ETH, XRP, ETC – Will They Outperform BTC?

3 min readETH (ETH) is potentially completing a fourth wave pullback and has created a bullish short-term pattern.

XRP (XRP) has broken out from a long-term descending resistance line but was rejected by the 3,700 satoshi resistance area.

ETH Classic (ETC) is trading above the ₿0.00125 horizontal support area.

This article will deal with the BTC pairs. For the USD analysis, click here.

ETH

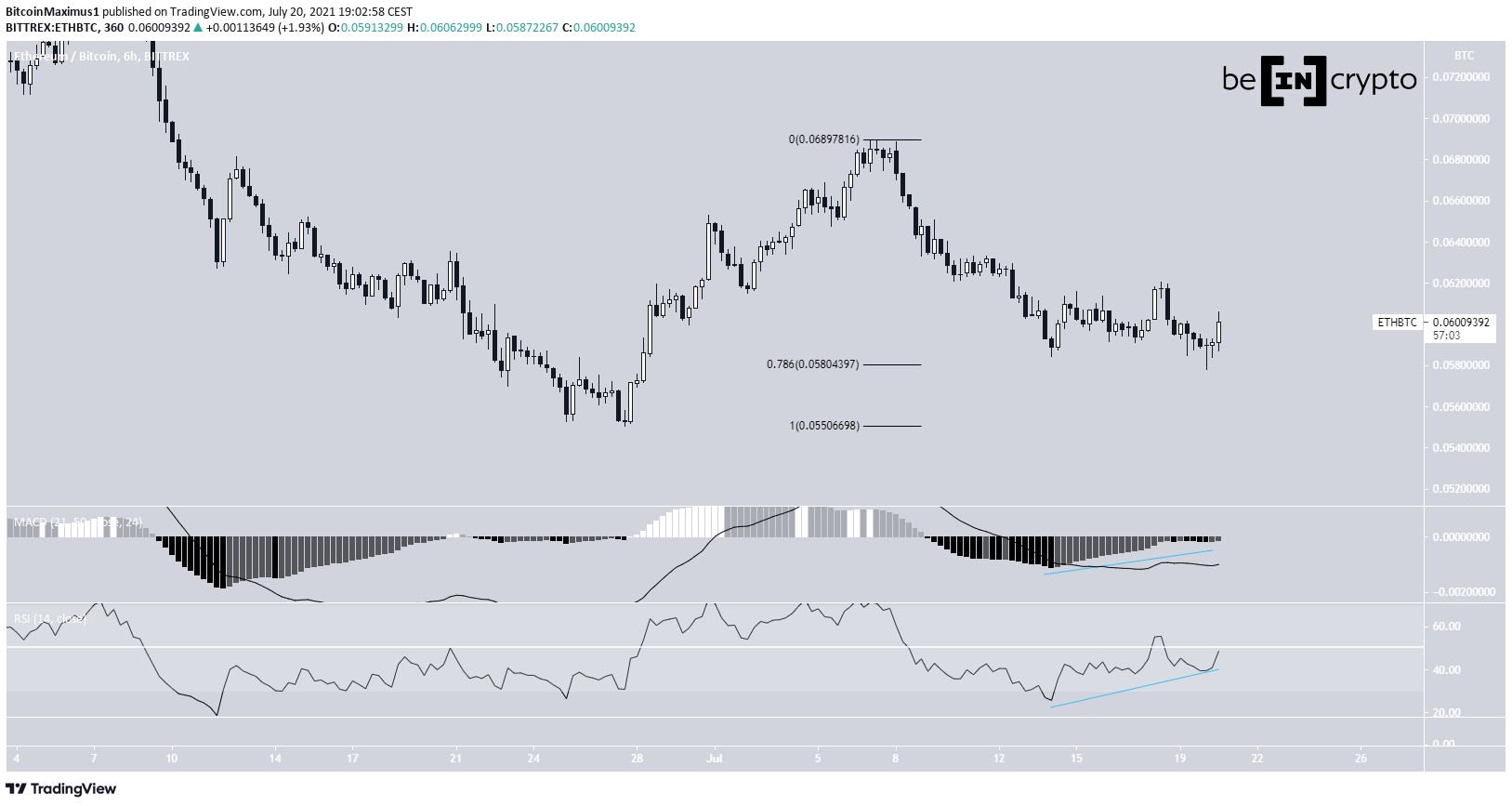

ETH has been moving downwards since July 7. On July 13 and 20, it bounced twice at the 0.786 Fib retracement support level when measuring the most recent portion of the increase at ₿0.058.

It potentially created a double bottom pattern at the support area. The pattern was combined with bullish divergence in both the RSI & MACD. This is a sign that the token is expected to move upwards, towards the ₿0.069 July highs, and potentially break out.

The daily chart shows that ETH is potentially completing a fourth wave pullback. If successful, the two potential targets for the top of wave five are at ₿0.094 and ₿0.117. A Fib projection on waves 1-3 is used in order to arrive at the targets.

Unlike the six-hour time-frame, technical indicators are relatively neutral. The MACD is close to the 0 line while the RSI is close to the 50 line.

Highlights

- ETH has created a short-term double bottom.

- It is completing a fourth wave pullback.

XRP

XRP had been following a descending resistance line since Sept. 2018. After three unsuccessful attempts, it managed to break out on April 2021. However, the upward movement could not be sustained since XRP was rejected by the 3,700 satoshi horizontal resistance area. This was the third rejection from this area since Oct. 2019.

Technical indicators in the weekly time-frame are neutral. The MACD is at the 0 line and the RSI is at the 50 line. While the Stochastic oscillator has made a bullish cross, it has begun to move downwards.

Despite the breakout from the resistance line, the long-term trend cannot be considered bullish until XRP manages to reclaim the 3700 area.

The daily chart shows that XRP has fallen below the 1,880 satoshi area, which is now expected to act as resistance. While it initially seemed to reclaim it, the token fell below the area once more in the beginning of July.

The next closest support is at 1,330 satoshis, the 0.786 Fib retracement support level.

Technical indicators in the daily time-frame are decisively bearish. This is especially evident by the bearish cross in the Stochastic oscillator (red icon).

As a result, the most likely scenario has XRP dropping to the 1,330 satoshi support area.

Highlights

- XRP has broken out from a descending resistance line.

- It is facing long-term resistance at 3,700 satoshis.

ETC

ETC has been decreasing since reaching a high of ₿0.0031 on May 6.

Despite the drop, it is still trading above the ₿0.00125 support area. Staying above this level is crucial for the continuation of the upward move, since the same area acted as resistance in Jan. 2020. Therefore, the current drop resembles a bullish re-test.

Technical indicators are relatively neutral. The MACD is positive and the RSI is above 50, but both are decreasing. Similarly, the Stochastic oscillator has made a bullish cross but is falling.

The closest resistance area is at ₿0.0028.

The shorter-term six-hour chart shows that ETC has already broken out from a descending resistance line. It is currently trying to find support above ₿0.0013. The RSI has generated bullish divergence and the MACD is moving upwards.

Therefore, an upward movement seems likely.

The closest resistance is at ₿0.00207.

Highlights

- ETC is trading above the ₿0.00125 support area.

- It has broken out from a descending resistance line.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post ETH, XRP, ETC – Will They Outperform BTC? appeared first on BeInCrypto.