Grayscale Investments just announced another gangbuster quarterly performance.

The company, in its third-quarter digital asset investment report, revealed that it attracted more than $1 billion to its coffers during the period. As usual, most of the capital, or 84%, originated from institutional investors, the lion’s share of which were hedge funds.

Of the $1.05 billion that flowed into Grayscale products, the average weekly investment into the firm’s Bitcoin Trust was $55.3 billion. Grayscale has become a behemoth and now oversees $5.9 billion in assets under management (AUM).

Hedge funds found more reasons to invest in Grayscale’s Ethereum Trust after it announced that it had just become an SEC reporting company. In doing so, the firm can offer investors shorter lock-up periods, which would give sophisticated traders like hedge funds access to greater liquidity.

Grayscale has surpassed its own quarterly performance, with the latest results representing the firm’s third straight record.

Year-to-date, Grayscale has seen inflows of more than $2.4 billion, which is more than twice as much as the cumulative amount it attracted in the six-year period leading up to 2019. The firm has momentum on its side. The Q3 breakdown was as follows:

Grayscale Ahead of the Pack

With the bitcoin price now perched above $11,000, some investors are finding more reasons to be bullish about the BTC price trajectory.

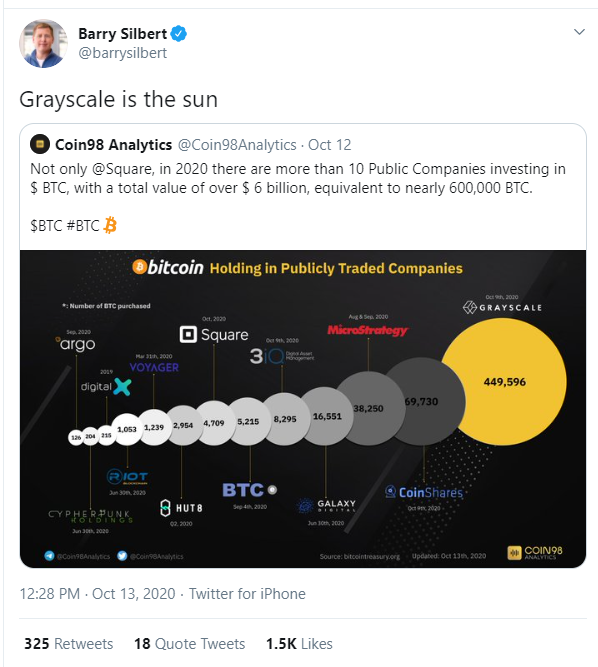

In addition to Grayscale, other publicly traded entities that have also been buying up bitcoin include MicroStrategy, Jack Dorsey’s Square, and others. Coin98 Analytics states that there are more than 10 listed companies with exposure to BTC of more than $6 billion, or 600,000 bitcoins.

Meanwhile, in recent days, asset management firm Stone Ridge, which oversees $10 billion in AUM, poured more than $100 million into bitcoin. On the retail investor side, former pro cyclist Lance Armstrong is seemingly dipping his toe into the space.

Grayscale raised $1 billion in Q3, which is their largest quarter ever.

Hard not to be bullish.

— Pomp

(@APompliano) October 14, 2020

Bullish Fundamentals

Indeed, as the bitcoin price manages to trade above $11,000 but falls short of the $12,000 handle, the fundamentals appear to be getting stronger.

Glassnode points out in a tweet that “accumulation has been on a constant upwards trend for months,” pointing out that 14% of the BTC supply is being held in what’s known as “accumulation addresses.” These represent “hodlers” who have yet to spend their bitcoin.

#Bitcoin accumulation has been on a constant upwards trend for months.

2.6M $BTC (14% of supply) are currently held in accumulation addresses.

Accumulation addresses are defined as addresses that have at least 2 incoming txs and have never spent BTC.https://t.co/VEt4a503ae pic.twitter.com/QhGqmxpv2S

— glassnode (@glassnode) October 14, 2020

Meanwhile, the Bitcoin hashrate in recent days attained a new all-time high. According to Arcane Research, the seven-day average hashrate has surpassed 140 EH/S.

That’s nearly 40% higher than where the hashrate hovered in early 2020. The coming weeks will show whether these bullish fundamentals spill over into the price through year-end, as some are predicting.

The post Grayscale Boasts Billion-Dollar Quarter, Hedge Funds Flock to BTC Trust appeared first on BeInCrypto.

(@APompliano)

(@APompliano)