Five Biggest Altcoin Gainer Showcase — July 26 – Aug 1

3 min readTable of Contents

BeInCrypto breaks down the five biggest altcoin movers and shakers from the previous week. Will their momentum continue?

The five altcoins that increased the most last week were:

- Quant (QNT): 67.39%

- THORChain (RUNE): 53.45%

- Siacoin (SC): 31.25%

- Ankr (ANKR): 30.82%

- Neo (NEO): 30.05%

QNT

QNT has been moving upwards at an accelerated rate since July 20. On Aug 2, it managed to reach a new all-time high price of $187.

The high was made just above the 2.61 external Fib retracement level when measuring the most recent portion of the drop.

However, the higher prices could not be sustained and QNT created a bearish candlestick with a long upper wick (red icon).

While there is weakness in time frames of six hours and lower, daily time frame signals are still bullish.

RUNE

RUNE has been decreasing underneath a descending resistance line since May 27. On July 20, it reached the $3.80 horizontal support area and bounced.

The bounce caused it to break out from the descending resistance line. Currently, RUNE is approaching the $7.25 horizontal resistance area.

Technical indicators in the daily time frame are still bullish. The RSI has moved above 50 and the Stochastic oscillator has made a bullish cross (green icon). This indicates that an eventual breakout is likely. However, a short-term rejection could occur prior to this.

The next resistance level is found at $10.30. THis target is the 0.618 Fib retracement resistance level.

SC

SC has been moving upwards since June 22. On July 20, it created a higher low and accelerated its rate of increase.

This caused a breakout above the $0.014 resistance area and led to a high of $0.02 on Aug 1.

However, SC failed to break out above the $0.02 resistance area, creating a long upper wick (red) instead.

Despite the rejection, technical indicators in the daily time frame are still bullish.

The $0.014 area is now expected to act as support.

ANKR

ANKR has been trading inside a descending parallel channel since March 18. Such channels often contain corrective movements.

On June 22, ANKR fell to a low of $0.047, touching the support line of the channel for the fifth time. It has been moving upwards since.

On July 27, it managed to move above the midline of the channel and the $0.078 horizontal resistance area. This area is now expected to act as support.

Technical indicators in the daily time frame are bullish.

If a breakout from the channel occurs, the next closest resistance area would likely be found at $0.155.

NEO

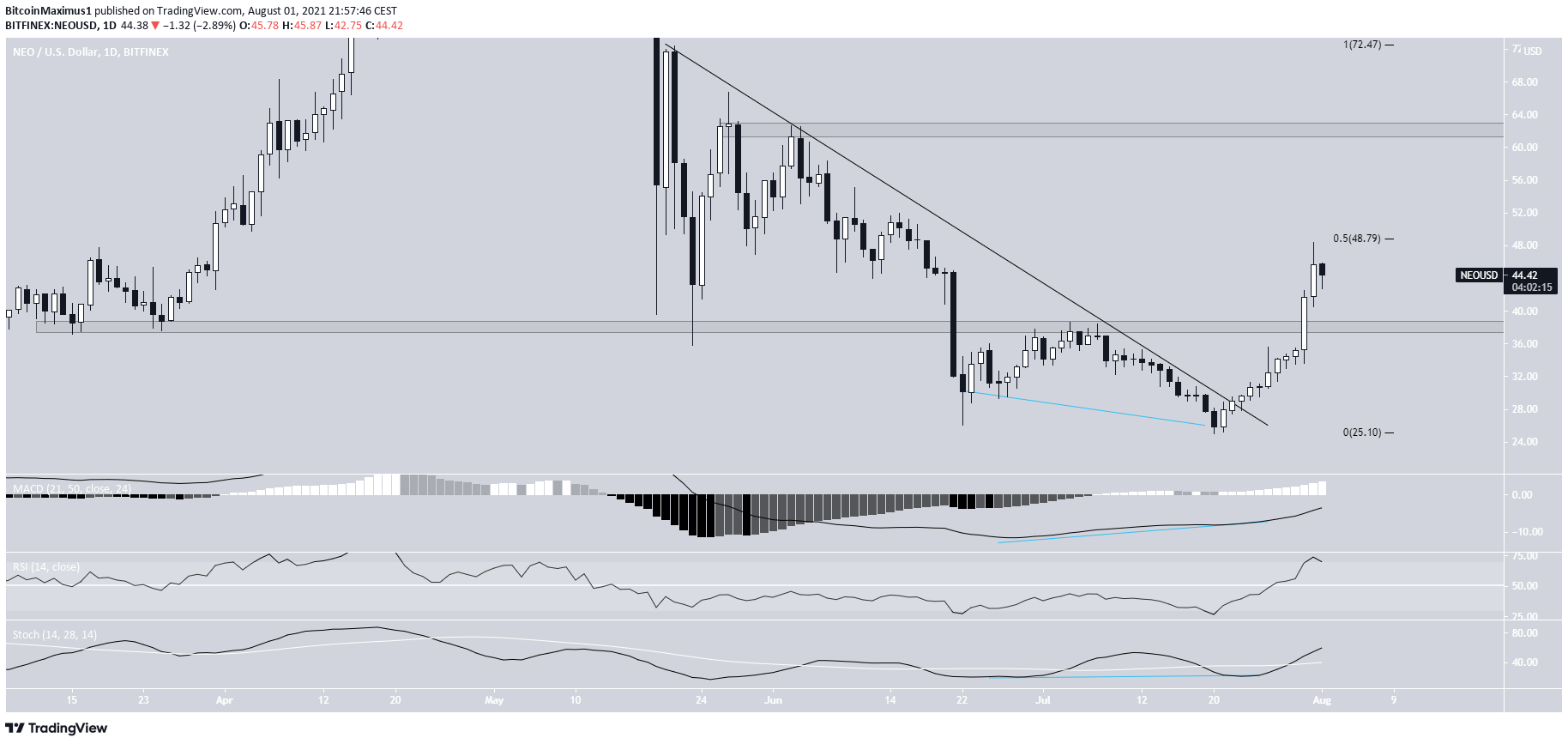

On June 22 and July 20, NEO created a double bottom pattern. The double bottom is often considered a bullish pattern and was also combined with bullish divergences in the MACD and Stochastic oscillator. The latter made a bullish cross shortly after.

After the creation of the pattern, NEO broke out from a descending resistance line and eventually moved above the $38 horizontal resistance area. The same area is now expected to act as support.

So far, NEO has reached a high of $48.45, right at the 0.5 Fib retracement resistance level. A move above this area could trigger a sharp increase toward $62.

Technical indicators in the daily time-frame are still bullish.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Five Biggest Altcoin Gainer Showcase — July 26 – Aug 1 appeared first on BeInCrypto.