Hedera Hashgraph (HBAR), Ankr (ANKR) and Chiliz (CHZ) are all trading inside long-term descending parallel channels.

HBAR and ANKR have already moved above the middle of their respective channels, while CHZ has yet to follow suit.

HBAR

HBAR has been trading inside a long-term descending parallel channel since March 15. Such channels usually contain corrective movements. It has validated both the support and resistance lines numerous times.

Most recently, it touched the support line on June 22 and began an upward movement.

The June 22 low also validated the $0.156 horizontal area as support. The token returned to this area once more on July 20 and began an upward movement afterwards.

On July 27, it finally moved above the middle of the channel, managing to reach a close of $0.197.

Technical indicators in the daily time-frame are also bullish. The upward movement was preceded by bullish divergence in both the RSI & MACD. In addition to this, the Stochastic oscillator has made a bullish cross (green icon) and the RSI has moved above 50.

This indicates that an upward movement towards the resistance line of the channel is the most likely scenario.

Highlights

- HBAR is trading inside a descending parallel channel.

- There is support at $0.165.

ANKR

ANKR has also been trading inside a descending parallel channel since March 19. It touched the support line of the channel five times, most recently on June 22. It has been moving upwards since.

On July 27, it managed to move and close above the middle of the channel.

Unlike in HBAR, there are no bullish divergences in place. However, technical indicators are still relatively bullish. The MACD and RSI are increasing, the latter having just crossed above 50. However, the Stochastic oscillator has yet to make a bullish cross.

The resistance line of the channel is at $0.11.

Highlights

- ANKR is trading inside a descending parallel channel.

- Technical indicators are relatively bullish.

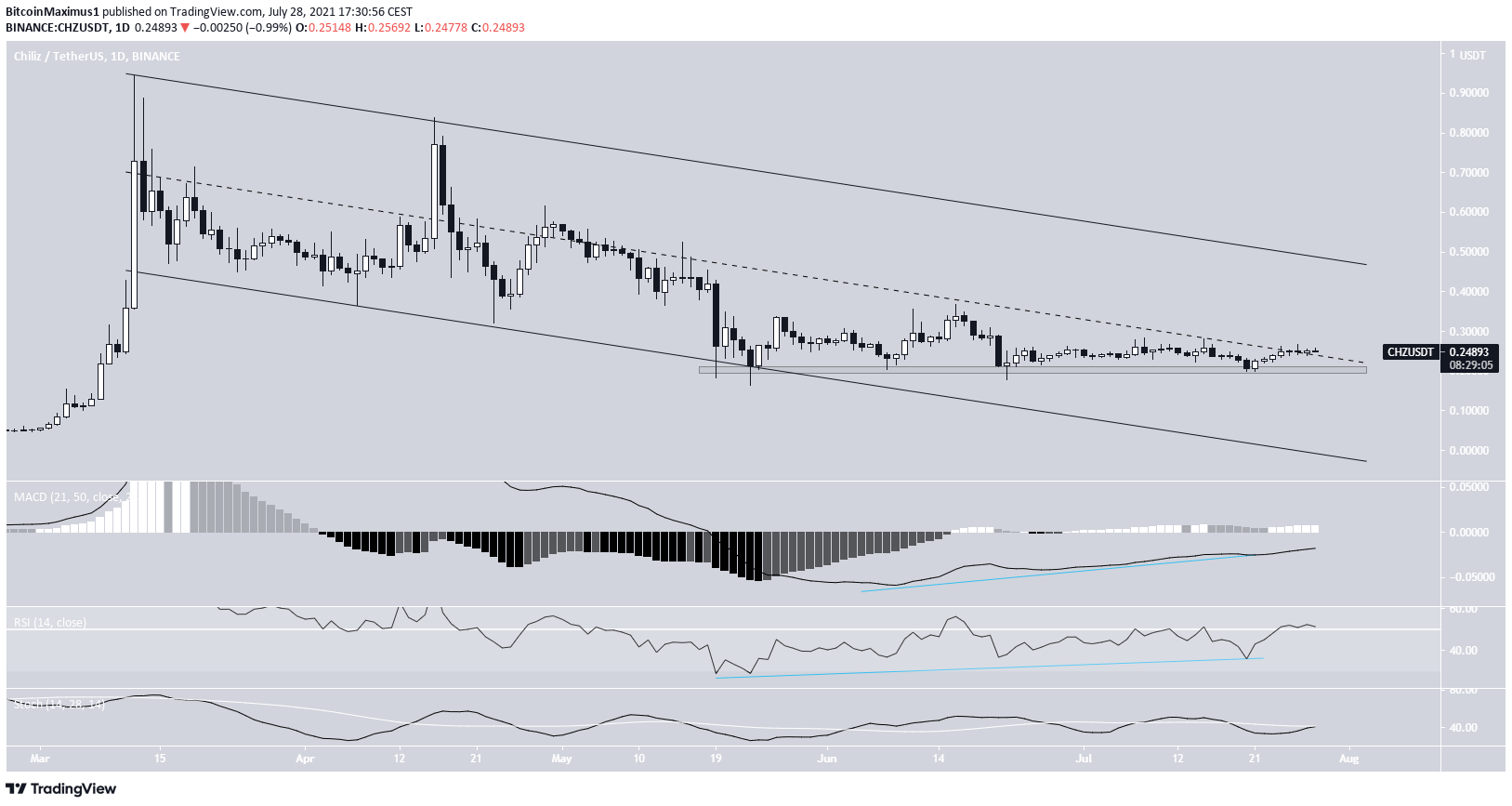

CHZ

CHZ has been decreasing inside a descending parallel channel since reaching a high on March 12. It bounced at the support line of the channel several times, most recently on May 23, when it reached a low of $0.164.

The ensuing bounce validated the $0.20 horizontal area as support. CHZ returned to this level several times throughout June and July. Similarly to HBAR, these lows were combined with bullish divergences in both the RSI & MACD. In addition to this, the RSI has just moved above 50 and the Stochastic oscillator has made a bullish cross.

CHZ reclaimed the middle of the channel on July 28 but has not begun an upward movement yet.

The resistance line of the channel is at $0.45.

Highlights

- CHZ is trading inside a descending parallel channel.

- There is support at $0.20.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post HBAR, ANKR And CHZ Pursue Breakout From Descending Channels appeared first on BeInCrypto.