The ECB is getting ready for the first cut in key interest rates

2 min readTwo leading representatives of the European Central Bank have given the green light for a reduction in key interest rates in the euro area. This should come, as expected, in June.

The first to speak is the German ECB director Isabel Schnabel in an interview with the Tagesschau. For a long time she was considered an advocate of a restrictive high-interest rate policy to combat the crisis. Now she described a rate cut in June as likely.

ECB: Isabel Schnabel believes in the launch in June

If inflation returns to the targeted two percent, the ECB will probably cut interest rates, she said. This should adjust market prices for loans in advance, as the markets are expecting this interest rate cut.

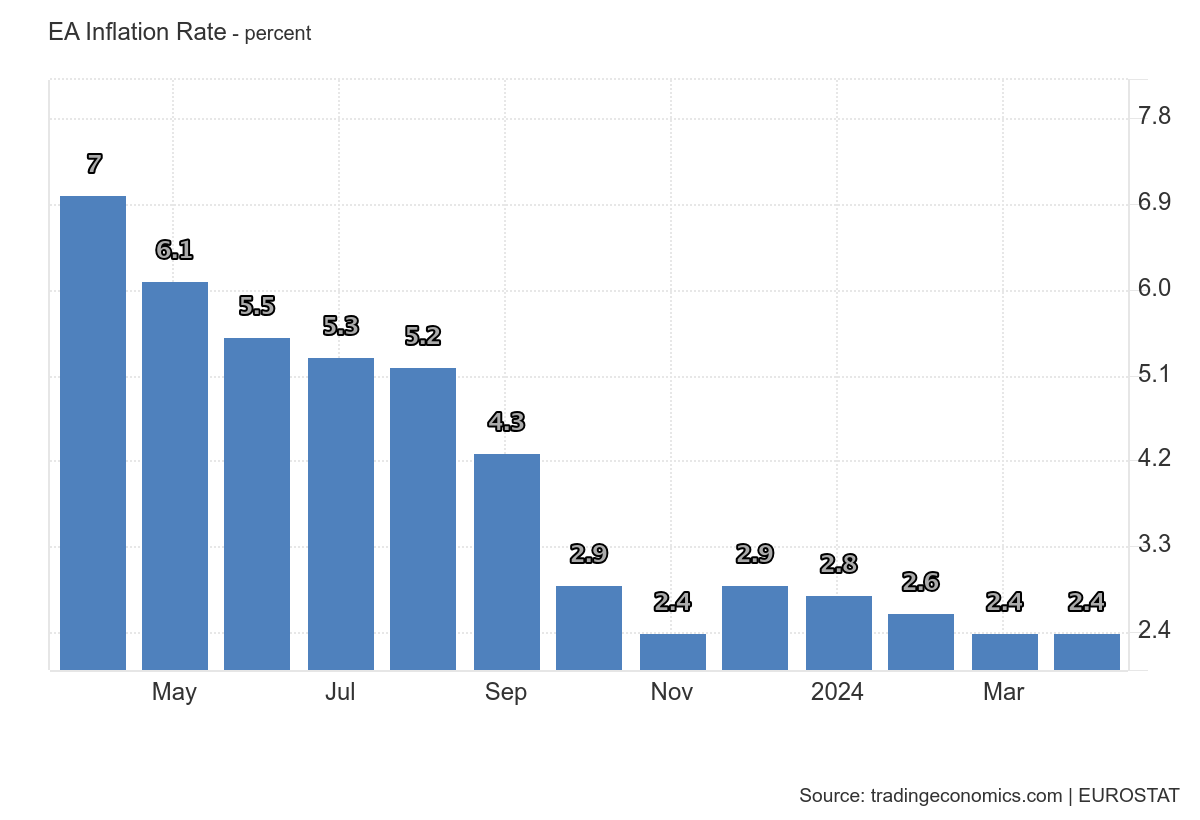

But she still sees inflation as stubborn, so the ECB wants to continue to monitor developments closely. Schnabel warned against moving too quickly in order not to lower interest rates too quickly.

It estimates the risk of a wage-price spiral as low

She hopes that it will continue to be possible to curb price increases without leading to a recession. However, she admitted that there was stagnation last year. Schnabel sees only a small risk of a wage-price spiral occurring; she does not see the current situation as comparable to that of the 1970s.

In any case, Schnabel is optimistic that inflation will fall back to 2 percent in 2025.

The chief economist also gives the green light

The chief economist of the European Central Bank, Philip Lane, echoed the same sentiment. In an interview with the Financial Times, he confirmed the path outlined by Schnabel. Lane rejected all those who expect the ECB to take a surprising step.

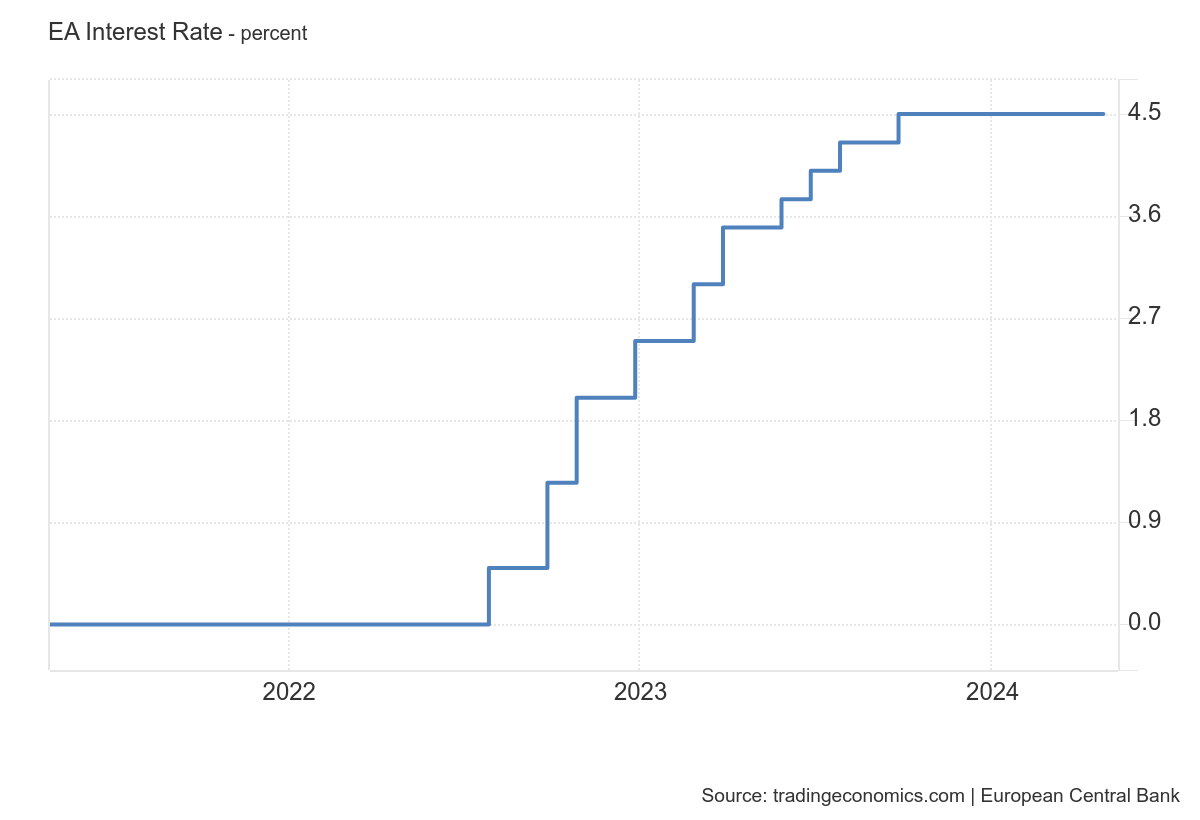

In any case, the markets are assuming that the ECB will lower the key interest rates by 0.25 percent at its next meeting on June 6. That would be a first small step on the way to normalization. The markets would be satisfied without a dramatic interest rate cut being made straight away. This could devalue the euro and fuel inflation again. The monetary authorities want to avoid that at all costs. Currently, interest rates are at a 22-year high of 4.5%.

The crypto market will certainly be happy. Lower interest rates mean more risk-taking and thus more capital will flow into cryptocurrencies.