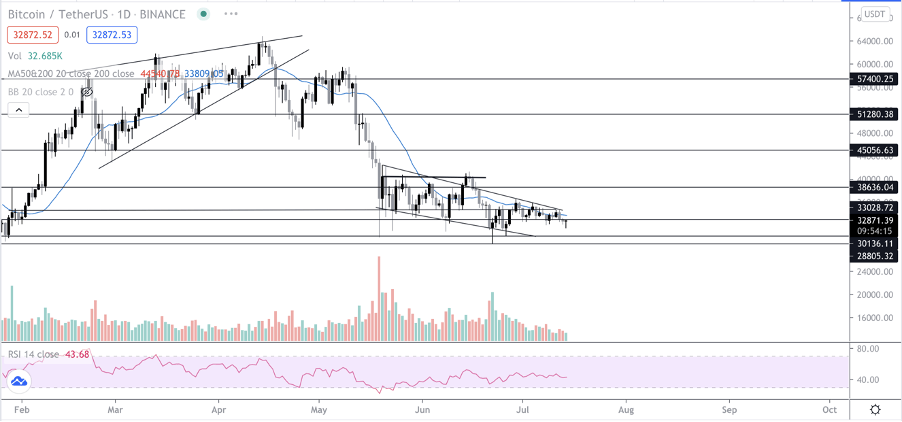

The largest cryptocurrency by market cap continued its downtrend this week, fueled by both poor technicals and increasingly neutral sentiment for the crypto market as a whole.

BTC price continued to fall during the Wednesday session as traders anticipate a bearish few days ahead. The price range continues to be stuck in the $30,000 and $35,000 range.

CryptoQuant, a popular on-chain data analysis tool for BTC, reported that “Low Demand at Support” continues to exist and would spell further downside for digital gold.

“If stablecoin inflows continue to be low, it is very likely that the price will test the lower supports of the range,” the team wrote in a post.

On the technical side, “IncomeSharks,” an anonymous yet popular cryptocurrency trader, suggested that there might be more downside to the price in the coming days as many indicators look bearish.

$BTC – 4h time frame still showing us at support. But OBV already broke down, support not holding up well with volume, and best chance of a stronger support is below. This is where I'll look to buy back with larger bags. pic.twitter.com/FX8nondajL

— IncomeSharks (@IncomeSharks) July 14, 2021

Several large-cap altcoins like Dogecoin (-6.5%), Polkadot (-6.3%), and Solana (-5.9%) took price hits as BTC fell to the $30,000 price zone last night. The move, as such, coincided with lower liquidity on popular crypto exchanges,

So what’s next for BTC?

BTC price seems to be moving in the downward channel with the support of the channel being in the $30,200 range. However, currently, BTC is holding below the weekly support of $32,800.

A continued sell-off is possible and it is very likely that the price might revisit last night’s $30,000 range.

The Bollinger Bands (a popular price indicator used by the traders to determine the market trend) seem to be squeezing tighter onto the price which indicates a big move is certain, but the direction is yet to be determined as the market continues to trade in a range (BTC has been hovering between $30,000-$35,000 since the past few weeks).

Volume in the past few days also seems to have become “flat” indicating a lack of buyer interest.

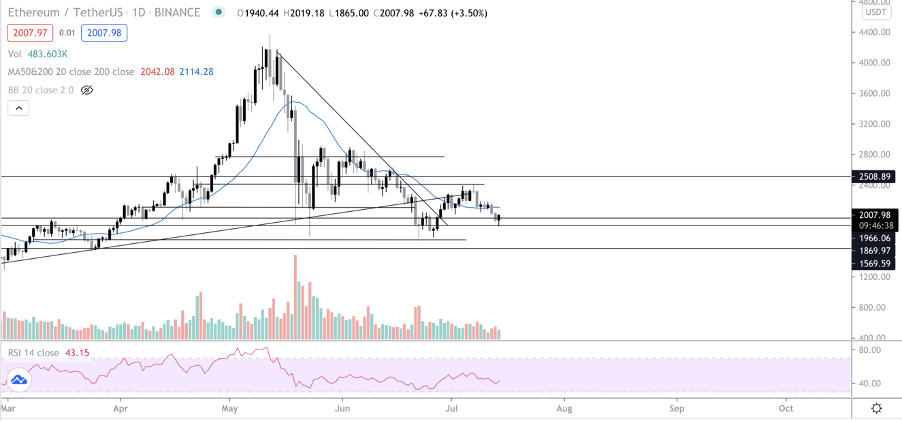

What’s next for ETH?

ETH also turned bearish as the price closed below the 20MA and now is testing the $1,850 support. As of now, the support looks strong and there is a favorable chance that it should hold these levels.

The volume on ETH also seems to be “flat” now showing a lack of buyer interest at these levels

On the shorter time frame, $2,060 is a likely rejection area as the 4hr 20MA might act as resistance. However, a close above $1,962 should be a good daily price close for the world’s second-largest cryptocurrency.

The post Doge, XRP, ADA take price hit while BTC technicals show lack of buyer interest appeared first on CryptoSlate.