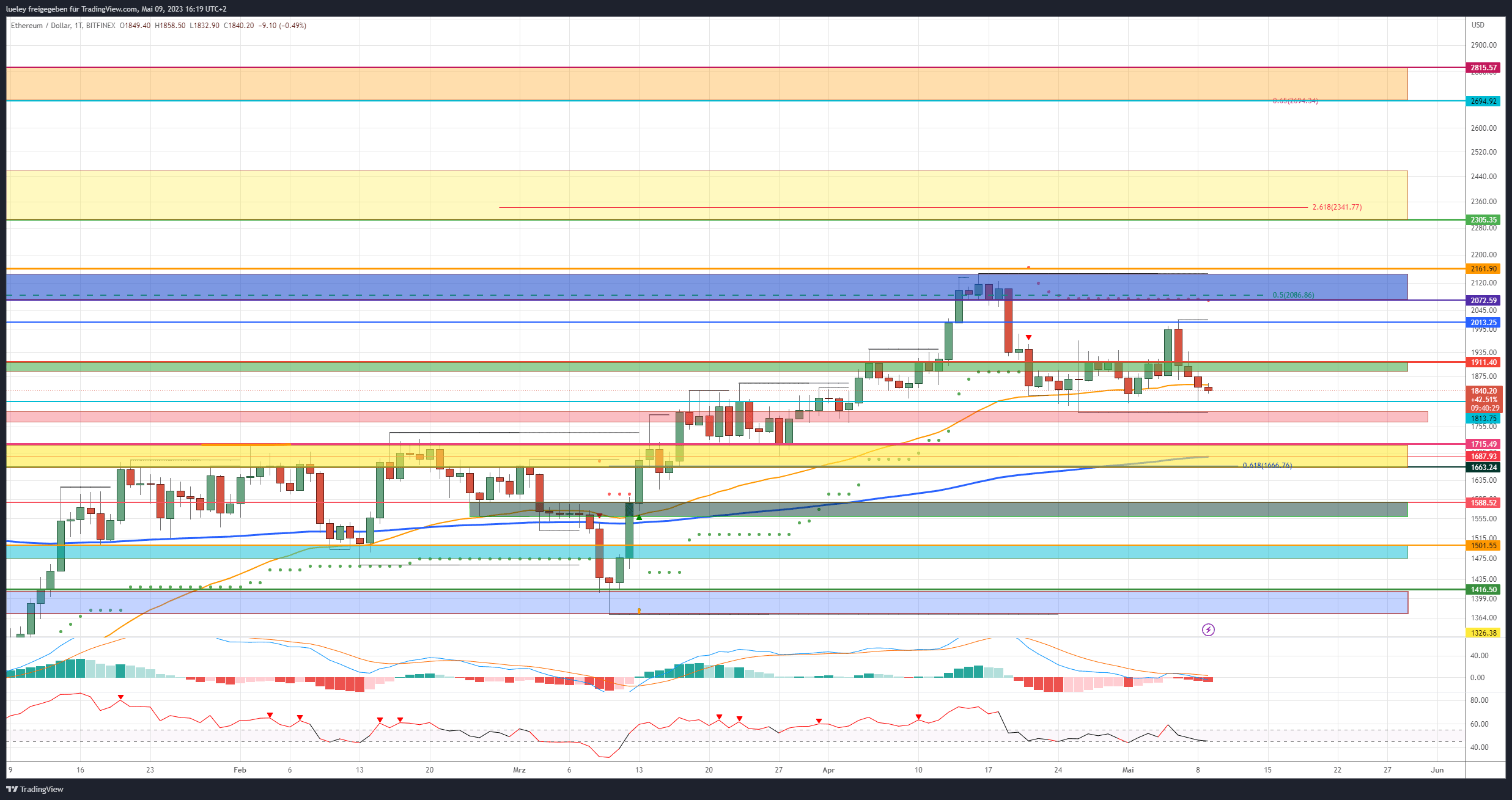

Despite all the concerns, the Shanghai upgrade did not lead to the expected sell-off of staked Ethereum tokens. Much more increased the net staking balance since then even by 56,000 Ether. The price of Ethereum (ETH) has nevertheless consolidated by a good eight percentage points in the last 4 trading days to currently just under 1,850 US dollars. Once again, ether price failed to recapture the resistance at 2,013 USD and subsequently slipped below the 50-day moving average (EMA50) (orange). In addition to a correction in the US stock index S&P500, the recovery of the US dollar index in particular caused headwinds on the crypto market.

The price of the key crypto currency Bitcoin (BTC) also corrected back to the support area at 27,300 US dollars at the start of the week. As a result, Ethereum price also declined, hitting the support at 1,813 USD. Only when the ether price then undercuts the lower edge of the red support zone at 1,764 US dollars at the daily closing price would an expansion of the correction in the direction of the breakout level at 1,715 US dollars be planned. For their part, however, the buy side would have to try to dynamically recapture the resist at 1,911 USD in order to initiate another attempt to climb towards last week’s high. The forthcoming US inflation data in the next two trading days could give a preliminary decision. An additional risk of a sell-off is currently looming from massive inflows to various crypto exchanges. According to Whale Alert around 60,000 ether coins were sent to Binance and Coinbase in the last 24 hours of trading.

Bullish price targets for the coming trading weeks

Bullish price targets: 1,885 USD/1,911 USD, 2.013 USD, 2,072 USD, 2,147/2,162USD, 2,305 USD/2,458 USD 2,694 USD/2,815 USD

The price weakness of the past few trading days has left the first scratches on the bull horns. Only a jump back above the EMA50 in the direction of the green resist zone would be the first sign of life for the bulls. If Ethereum then breaks the top line at 1,911 USD, the bulls are likely to try again to target 2,013 USD. Here it should again be difficult for the buyer camp. Another rebound is not unlikely.

A retest of the broken support at 2,072 US dollars should only be planned when Ethereum can again overcome the important chart mark at 2,013 US dollars. A preliminary decision is made at this make-or-break level. In addition to the horizontal resistance level, you can also find the supertrend in the daily chart here. If a recapture of this price level succeeds, the bulls could once again focus on the high for the year at 2,146 US dollars.

However, the distinctive low of January 24, 2022 at 2,162 USD must then also be broken through in order to generate further upside potential in the direction of the medium-term target zone between 2,305 and 2,458 USD. This is where the tear-off edge of the subsequent sell-off from May 2022 runs. In this area, renewed profit-taking is to be planned.

The maximum parent price target for Ethereum remains at 2,694 USD. In addition to the important old support mark from May of the previous year, the golden pocket of the complete price movement, starting from the all-time high, runs here.

Bearish price targets for the coming trading weeks

Bearish price targets: 1,813USD 1,791/1764 USD, 1,715 USD, 1,687/1,663 USD, 1,588 USD, 1,501/1,474 USD, 1,416/1,371 USD

The bears are gaining momentum and last week refrained from another break above the strong resistance at 2,013 USD. So far, however, the sell-side has failed to break the key support level at 1,813 USD.

If the ether price is capped below the EMA50, a new sell-off attempt can be expected at any time. Then the area around the previous month’s lows between 1,791 and 1,764 USD would come into focus. A directional decision is to be expected here.

If Ethereum’s daily close base slips below this support zone, a correction extension to the yellow support zone between 1,715 and 1,663 USD is likely.

There are several strong supports here. Above all, the golden pocket of the last upward movement and the EMA200 (blue) in the daily chart. In addition, this area acted as the springboard for the rise to the year-to-date high in March. From a technical point of view, this zone represents the optimal short-term correction target. If, contrary to expectations, this support area is abandoned, the chart picture will become significantly clouded. Subsequent deliveries up to the gray support area at 1,588 US dollars are likely to follow. In the medium term, a fall back to 1,501 USD and below would also be conceivable.

Ethereum: A look at the indicators

Due to the correction in the last few days, the RSI slipped again to the lower edge of the neutral zone. If the level falls below 45, a fresh sell-signal is activated on a daily basis. The MACD indicator already shows a fresh short signal, which would strengthen if it falls below the 0 line.

Although both indicators continue to show buy signals on a weekly basis, the RSI and the MACD are increasingly trending south. The RSI could slip back into the neutral zone on a weak weekly close on Sunday, adding to the bearish bias.