manages to move above it, we cannot consider the trend bullish.

In addition to this, an increase above the $1.246 low (red line) would confirm that the downward movement is not a bearish impulse, rather it is a correction, which might be complete.

Highlights

- There is resistance at $1.28.

- Technical indicators are attempting to turn bullish.

For BeInCrypto’s previous BTC (BTC) analysis, click here.

The post DEX Tokens Attempt to Create Bullish Structures With Strong Bounces appeared first on BeInCrypto.